Crow Holdings has had an eventful 2023.

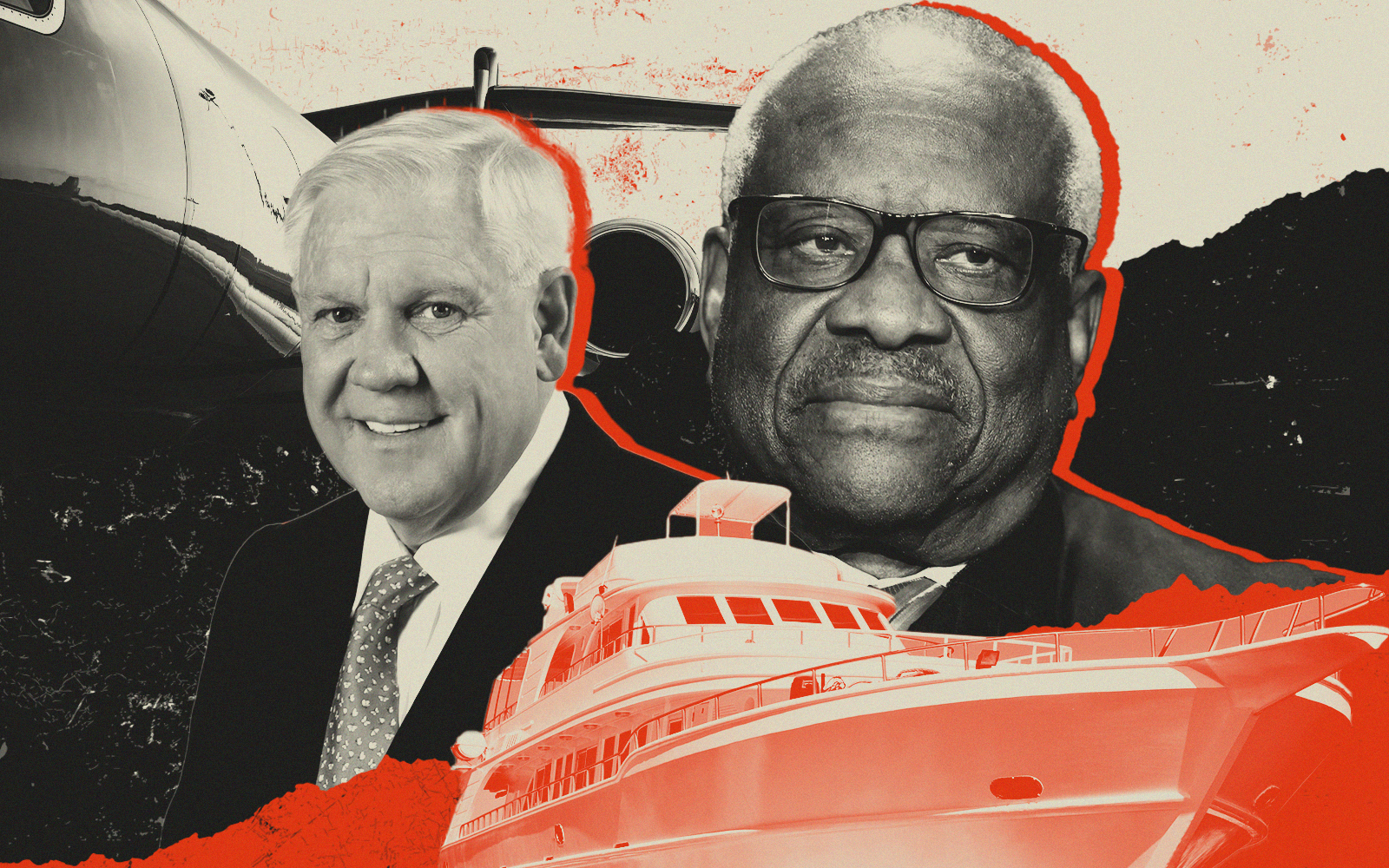

The iconic Dallas firm is constructing an addition to its headquarters at Old Parkland. It launched a $2.8 billion fund to invest in small-format retail properties. It’s venturing into solar energy. And, oh yeah, Chairman of the Board Harlan Crow has been under national scrutiny for extending financial favors to Supreme Court Justice Clarence Thomas.

