The California-based developer behind the planned redevelopment of the shuttered Pecan Valley Golf Course into a veteran-focused community in Central Texas is at risk of losing its property.

A court-appointed receiver moved to foreclose on Valor Club Partners’ 50-acre parcel on the Southeast Side, the San Antonio Express News reported. The receiver wasn’t identified.

The looming foreclosure stems from a $7 million loan Valor Club received in 2018 from Pride of Austin High Yield Fund 1, a fund now embroiled in its own financial turmoil.

Harney Partners, the consulting firm overseeing Pride of Austin, allegedly uncovered evidence of fraudulent practices within the fund, leading to its value dropping from $60 million to $20 million. With few assets remaining, the fund’s court-appointed receiver pursued foreclosure, scheduling a Nov. 5 auction.

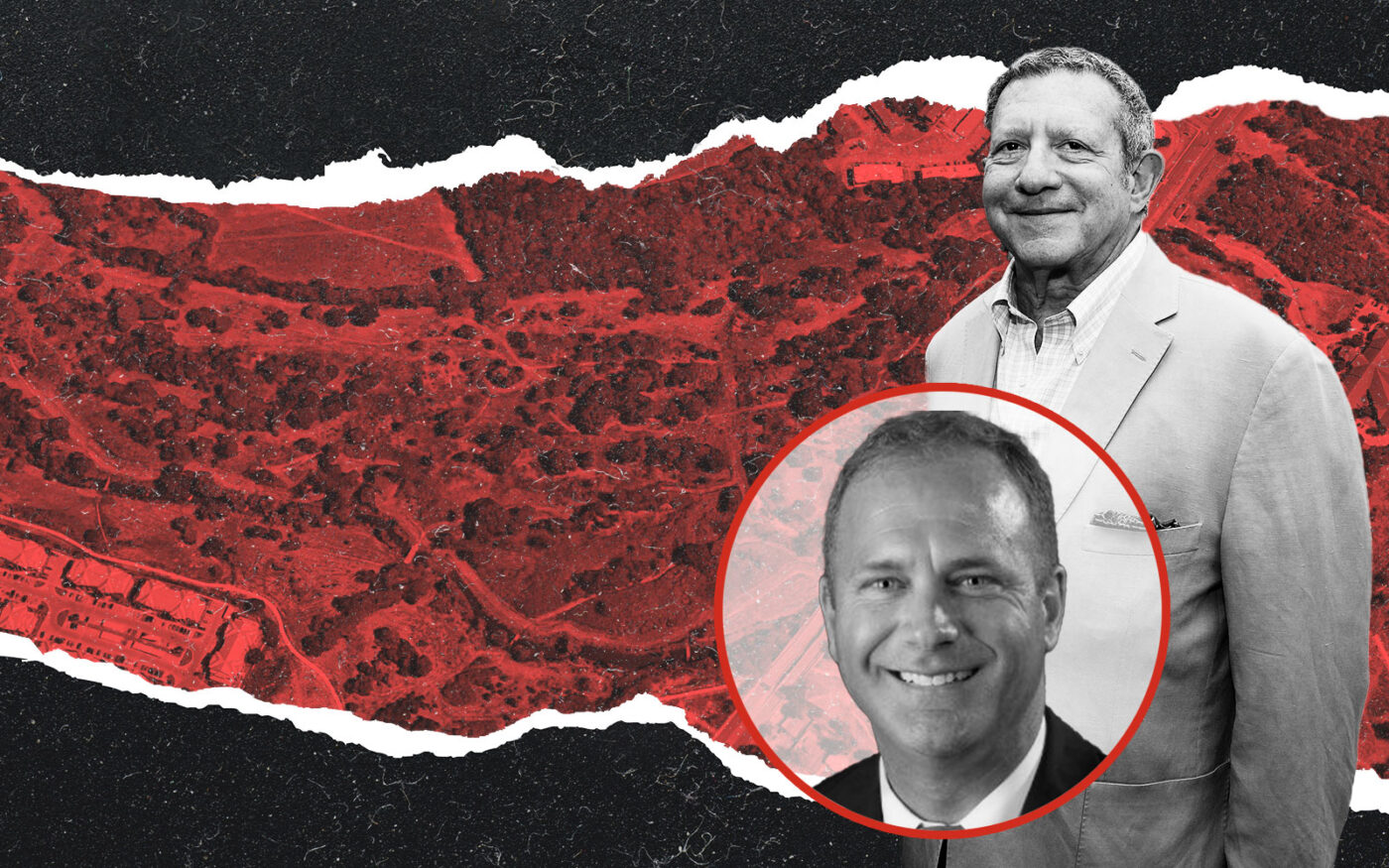

The move comes after Valor Club — led by CEO Michael McDowell and also tied to Los Angeles-based affordable housing developer Irwin Deutch — lost another 160 acres, meant to be part of the same development, to foreclosure last year after defaulting on a loan it received from a lender who wasn’t identified.

Negotiations are underway to avert the foreclosure, Valor Club’s attorney James Griffin told the outlet.

Valor Club previously explored partnerships with military and educational leaders as well as an entertainment venue, but the land remains undeveloped, awaiting either a resolution or an ownership change that could determine the future of the project.

The community has been in the works for over a decade, envisioned as a master-planned community with homes, job training and recreation tailored to military personnel and their families.

Plans called for a handicap-accessible golf course, a 200-key hotel, an event center, a BMX racetrack and mental health services to support military veterans’ transition to civilian life.

Foresight Golf’s Dan Pedrotti Jr. is who initially envisioned the development, inspired by witnessing veterans benefit from the therapeutic aspects of golf. He started a nonprofit for the venture but partnered with Deutch and McDowell, who acquired the land in 2017 and 2018.

— Andrew Terrell

Read more