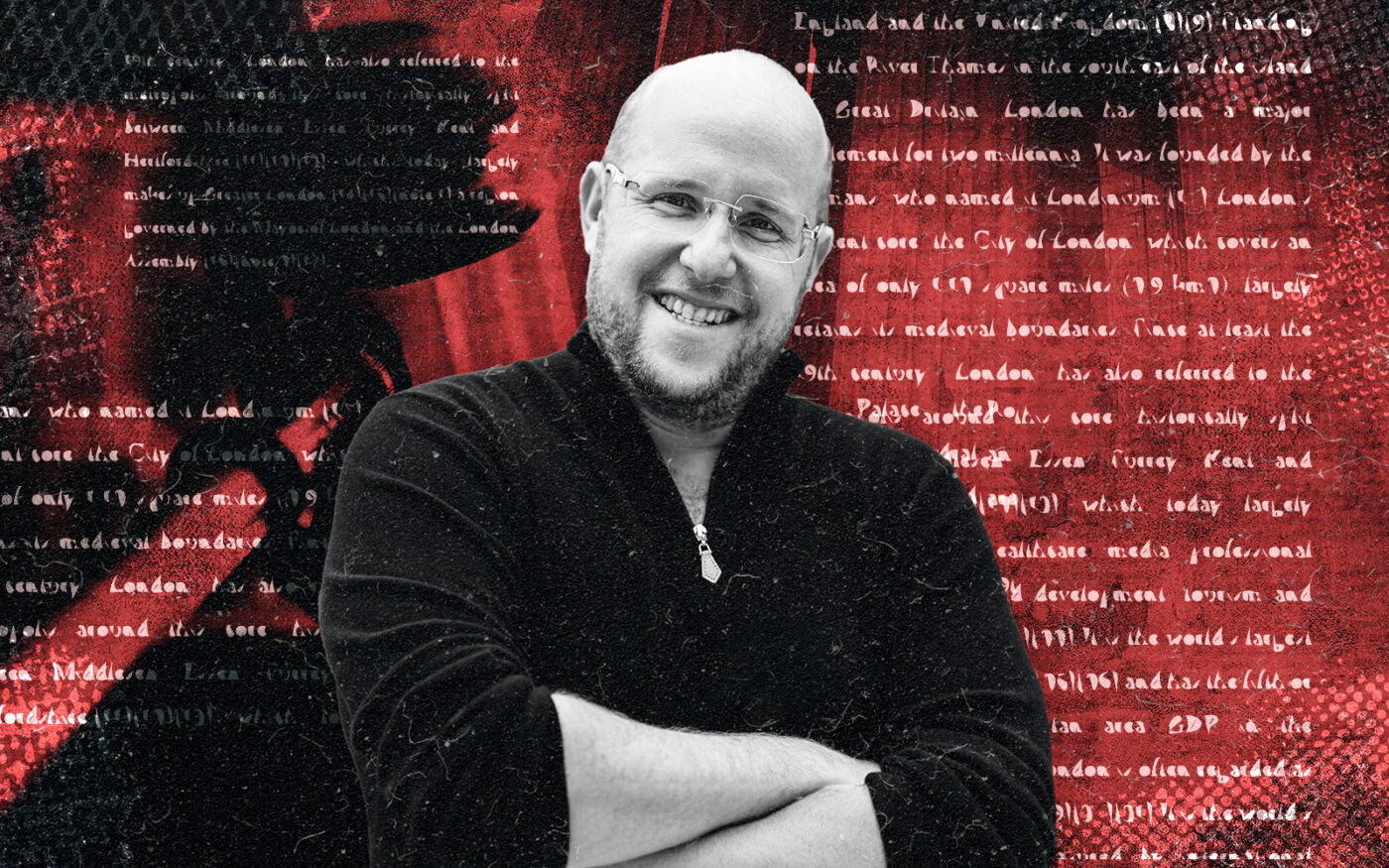

Lenders are trying to poke holes in Shaya Prager’s shield as they mount more legal attacks.

While navigating a web of foreclosures, lawsuits and loan defaults related to his crumbling office empire, the Opal Holdings founder has maintained that his lenders were aware of the controversial ground lease structure he’s used at investment properties around the country.

The latest lawsuits against him say otherwise.

While snapping up billions of dollars worth of office properties over the past five years, Prager created ground leases at them and took out separate loans against the land and the buildings above. The combined amount of the mortgages often exceeded what he had paid for the properties. (Representatives for Prager emphasized that he did not use this structure in all of his acquisitions.)

This didn’t surface as a problem until Prager’s entities started defaulting on loans.

In the lawsuits related to three New Jersey office properties, 194 Wood Avenue in Iselin and 333 and 343 Thornall Street in Edison, Valley National Bank claimed Prager has “a direct or indirect interest” in the entity that owns the ground despite telling the bank he didn’t.

The lawsuit cites misrepresenting the “No Affiliation Representation” as one of the reasons for the default.

That mirrors allegations from other lenders, including Pinnacle Bank, the mezzanine lender on Fort Worth’s Burnett Plaza.

In a lawsuit by Tarrant Construction Services against Prager and Pinnacle Bank for nonpayment of a $1 million bill, Pinnacle claimed Prager’s ground lease structure was tantamount to mortgage fraud. After publication of this article, the claims between Prager and Pinnacle were dismissed. The nonpayment case will go to trial in July.

Prager called Pinnacle’s charges “baseless” and said he had used the transaction structure over two dozen times.

“Pinnacle is the only party involved in one of those transactions that claims it was not aware of the potential common beneficial ownership between the landlord and tenant,” he said then.

New Jersey-based Valley National is accusing Prager and his wife Shulamit Prager of defaulting on loans totaling $179.3 million. The unpaid balance on the loans is $158.8 million.

Valley National’s claims are also “baseless,” Prager said through a spokesperson, and he plans to prove that in court. He maintains that all lenders were informed of “the possibility of common beneficial ownership.”

The statement continued, “All ground leases contained exhibits with an organization chart reflecting the ownership structure and interests of the landlord and tenant.”

Prager stopped paying the loans in May and August, the suits claim.

This lawsuit makes at least a dozen against the embattled investor, who’s already lost two properties to foreclosure this year.

This story has been updated with clarifications from Prager’s representatives, and to include new information about claims made by Pinnacle Bank.

Read more