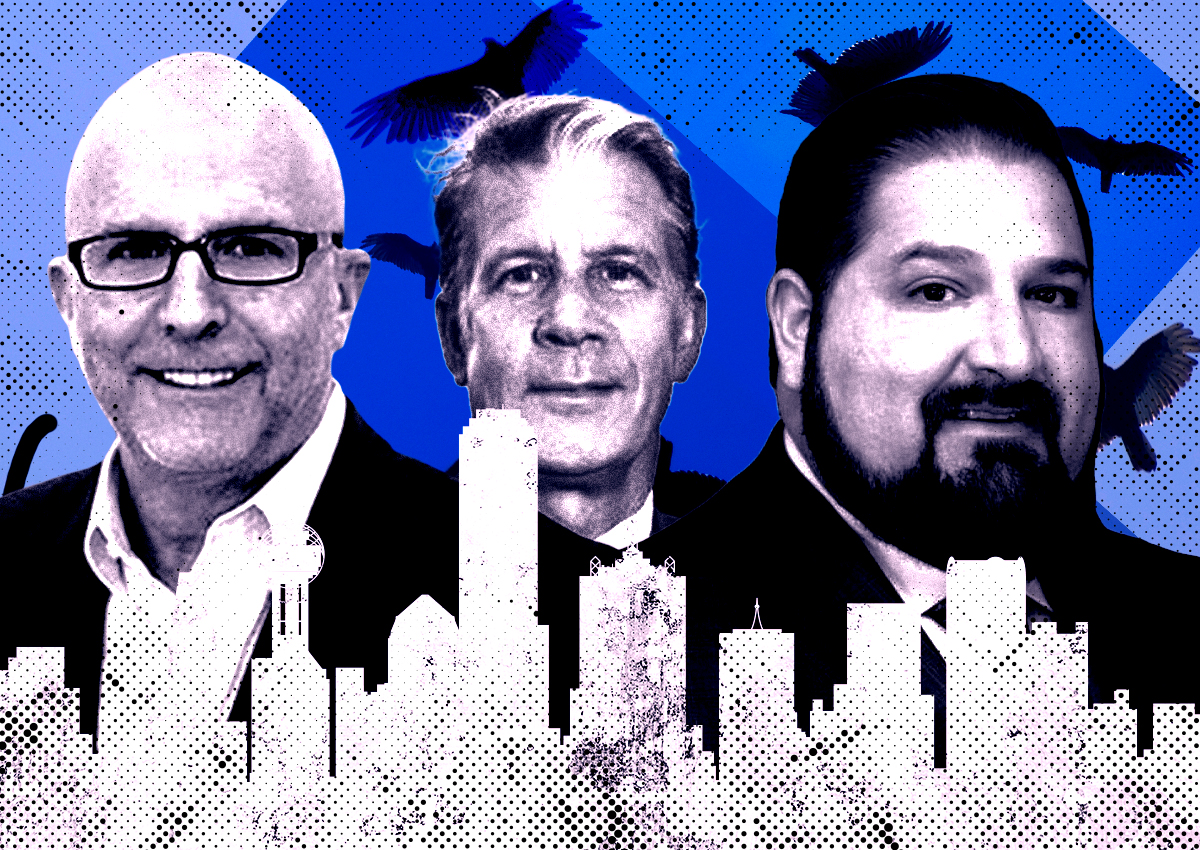

Tricky waters to navigate, but CEO Michael Levy is from New York City. He’s used to a bit of chaos. Levy helped rebuild Morgan Stanley after the 2008 financial crisis. Harlan, third son of real estate legend Trammell Crow, lured him to Texas in 2017 to take the head job at Crow Holdings.

Commercial development firm Trammell Crow Company, now owned by CBRE, and Crow Holdings were both formed in 1948 by Trammell Crow but are separate entities. Crow Holdings focuses on residential and capital investments and is still owned by the Crow family. Companies under the Crow Holdings umbrella include Trammell Crow Residential, Crow Holdings Capital, Crow Holdings Industrial and Crow Holdings Office.

Patriarch Trammell Crow passed the CEO torch in the early ’80s to Harlan, who grew Crow Holdings into the $30 billion valuation it holds today. Levy was hired after a nationwide search because Harlan wanted to step into a board role and spend more time focusing on philanthropy and political engagement.

