South Florida became a magnet for out-of-state companies in recent years, prompting giddiness over the tri-county region’s office market. Even as headwinds emerged, developers pushed new projects through approvals.

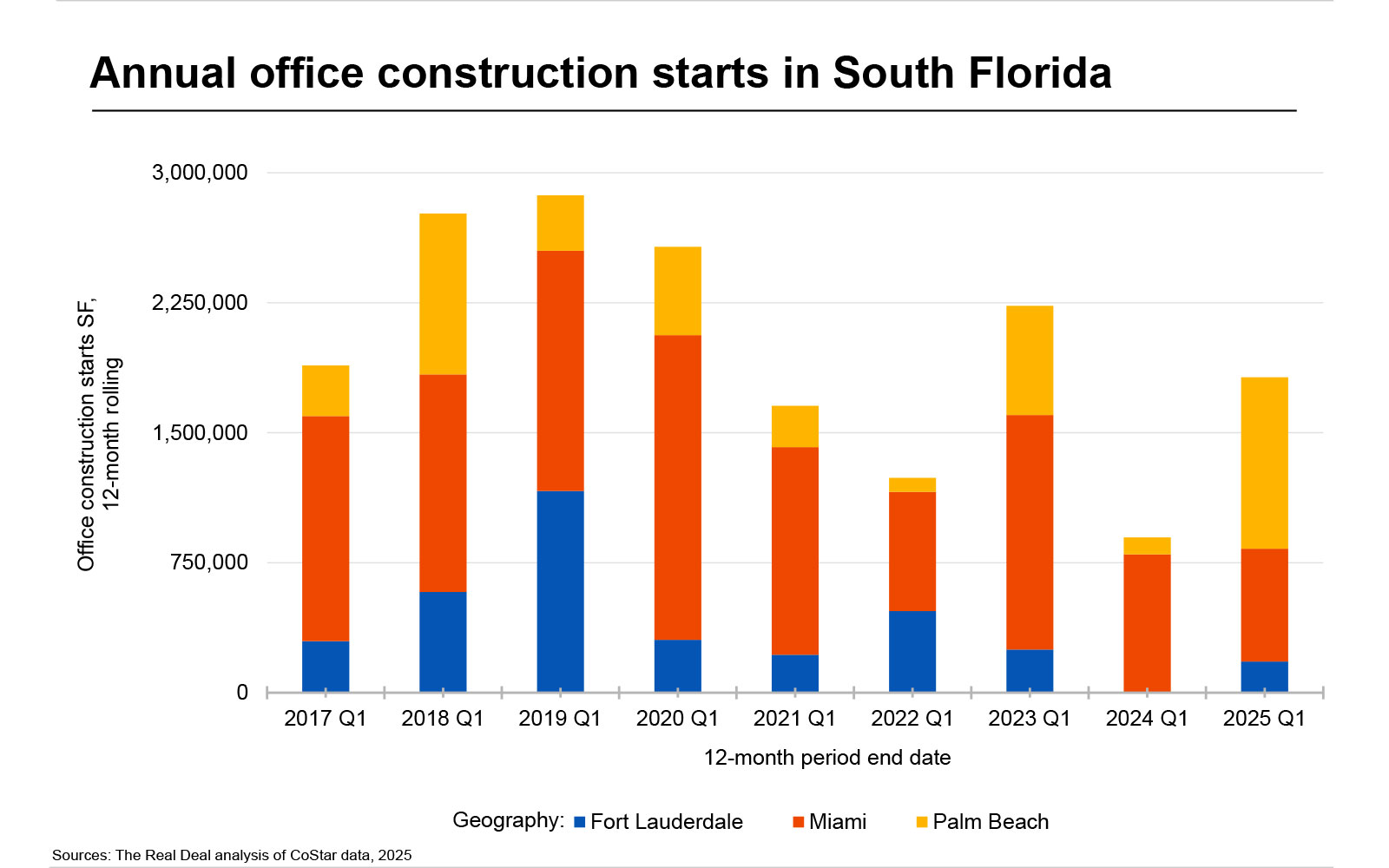

But now, many of the planned offices remain concepts on paper. Office construction starts in Miami-Dade County –– an epicenter of recent years’ bonanza –– were about 650,900 square feet for the one-year period from April 1 of last year through March 31, according to The Real Deal’s analysis of data provided by CoStar Group. That marks the lowest amount of annual construction starts since at least 2017.

Yet, the construction slowdown isn’t ubiquitous across South Florida. Palm Beach County experienced the highest amount of office construction starts since 2017. And Broward County had more office construction starts in the past year than in the previous year, but starts still were less than in all other years since 2017.

However, in Miami-Dade, developers started on less space in the past year even compared with pre-Covid years, a period experts commonly describe as “normal” times before the pandemic-induced South Florida boom.

A confluence of issues has led to the construction slowdown in Miami-Dade. Among them:

elevated interest rates, skyrocketing insurance, lower office values and lenders pulling back from financing offices, experts said. At the same time, the pipeline of Northeast and West Coast companies that lease big blocks of space has slowed.

While construction labor and material cost increases have calmed, they remain high, and Trump’s deportation and tariff policies are expected to further raise such costs. The administration so far has imposed a 10 percent universal tariff, a 25 percent tariff on steel and aluminum imports, and a 145 percent tariff on Chinese goods.

Most of the offices under construction are part of mixed-use projects with residences and retail. Few developers are willing –– or able –– to overcome market obstacles to build standalone, speculative office buildings.

“We have indeed seen a significant slowdown of office-only towers across the board. That’s basically been gone since 830 Brickell,” said CoStar’s Juan Arias, referring to the 57-story tower in Miami.

