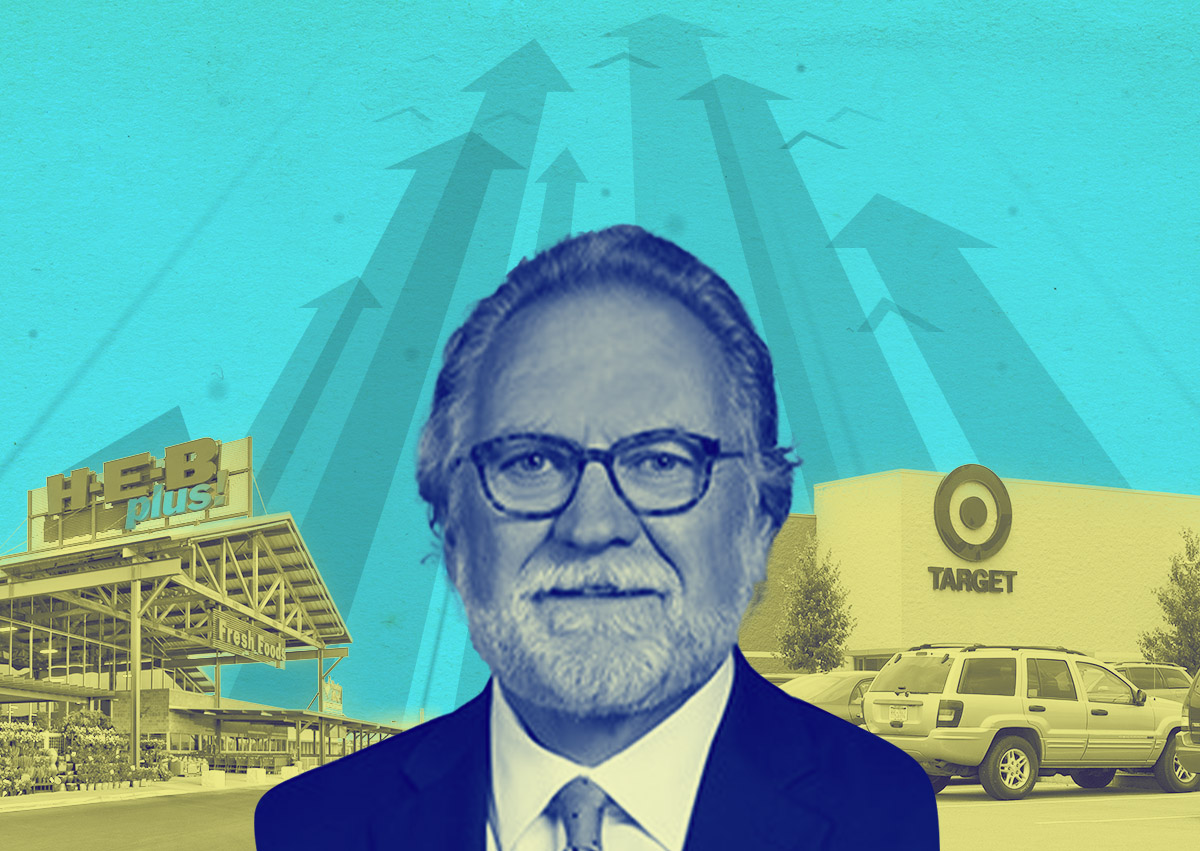

Crow Holdings is making a $2.8 billion bet on retail.

The Dallas-based firm formed a joint venture and retail real estate investment platform with its investment management business, Crow Holdings Capital, and an unnamed global institutional investor, the Dallas Regional Chamber’s news platform reported.

The partnership aims to capitalize on the growth potential of “small-format, convenience-oriented, open-air food and service shopping centers.”

Small-format retail is resilient in the face of e-commerce disruption, especially in the food and service sector, according to Crow Holdings CEO Michael Levy.

The forward-looking plan is to acquire properties by recapitalizing an existing portfolio valued at $1.8 billion. That portfolio holds 173 properties located in more than 50 cities across 30 states. It focuses on dense and affluent markets near major suburban population and employment hubs, benefiting from positive net in-migration, limited new supply and job growth.

Crow Holdings Capital has experience in applying an institutional asset management framework to unlock the value of non-institutional-scale assets, said Sam Peck, Crow Holdings Capital managing partner. The firm’s assets include a portfolio of 35 gas stations in affluent Westchester County and Long Island, New York, for example.

With $29 billion in assets under management, Crow Holdings operates from 20 offices nationwide, dealing in multifamily, industrial and specialty real estate. —Rachel Stone

Read more