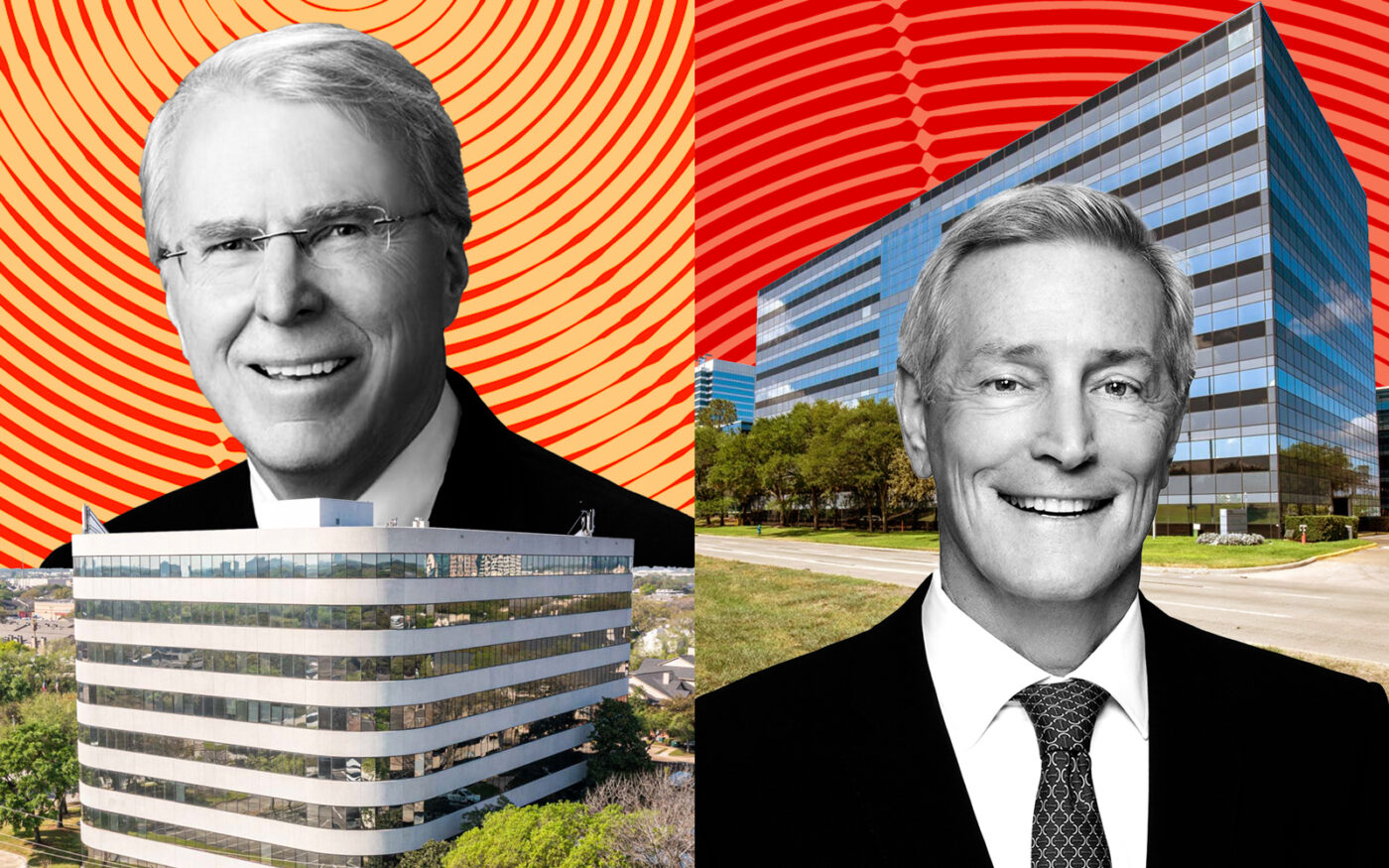

Two Westchase office buildings are up for sale as aging buildings in the West Houston submarkets are hit hard by the flight-to-quality trend.

Local firm Woodbranch Management has listed an eight-story building at 9800 Richmond Avenue, near the Sam Houston Tollway between Briarpark Drive and South Gessner Road. Built in 1982, the 334,000-square-foot office building houses 673 units, which span 177,000 square feet of net rentable space, according to public records. Its vacancy rate sits at about 51 percent, according to CBRE, which has the listing. The price isn’t listed, but it was appraised in January at almost $13.5 million, or about $40 per square foot, according to the Harris County Appraisal District.

Three miles northwest lies the 100 percent vacant Westchase Point, a 40-year-old, eight-story office building that has also recently gone up for sale. The Class B building holds 156,000 square feet of net rentable area across 565 units. An LLC linked to Miami-based firm Rialto Capital is listed as the owner of the building, which has an appraised value of $13.5 million. Colliers has the listing.

Westchase’s office vacancy rate currently stands at 33 percent, the third-highest among the 25 Greater Houston regions that real estate research firm Avison Young tracks. A dearth of upscale property could be to blame as companies opt for locations with more amenities. The metropolitan area has witnessed a record-high vacancy rate of 27 percent in the office market. However, it also experienced its slowest annual vacancy increase since the oil crash in 2015, showing signs of stabilization.

Most of the tenants in Westchase are energy or engineering related, so it’s no big surprise how hard it’s been hit, said Brad Sinclair, principal of Houston office leasing at Avison Young.

“When the oil bust essentially hit in 2015, it was seven consecutive years of negative absorption, and we were about to level out but Coronavirus hit,” Sinclair said. “So the pandemic extended everything by another two to three years.”

Energy remains king in Houston, but the recovery of the oil and gas industry from the pandemic has been sluggish, which has prevented the city’s economy from rebounding as experts anticipated. Labor shortage and supply chain woes are prime among the causes for the slowed growth in “the energy capital of the nation.” Despite fluctuations in the Westchase submarket and record vacancy, Greater Houston remains one of the top-performing office markets in the nation. Yardi Systems ranked the Bayou City third on its list of top office markets, behind Boston and Miami, based on sales data from the first quarter, which totaled $431 million for the Houston metro.

“We’re starting to see big transactions now. It has been the biggest challenge I’ve seen since the ’80s, but I do think the worst is behind us.” Sinclair said.

A rebound in the office market will have to be “societally driven,” Sinclair said.

“It’s going to have to be a continued push and a drive for employers to require employees of all levels to go back to the office,” he said.

Woodbranch Management declined to comment. Rialto Capital and Colliers did not immediately respond to requests for comment.

Read more