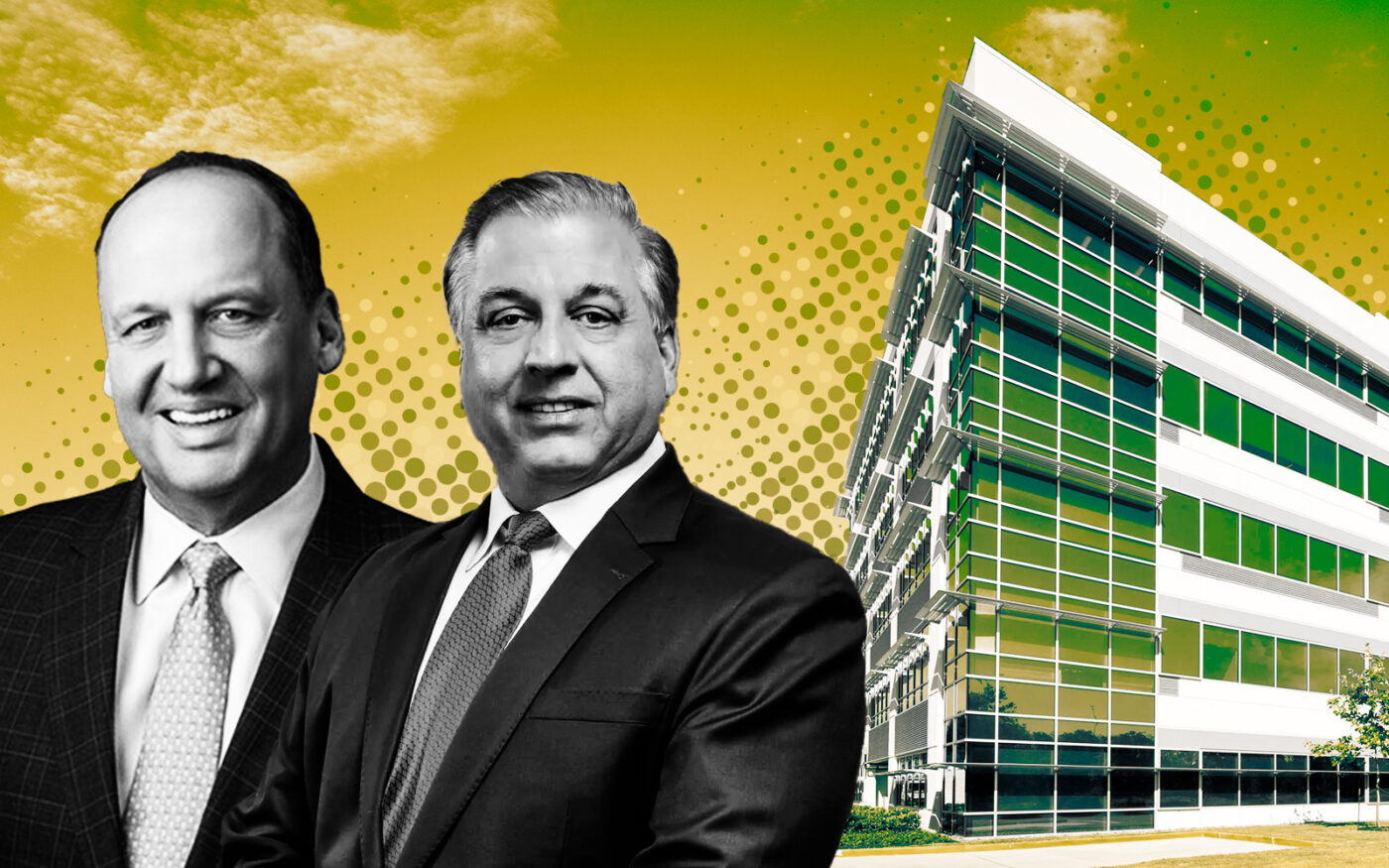

A troubled real estate investment trust linked to KBS Realty Advisors found another buyer for the Houston office building it’s trying to offload.

Capital Commercial Investments entered into a purchase agreement to buy the Offices at Greenhouse for $17.6 million, according to SEC documents. That’s just $87 per square foot for the 203,000-square foot building and a 63 percent discount from its last trade.

KBS paid $47 million for the property in 2016, over $231 per square foot. The REIT borrowed $72 million from JP Morgan Chase at the time of purchase and has struggled to pay off the debt; its maturity has been extended four times.

The parties are expected to close on the deal by July 8.

The property is located at 19219 Katy Freeway in West Houston. It’s the REIT’s final property in its effort to liquidate its office portfolio.

News of the sale comes just a month after a deal fell through to sell the property to New Jersey-based Red River Asset Management.

Red River defaulted on the purchase agreement when it failed to pay the balance of the purchase price, according to SEC documents. As a result, Red River forfeited its $800,000 deposit.

The sale is part of the REIT’s effort to liquidate its assets, according to a plan established in May of last year. The firm has blamed its financial woes on the pandemic and a downtown in the oil market.

KBS’ Growth and Income REIT isn’t the firm’s only trust in trouble.

At the end of last year, KBS Real Estate Investment Trust III said it had experienced a $350 million decline in the value of its portfolio since September 2022.

Stream Realty Partners developed the 5-acre Offices at Greenhouse in 2014. It had originally planned for the office to be part of a 12-acre mixed use project.

The five-story building is at the intersection of Interstate 10 and Greenhouse Road. In April, the building was 92 percent leased. Dallas-based engineering firm AECOM occupies 62 percent of the building, but its lease is set to expire in December. Capital Commercial Investments, led by Doug Agarwal, is an Austin-based firm that buys bargain-basement office assets. It focuses on suburban markets in the Sun Belt.

Read more