An investment group that referred to itself as a “person you can trust” has allegedly been perpetrating fraud targeting Dallas-Fort Worth’s Indian American community.

Nanban Ventures LLC, a firm comprising three Frisco men, has raised nearly $130 million from hundreds of investors since April 2021, saying it was investing in technology and real estate. But “in classic Ponzi fashion,” Nanban allegedly used investors’ money to make fake distribution payments to other investors and siphoned off millions of dollars for themselves, as revealed in a recent complaint by the Securities and Exchange Commission, the Dallas Morning News reported.

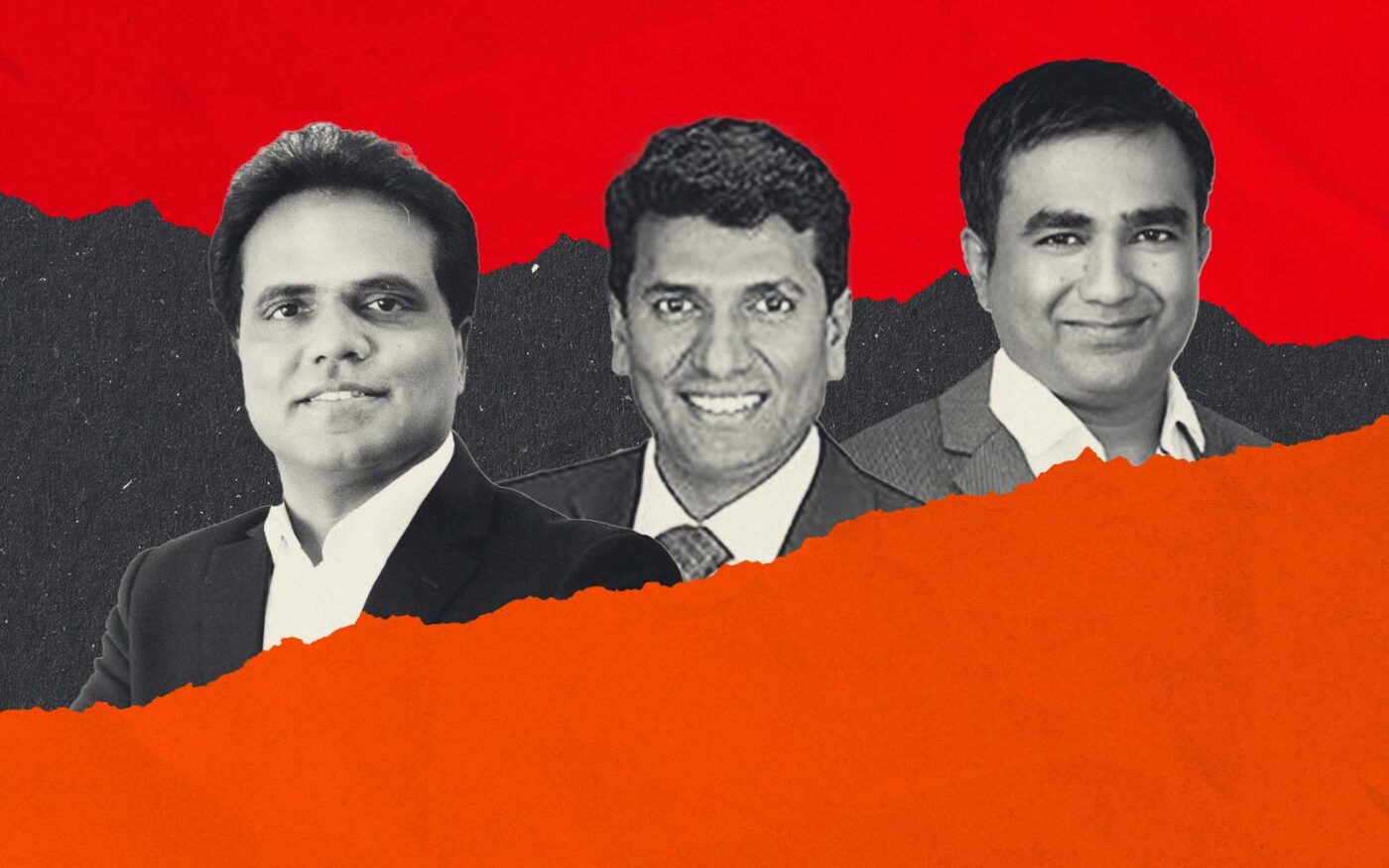

The SEC has issued a temporary restraining order, froze the company’s assets and taken additional measures to stop the alleged perpetrators — Gopala Krishnan, Manivannan Shanmugam and Sakthivel Palani Gounder — from operating.

“The defendants used the ‘Nanban’ branding, a word that means ‘friend,’ when raising nearly $130 million from investors of mostly Indian descent,” Eric Werner, director of the SEC’s Fort Worth regional office, told the outlet. “However, the defendants have been the furthest thing from ‘friends’ to their investors, raising money and paying false returns on a foundation of lies.”

The three founders, who had limited experience in the investment sector, allegedly misled more than 350 investors, collecting over $89 million for purported venture capital funds under the Nanban Ventures banner. In addition, they raised $39 million from 10 investors who contributed capital directly to other entities controlled by the founders.

The SEC claims that the defendants misrepresented Krishnan’s expertise, particularly his “GK Strategies” trading method, which resulted in returns of over 100 percent. These financial results were promoted on various financial and media platforms, further duping investors.

The founders raised $116.5 million from 2020 to September 2021 for four hedge funds. In response to angry investors who requested their money back, they then shifted to venture capital funds and told investors that these funds would be used to invest in startup tech companies and real estate. From July 2021 to June 2023, the founders allegedly compensated themselves with at least $6 million from investor funds, the outlet reported.

The SEC complaint seeks to impose permanent injunctions, require the repayment of illegally obtained funds with prejudgment interest and levy civil penalties against the three founders. Furthermore, it aims to prevent them from serving as officers or directors of any public company.

In a letter to investors, Nanban responded to the allegations by saying that it’s been cooperating with the SEC for the past year and that the agency doesn’t understand how the firm operates.

“If we find ourselves unable to do so, we will vigorously contest the allegations,” the letter said. “It is our position that Nanban has sufficient means to honor our commitments to our investors.”

—Quinn Donoghue

Read more