In Dallas, Crow is a household name, a mainstay of local and state politics and one of the city’s most important families. But after a scathing ProPublica investigation this April, Harlan Crow has become known nationally as the right-wing billionaire that’s been bankrolling vacations and financial favors to a conservative Supreme Court Justice.

He explained the origins of his 30-year friendship with Thomas and claimed none of it was based on political favoritism, in an interview with the Dallas Morning News.

“I think that the media, and this ProPublica group in particular, funded by leftists, has an agenda to destabilize the [Supreme] Court,” Crow told the outlet. “What they’ve done is not truthful. It lacks integrity.”

Stephen Engelberg, editor-in-chief of ProPublica, responded, noting that ProPublica is an independent, nonpartisan nonprofit news organization funded by 36,000 donors.

Crow Holdings has yet to make any official statement regarding the investigation, and its strongly opinionated CEO hasn’t either. When The Real Deal asked Levy if the investigation had affected Crow Holdings’ business or his relationship with Harlan in any way, he kept it short and sweet.

“No comment, and Harlan is an incredible human being,” Levy said.

While Levy won’t talk specifically about Harlan and Clarence Thomas, he does encourage real estate to engage politically.

“The business community in America has truly abandoned local politics. Dallas just had the city council elections, and 8.8 percent of the people voted … 8.8,” Levy said. “I would encourage every single business person in every single city to make that a priority. Give money to the right candidates, give money to causes, get involved, get to know your people. I think that engagement is critical, and I do what little I can but I’m one voice.”

Levy maintains that he and Harlan have had a close relationship in and out of business since their first meeting.

“When I came to Dallas the first time to talk about this job, I met Harlan Crow … I didn’t know what to expect, but what I got was this kind, thoughtful, interesting, benevolent person, who simply wanted to discuss: Who was I and where did I come from?” he said. “The conversation was anything but business. It was more, ‘Tell me about your grandparents.’ I left after a couple of hours and said, ‘Wow.’”

Local position, global ambition

Crow Holdings’ investment activity is down about 90 percent as the firm takes a wait-and-see approach to the market, Levy said.

The firm will continue to be rooted in multifamily and industrial assets, but it’s now focusing on expansion into solar development while investing in capital markets on a global scale. The firm is expanding its client engagement and marketing staff to compete with top firms, Levy said.

“We are a private U.S. company whose name is not sitting on the mouth of the global real estate investor like a Blackstone is,” Levy said. “I see the scale of the client engagement teams at the firms that are household names. They have made a massive internal investment, and I would say those investments have trumped — no pun intended — their actual track records in investing. So we’ll continue working on that.”

Levy’s love affair with Dallas comes with concern for the city’s direction. Distress in major cities like San Francisco, Seattle and Los Angeles could happen here too, he says.

While the Dallas-Fort Worth Metroplex turns heads with its No. 1 real estate markets and fastest-growing cities, the city of Dallas has actually declined slightly in population, Levy noted.

The U.S. Census Bureau estimated the city’s population at 1,299,544 in July 2022, compared to 1,304,317 in April 2021.

People think of Dallas as a business-friendly city, but that perception actually comes from the surrounding region, Levy said.

Take Frisco. The suburb had empty fields a decade ago and is now getting a Universal theme park to go with the headquarters of the Dallas Cowboys and PGA of America. Meanwhile, the Dallas Builders Association last year compared the City of Dallas permit center to a 1960s bomb shelter, where it was taking up to six months to get approvals. The city has since made plans to build a new permit center.

“We are going to wind up with an unhealthy urban core,” Levy said. “And you’re gonna have all these nodes doing great because the urban core needs to make changes with respect to its engagement with the business community.”

It took Crow Holdings nearly 10-months to gain approval for its nine-story office expansion at Old Parkland from the city and the Oak Lawn Neighborhood Committee, he said.

“This complex rejuvenated Oak Lawn, and that went to the very bitter end of a protracted battle to get this approved. That is unacceptable, it shouldn’t happen, and it’s happening all over this city,” Levy said.

“Say ‘I want to build a warehouse,’ but the city says, ‘What I want is low income housing.’ The economics for low income housing don’t make sense, and I can bring jobs and tax fees to build this warehouse right here. I’m sympathetic to the city’s goal, but it’s just economics. And with the time it takes to get things approved, that’s why people are saying ‘screw it, I’m going to Frisco.’”

Read more