On the fifth day of the Los Angeles wildfires, “Selling Sunset” star Jason Oppenheim told the BBC that landlords were illegally hiking rents as displaced Angelenos stoked demand.

“This isn’t the time to be taking advantage,” Oppenheim said on the BBC program, noting California’s anti price-gouging law, which bars hikes above 10 percent during emergencies.

The day before, an Oppenheim broker had listed a gated five-bedroom in the Hollywood Hills for $17,500 — 17 percent above the rate advertised by Zillow in November — before axing the price back down to $14,995.

“This was a mix-up,” the agent, Peter Cornell, explained by phone.

Since the first of the L.A. fires ripped through Pacific Palisades early last week, citizen journalists and tenant groups tracking rents on Zillow and Redfin have flagged hundreds of listings for alleged price gouging, some made by agents from prominent brokerages.

Social media posters have been quick to lambast the landlords pushing the hikes or brokers carrying out orders.

“Landlord scum” is a common refrain on Reddit.

But not all posters are purposefully juicing prices, brokers say.

At the Hollywood Hills house, Cornell attributed the misstep to furniture and a quirk of Zillow.

The November rate reflected an unfurnished place; the January premium, a furnished one. Cornell made the distinction on the MLS, but Zillow didn’t pick up the nuance. So the broker cut the rate and specified the furniture option in the comments.

“As soon as I heard about this the other day, I was all over it,” Cornell said.

Amid the emotional toll of the fires and the outcries by tenants, parsing rents raised to profiteer from reasonable free market gains or increases that reflect needed amenities such as furniture can be a tricky exercise.

