Daiwa House Group isn’t the first Japanese company to invest in the American residential real estate market, and it probably won’t be the last.

A subsidiary of the major Japanese homebuilder, Daiwa House USA Holdings, bought a minority stake in Alliance Residential Company, a multifamily developer and investor based in Scottsdale, Arizona.

Dallas-based investment bank Jefferies and Tokyo-based securities firm SMBC Nikko were Alliance Residential’s financial advisors on the deal, according to a news release.

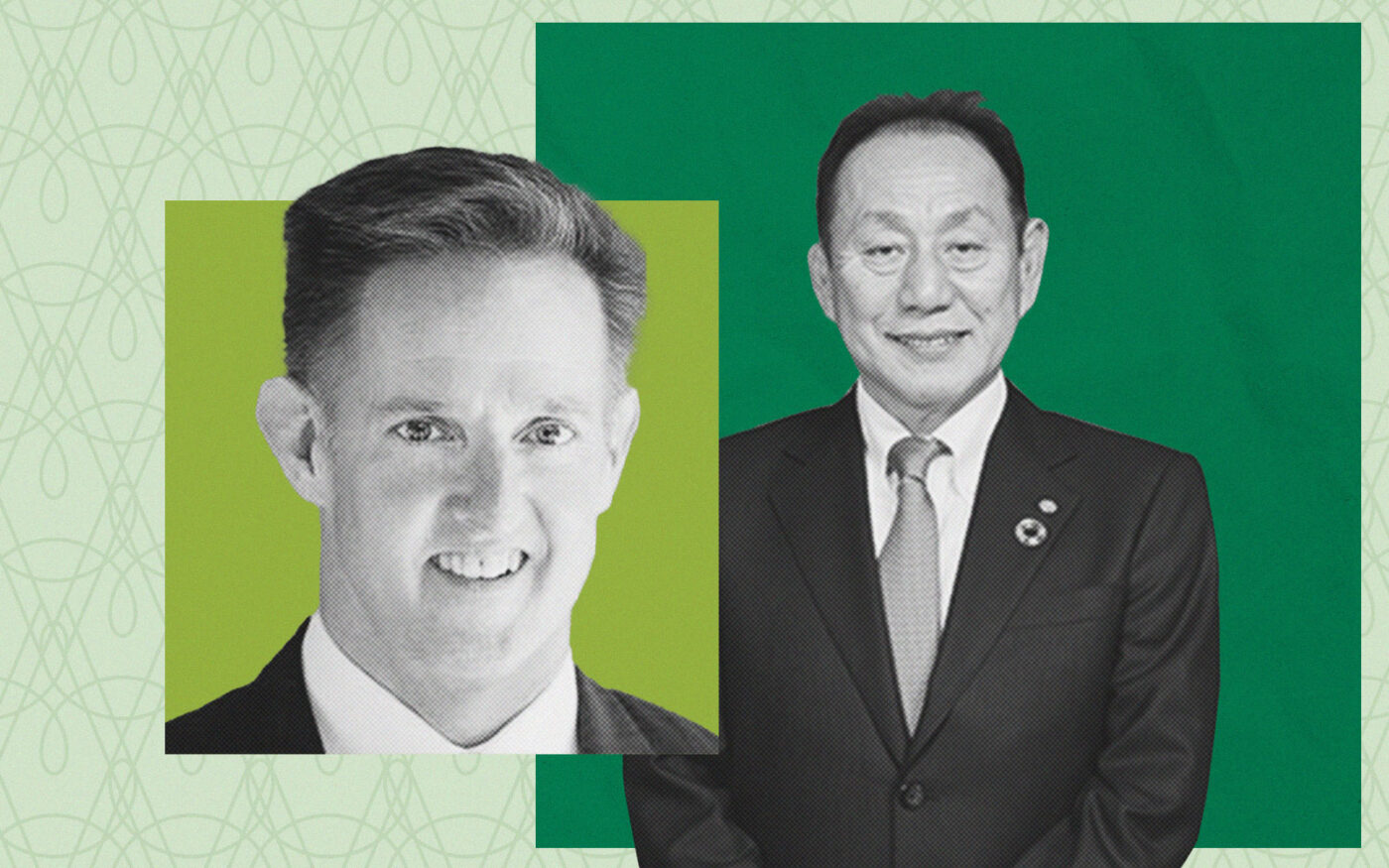

Alliance was founded by Trammell Crow Company alum Bruce Ward in 2000. It focuses on building or updating luxury apartment communities and then selling them off to investors. Daiwa House USA Holdings is headquartered in Dallas. Its parent company was founded in 1955; Keiichi Yoshii has been the firm’s president since 2017.

The minority investment is not expected to significantly impact the firm’s business model or operations, the news release from Alliance said. However, Ward will step down as chairman, and former Chief Operating Office V. Jay Hiemenz will take his position.

Alliance has offloaded a number of Houston apartment communities in the last few years. This summer, it sold off a nearly 1,200-unit portfolio of the firm’s Prose line, which is Alliance’s brand of more affordable units, in Houston to Hamilton Point Investments for $195 million.

In addition to the Houston sales, Alliance sold the management arm of its business to Greystar in a $200 million deal in 2020. That operation manages 130,000 units.

News of the Alliance-Daiwa deal comes about a year after Tokyo-based logging and construction company Sumitomo Forestry bought Irving-based developer JPI, the Metroplex’s most prolific apartment developer.

The terms of that deal were not disclosed, but Nikkei Asia estimated its value at $215 million.

Prior to purchasing JPI, Sumitomo invested more than $200 million in seven of the firm’s rental communities.

Read more