Whitestone REIT is fighting a costly proxy battle with investor Erez Asset Management.

Erez owns 1.3 percent of the Houston-based REIT, a shopping center landlord, and it is campaigning for shareholders to elect its two candidates, including its founder, to Whitestone’s board of directors, Bisnow reported.

New Rochelle, New York-based Erez’s beef with Whitestone includes that the REIT allegedly “rebuffed” an attempted takeover by Fortress Investment Group last year, even though the “proposed price was a significant premium to the market price,” a news release from Erez states.

Erez also alleges that Whitestone has offloaded assets for below their net value and is engaging in a “value-destructive ‘buy high, sell low’ strategy.”

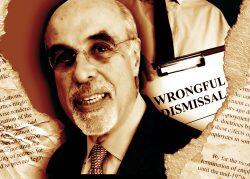

Whitestone started selling off assets after it fired CEO James Mastandrea in 2022. A year later, Mastandrea sued the REIT for $25 million, claiming he was wrongfully terminated because he was in negotiations to sell the REIT. The lawsuit has since been dismissed.

“Whitestone’s total shareholder returns have been poor, and the Company has traded at a persistent discount to its peers,” Erez states in a presentation on its website.

The investor wants its founder, Bruce Schanzer, a former shopping center REIT CEO, and Catherine Clark, a former shopping center REIT executive, to be placed on the board.

Whitestone wants to reelect David Taylor and Nandita Berry, the longest-tenured members of the board.

“Our business is frankly firing on all cylinders,” Whitestone CEO David Holeman said in a first-quarter earnings call on Thursday. “Our tenant demand is strong. We’ve got great locations. You’ve got a team that’s synced and executing. We intend to keep delivering and keep laying down a track record.”

In the first quarter, occupancy sat at 93.6 percent across Whitestone’s 50 shopping centers in Phoenix, Chicago, Austin, Dallas-Fort Worth, Houston and San Antonio, and average rents were up 7.2 percent from last year, at $23.83, he said.

Whitestone has spent $400,000 on the proxy battle in the first quarter, and it expects to spend $1.2 million on it this quarter.

Erez is fixated on a sale, which “speaks volumes about their strategic misjudgment,” Whitestone said in a news release.

“We are not opposed to selling the Company or exploring strategic alternatives if they lead to maximizing shareholder value. But we also do not want to shortchange shareholders by running a hasty sale process at the wrong time, as the Dissident seems to be recommending,” it said.

But Erez says it is concerned about the board’s lack of transparency, as well as its trend of only appointing directors from its own network.

“The board’s argument that now is not the appropriate time to sell the company may well be right; however, its lack of communication with shareholders makes it difficult to simply trust its views on the matter or assess its receptiveness to would-be acquirers,” said proxy advisory firm Institutional Shareholder Services.

A shareholder meeting is scheduled for May 14.

—Rachel Stone

Read more