Supply and demand

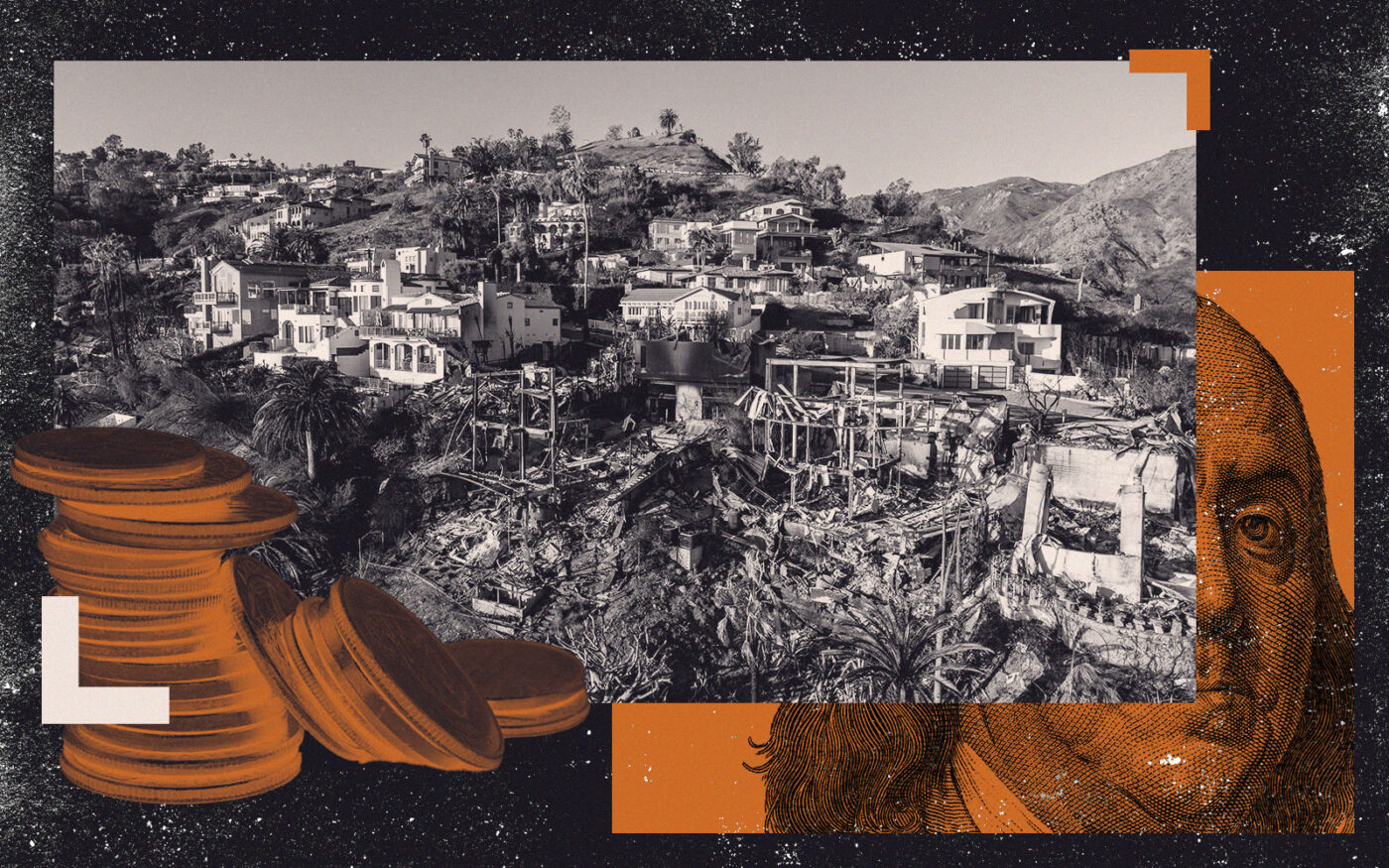

Inflated prices from the fire were inevitable. With 150,000 people under evacuation orders at the height of the blazes, which have razed tens of thousands of structures, they need places to stay. Combine that with a citywide vacancy rate of 5 percent — higher than in recent years, but still tight — the upward pressure on prices is real.

“This will, of course, drive up the cost of housing, due to supply and demand factors,” Dan Yukelson, executive director of the Apartment Association of Greater Los Angeles, said.

Some listings that showed increases a few percentage points above the state’s 10 percent threshold seem to point to that market response or an error on the broker’s part.

Tracy Tutor, an agent who left Douglas Elliman for Compass the day the Palisades Fire sparked, listed 1533 Marlay Drive, a three-bedroom with an infinity pool in West Hollywood, for $30,000 on Jan. 9.

The rate marked a near 15.5 percent jump above the asking price advertised on Christmas Eve.

By Jan. 13, Tutor had pulled the listing and on Jan. 15, reposted it for $28,600 a month, according to Zillow — exactly 10 percent above the pre-fire rate.

Tutor did not respond to a request for comment. But Cornell noted the MLS was recently updated with a warning against price-gouging, which may have tipped off some agents who unintentionally pushed prices above the cap.

Still, there are “some bad apples out there, for sure,” as Anthony Luna of L.A.-based advisory firm Coastline Equity put it in a phone interview.

Sources pointed to hikes in excess of 20 percent as a red flag for gouging. Tenant organizer Chelsea Kirk and a handful of volunteers have vetted hundreds of listings flagged for outsized hikes. The average increase of those reviewed came in at about 27 percent as of Wednesday.

“One of my first thoughts was ‘Wow, the rent is going to go up,” Kirk, who works for nonprofit Strategic Actions for a Just Economy, said. “But not like that.”

Shalom Gozlan, for example, the president of luxury villa brokerage Living The Dream, listed 1741 Stearns Drive on Jan. 10 for a buck shy of $20,000. Gozlan was asking $14,995 for the Mid-City home less than a month earlier. The increase: 33.4 percent.

On Jan. 12, Gozlan pulled the listing from Zillow, possibly signaling someone flagged the hike to Zillow, the county or state.

A spokesperson for Zillow said it is “taking action to help address price gouging on rental listings,” including rooting out potential violations internally. It also said it encourages renters to report illegal hikes to the website or California authorities.

Gozlan did not respond to a request for comment.

It wouldn’t be the first time he toed the line of unscrupulous behavior. The principal and his firm were sued in 2023 for failing to clean, maintain or provide adequate security on a property rented to the Consulate of Kuwait — and then stiffing the diplomat for a $22,000 security deposit.

Lease adjustment

No agent or landlord would willingly cop to price gouging. But some explanations for outsized increases are more convincing than others.

Ben Leeds Properties, a property manager with a few dozen units in Los Angeles, chalked up its rentals going for 25 percent above previous asking prices to lease length.

On Jan. 3, Ben Leeds posted a two-bedroom unit on Culver Boulevard in Del Ray for $2,945. By Jan. 12 — a few days into the fire — the price had surged 25 percent to $3,680. Similarly sized hikes popped up across the company’s listings last weekend.

A few days later, the company backtracked, cutting the rent to precisely 10 percent above its New Year price.

Ben Leeds agent Arian Talehakimi said the adjustment wasn’t to correct for gouging. Rather, the firm had switched its offerings to six-month leases from one-year terms, which Zillow doesn’t account for.

The switch was likely a move to meet demand. Tenants fleeing the fires are seeking short-term or flexible accommodations as they wait for the insurance payouts that will let them rebuild.

Landlords may charge a premium for those leases to compensate for the expense of a faster unit turn, and a shorter period of reliable revenue. But an increase of 25 percent is still a head above what the state allows or the market would seemingly dictate.

“Given the circumstances, when the severity of the fires became apparent, we decided to just limit it to 10 percent,” Talehakimi said.

Ben Leeds is offering half-off security deposits for those displaced by the fire and evacuees are still eligible for a six-month term on any of the company’s listings.

“I just want to be clear: no leases were signed and no applications were submitted under the 25 percent price increase,” Talehakimi said.