That building was fully preleased prior to its completion last year due to fortuitous timing: It was under development in 2021 and 2022, during the height of the influx of out-of-state firms. As the first standalone office tower in the coveted Brickell Financial District, 830 Brickell attracted many new-to-market tenants.

This success led developers to pursue their own project plans. But the market flipped on them.

“To go out there, find land and build, it’s not the right time,” said Carlos Segrera, chief investment officer at investment and development firm IMC Equity Group.

In Miami Beach, the Giller family scrapped its seven-story project with 28,200 square feet of offices, citing the tariff and deportation policies. For Swire Properties, which nixed the nearly 1,000-foot tall One Brickell City Centre in Miami, the issue was inadequate preleasing.

In Broward County, the only office project underway is the six-story building part of Hines and Urban Street Development’s T3 FAT Village mixed-use project in Fort Lauderdale. The 180,000-square-foot building accounts for the total amount of Broward construction starts in the past year.

The true outlier is Palm Beach County. Office construction starts from April 1 of last year through March 31 totaled nearly 990,000 square feet, mostly consisting of billionaire Steve Ross’ 10 CityPlace and 15 CityPlace towers. They mark his seventh and eighth office projects, including purchases and development, in West Palm.

Ross, who now exclusively focuses on South Florida through his Related Ross after stepping back from New York-based Related Companies last year, taps into his New York network to find tenants for his West Palm office buildings.

“Contacts really, really help,” Arias said. As a whole, in the South Florida market, “nothing really makes sense right now to justify breaking ground [on offices]. Unless, of course, you’re Ross.”

A time to buy, not build

It could cost up to $500 per square foot to develop a Class A office project and up to $300 a foot for a Class B project, Segrera, of IMC Equity, said.

“If you can find it, why do you have to build it?” he said.

That’s what IMC Equity did, paying $49 million –– or $95 per square foot –– last summer for the 11-building Sawgrass Technology Park in Sunrise. The Class B complex was 65 percent leased at the time, though IMC has increased this to 75 percent. It traded at an 11 percent cap rate, which signifies a lower property value. IMC Equity paid 34 percent less than the complex’s purchase price in 2019.

Across South Florida, some office landlords face lower occupancies as well as higher interest rates for floating rate loans and more expensive refinancing costs for maturing debt. Many are forced to sell at a discount.

Distress at some properties reduces office values across South Florida, said broker John Bell of Transwestern. This means that even if a lender opts to finance a new project, it would tag a lower valuation on the development and provide less financing for construction.

“The numbers just don’t pencil out right now,” Bell said.

Developers also are keeping an eye on recently finished offices in prime markets. At one office building completed this year in Miami’s Wynwood, roughly 200,000 square feet remain vacant, despite some preleasing.

“That doesn’t really say [to would-be developers], ‘I am going to break ground in Wynwood,’” CoStar’s Arias said.

The near future doesn’t look brighter. Both international and domestic in-migration has steadily declined, threatening workforce growth.

In the first quarter, 1,016 Cubans moved to Miami-Dade, a 73 percent decrease, year-over-year, according to the Miami Association of Realtors, which based its analysis on driver’s licenses exchanged. Colombians accounted for 809 move-ins and Venezuelans for 485, a 16.3 percent and a 43 percent decrease, respectively, year-over-year.

Trump’s policies are expected to exacerbate the slowdown of international in-migration, Arias said.

Meanwhile, in the first quarter, 922 New Yorkers moved to Miami-Dade, a 9.4 percent year-over-year drop, according to the Miami Association of Realtors. Californians accounted for 525 driver’s license exchanges, a 14 percent drop, year-over-year.

The decrease means “fewer people of working age [coming in] that will be able to continue to fill up the pool of workers,” he said. “If you want to expand and add employees, where are you going to get them from?”

Who’s not afraid of offices?

A few major office projects still are planned, but they are mostly for developers’ use and won’t add much to South Florida’s inventory.

In Brickell, billionaire Ken Griffin plans a $1 billion-plus mixed-use supertall on a bayfront site with 1.3 million square feet of offices. Most of the space will be used as the headquarters for Griffin’s Citadel and Citadel Securities, which he officially moved in 2022 from Chicago to Brickell. The firms are now in leased space. Also in Brickell, Banco Santander is tearing down its 14-story office building to make way for its planned 41-story tower with about 800,000 square feet of offices. Some of the space will be for Santander’s staff and some will be leased to tenants.

Also, Royal Caribbean Group is developing its 10-story, 380,000-square-foot headquarters at PortMiami.

In Bay Harbor Islands, Landau Properties and Taubco are developing the seven-story, 75,000-square-foot One Kane Concourse, which is Miami-Dade’s only standalone spec office building under construction now. New York restaurant BondST preleased space, but no office leases have been announced.

Next, Shvo plans to start construction late this year or early next year on two buildings in Miami Beach: the 62,500-square-foot One Soundscape Park and The Alton with 170,000 square feet of offices.

At Fort Lauderdale’s T3 FAT Village spec office building, about half the space has attracted strong interest from tenants across industries, said Tere Blanca, of Blanca Commercial Real Estate. The office building is slated to be completed late next year, she said.

Ross’ pair of West Palm towers are expected to be finished in 2027, a Related Ross news release says. 15 CityPlace is 60 percent preleased.

While Ross’ New York network has allowed him to quickly lease-up his projects, his ability to attract coveted top tenants isn’t exactly good news for other developers hoping to build a spec office project.

“It’s even tougher to justify a new development if you have Ross already tapping into the demand of relocations,” Arias said. “If he is already soaking up the relocations in Palm Beach [County] in nice shiny new towers, [others are] just battling for the existing market share for what is already here. And that’s really tough.”

Read more