The loss of a major tenant has put a Houston office landlord in financial danger, demonstrating the growing wave of office distress.

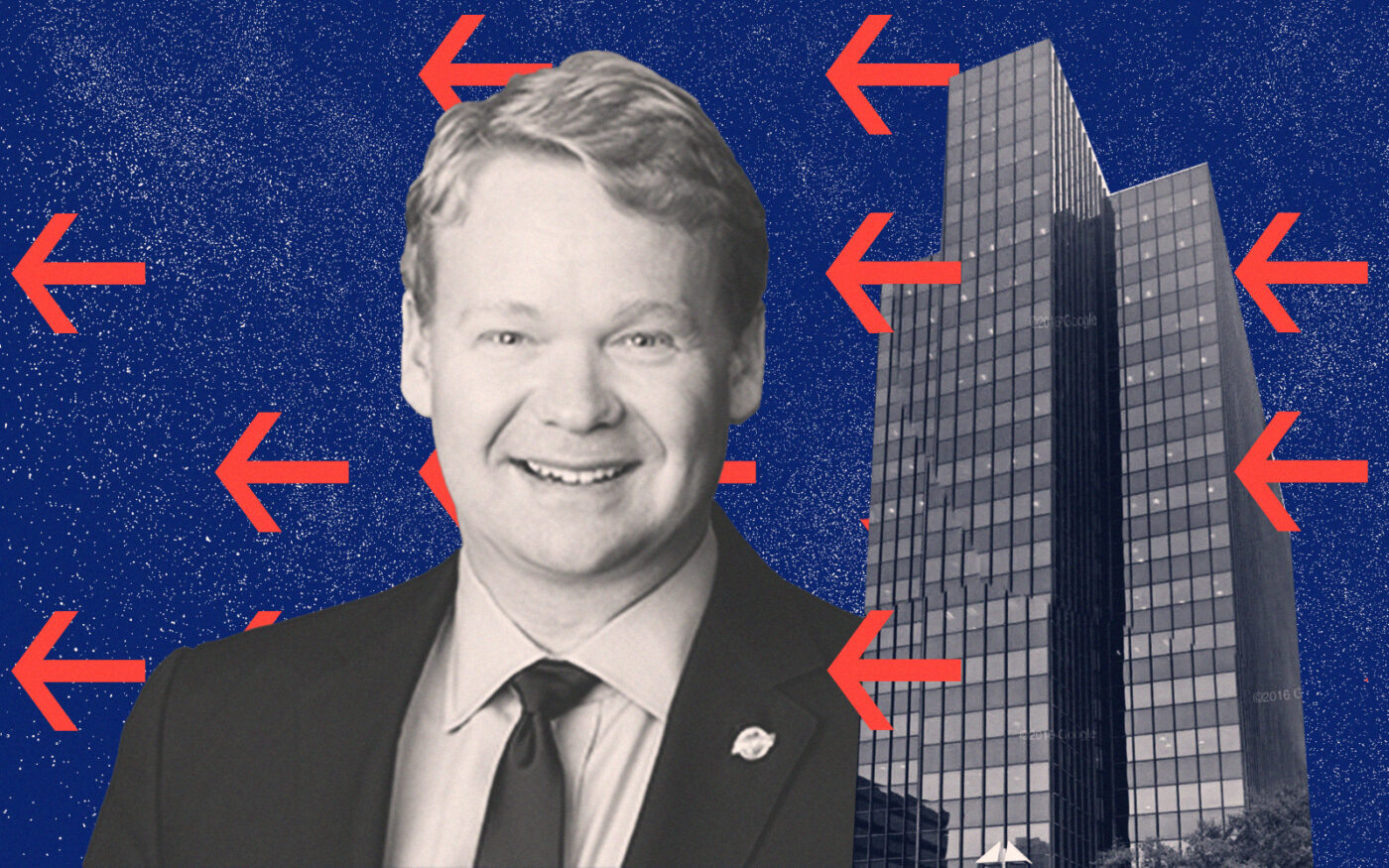

As engineering and construction firm Bechtel prepares to vacate the 441,500-square-foot building at 3000 Post Oak Boulevard, an $80 million loan on the property looms. Betchel occupies 99 percent of the building, the Houston Business Journal reported.

The loan, set to mature in March 2025, has been placed on a loan servicer watchlist. That status is a response to concerns over the loan’s repayment once the anchor tenant vacates.

Bechtel announced its departure in July 2022, opting for Parkway Property’s CityWestPlace campus across the street from Briarlake Plaza in West Houston’s Energy Corridor. The move, driven by hybrid-work policies adopted post-pandemic, will see Bechtel’s workforce relocating by the end of this year to offices half the size of its current space.

Bechtel’s departure triggered a “cash-trap event,” restricting the property’s cash flow loan servicing notes said. This situation will persist until a viable replacement is under contract. Bechtel’s lease at 3000 Post Oak runs through July 2024.

JPMorgan Chase originally issued the loan in 2020, before it was acquired by three mortgage trusts earlier this year.

While the building’s exact ownership is concealed from the public, some clues indicate that it’s tied to AIP Asset Management and Five Mile Capital Partners, the outlet reported. The assessed value of the property was just shy of $80 million as of Jan. 1, showing an increase from the previous year but significantly lower than its $143.9 million taxable valuation in 2019.

Bechtel’s destination, CityWestPlace, was acquired by Parkway in a recent transaction. The 39-acre campus was fully renovated in 2020 and has 1.5 million square feet of rentable space.

—Quinn Donoghue

Read more