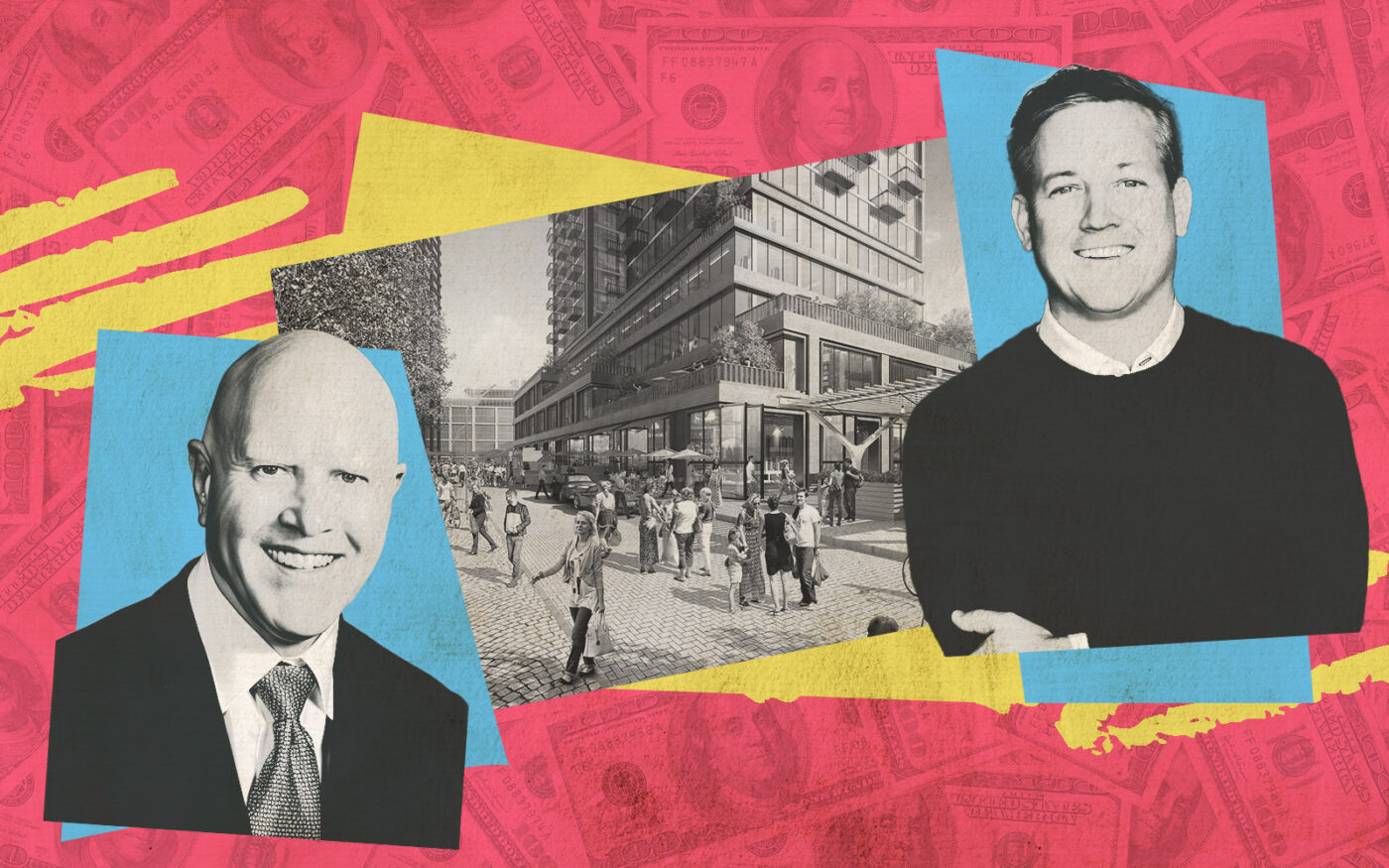

Sterling Bay’s Lincoln Yards initiative is facing heightened financial scrutiny following a significant write-down on a loan from Bank OZK.

The bank recognized a charge-off of $20.8 million during the third quarter, reducing the loan balance tied to a large section of the land for the Lincoln Yards megadevelopment from $128 million to $107 million, or 90 percent of the June 2024 appraised value, Bisnow reported.

The loan, associated with Alloy Property Company, a subsidiary of Sterling Bay, was secured in December 2019 and has been modified six times since then. Due to ongoing challenges in recapitalization efforts, the Little Rock, Arkansas-based bank reclassified the loan from “substandard accrual” to “substandard nonaccrual.”

“We are growing less patient with the progress that our sponsor is making. The progress has been slow, despite the sponsor’s serious and hard work toward accomplishing it,” Bank OZK CEO George Gleason said during the company’s third-quarter earnings call.

With Lincoln Yards, Sterling Bay aims to revitalize a 53-acre stretch of land along the North Branch of the Chicago River, creating a mixed-use hub with offices, residential units and retail spaces. However, it has struggled to maintain momentum, particularly as two of its major backers — J.P. Morgan Asset Management and Lone Star Funds — seek to offload their stakes at significant discounts.

Sterling Bay has been actively pursuing new financial partners for over a year but has encountered setbacks, including a recent rejection from the Chicago Teachers’ Pension Fund. Additionally, Kayne Anderson Real Estate considered an investment in March, although its current stance remains unclear.

To alleviate its financial pressures, Sterling Bay has listed several properties near Lincoln Yards for sale, including a bioscience center at 2430 North Halsted Avenue.

Bank OZK has also made moves to mitigate its commercial real estate exposure in Chicago, recently agreeing to extend the maturity date of a $150 million loan linked to a mixed-use property at 300 North Michigan Avenue until July 2025, and deferring the maturity date of a nearly $70 million loan for an office building at 345 North Morgan Street to August 2026.

The bank is in discussions with Sterling Bay to potentially secure additional reserves for the development. However, in response to concerns over its CRE exposure, Bank OZK plans to cap new loans at $500 million, signaling a shift toward risk management and diversification.

— Andrew Terrell

Read more