A bruising proxy battle between Blackwells Capital and Monty Bennett’s hospitality companies has ended in a truce.

Both sides will lay down their swords: Blackwells agreed to end its proxy battle, which aimed to oust Bennett from the board of Braemar Hotels and Resorts. For its part, Braemar will expand its board and end a lawsuit against Blackwells and its principals.

There’s also a financial angle to the deal. Blackwells will buy 3.5 million shares of Braemar Hospitality Trust, which was trading Wednesday at $2.46 per share. Braemar will provide a loan for the purchase (the amount was not specified in SEC filings). Before the purchase, Blackwells owned more than 1.2 million shares of Braemar common stock, including 250,000 in underlying options that Blackwells and its entities could exercise in October. It also holds 1,000 shares of another Bennett hospitality REIT, Ashford Hospitality Trust.

Braemar will add an independent director to its board “with input from Blackwells,” according to an SEC filing, though it did not specify what that will look like. In return, Blackwells withdrew its director nominations and agreed to vote in favor of Braemar’s nominees for a 10 year standstill period.

The agreement marks a stark turnaround. In May, Blackwells succeeded in its campaign against Ashford, as Bennett failed to receive the votes necessary to be re-elected to the company board. While the surviving board members simply reappointed him, Blackwells looked to build momentum off the loss in its fight against Braemar.

“Given that Braemar’s incumbent directors have overseen a nearly 90 percent collapse in Braemar’s stock price over the last decade, their fear of an open election against Blackwells’ highly qualified nominees is not surprising,” Blackwells CIO Jason Aintabi said at the time.

In the heat of the fight, Bennett said Blackwells was trying to make a quick buck.

“Blackwells is not a traditional investor that invests in a company such as Braemar and hopes that value increases over time,” Bennett told the Dallas Morning News in May. “They buy shares, immediately attack, then hope to get paid off as a nuisance.”

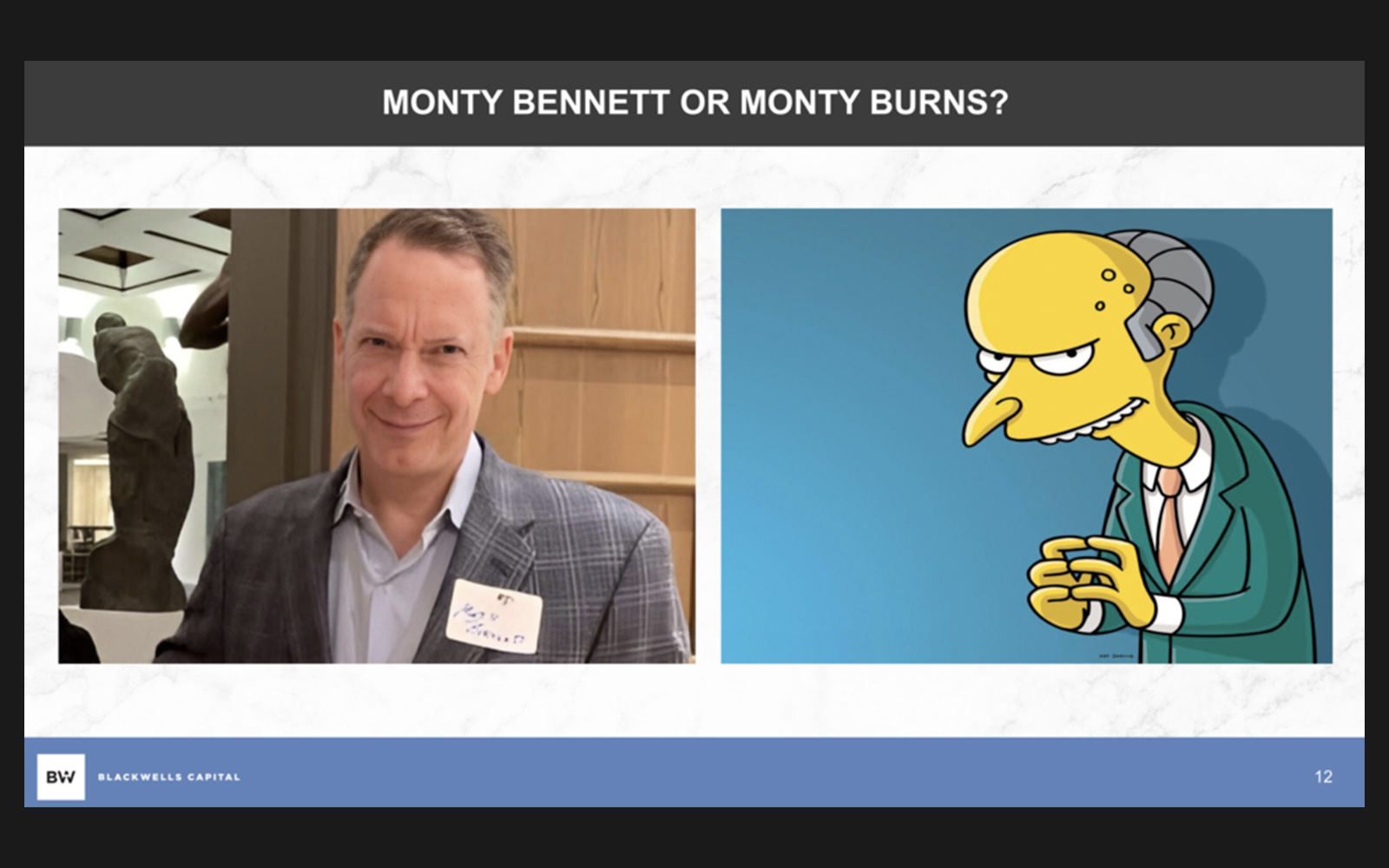

The proxy battle grew heated and at times resorted to schoolyard taunts. Each side created websites and social media accounts to attack the other. As part of the agreement, those have been deactivated. Blackwells’ NoMoreMonty.com and MontyMustGo.com are now password protected, and Braemar’s ExpelBlackwells.com has been removed.

Blackwells tried to buy Braemar in December for $4.50 per share, a 114 percent premium to the share price at the time. The deal never came together, and Blackwells instead nominated a new slate of board members.

During its fight, Blackwells took specific issue with the advisory agreement by which Ashford advises Braemar for an annual fee. Bennett, who chairs both companies’ boards and runs Ashford Inc., which advises both, made a fortune while the companies languished, Blackwells argued.

Braemar and Ashford own 105 hotels with more than 25,000 keys, according to Ashford’s website.