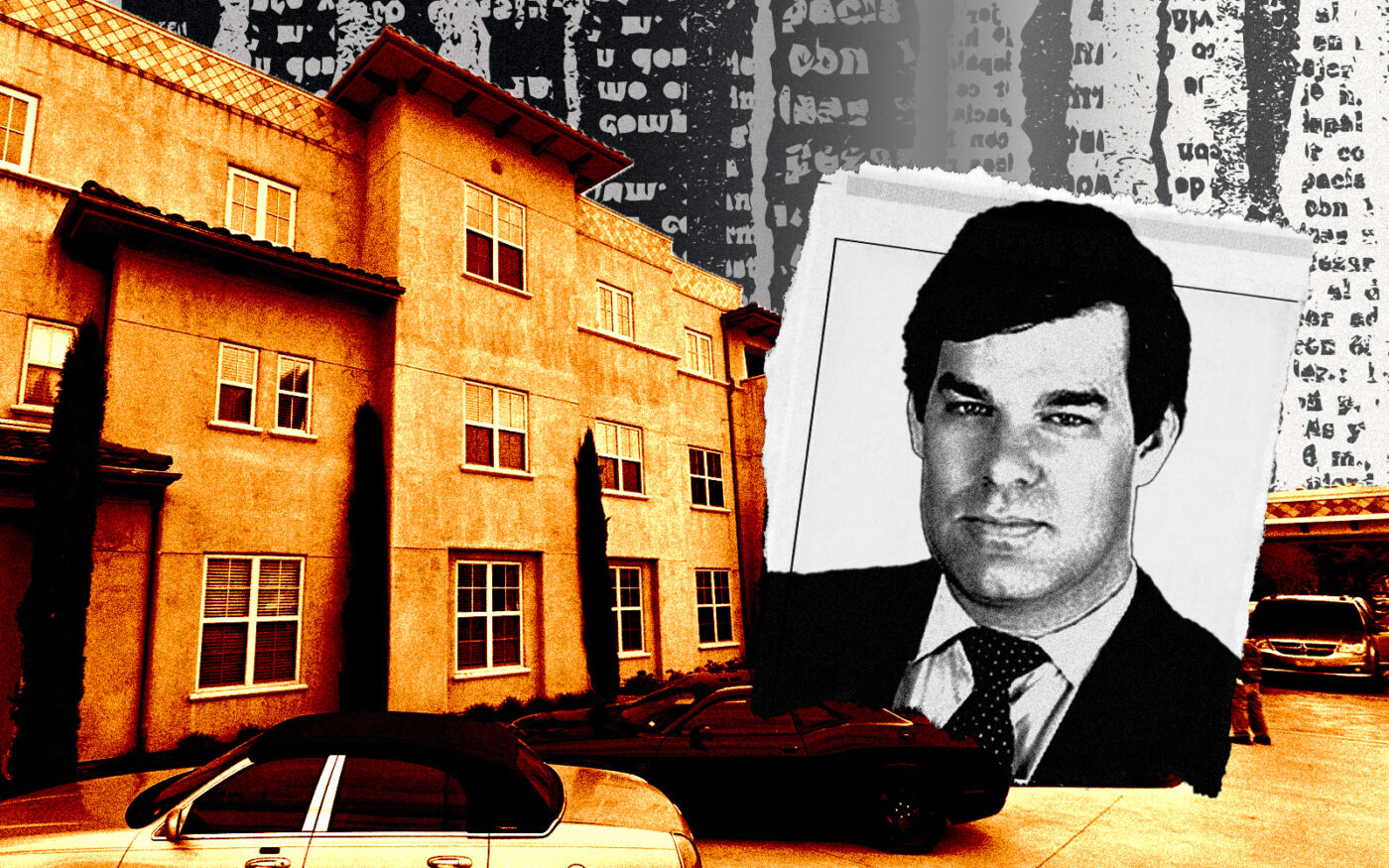

A luxury senior living development in Dallas may finally climb out of the bankruptcy hole that’s frustrated its residents.

A court-ordered rescue plan is nearing a conclusion for the 1.55 million-square-foot Edgemere. Plans call for selling the property for $48.5 million to Bay 9 Holdings, which will turn it into rentals, the Dallas Morning News reported. A judge will make a final decision soon, about a year after Edgemere filed for bankruptcy, citing struggles from the COVID-19 pandemic and a February 2021 winter storm.

The owner would sell bonds to refund homeowners’ entrance fees totaling $145 million. Edgemere’s parent company, Lifespace, also mentioned the unrestricted $188 million it has in cash reserves, ensuring residents are refunded by 2025 at the latest.

Lifespace announced in December that it would give back the fees as long as certain conditions were met, such as units being re-leased. But residents pushed back, some saying their units had been unoccupied since 2019.

All 289 households entitled to refund claims voted to approve the proposal. Of the 109 voters entitled to bond claims, 106 were in favor.

Though the plan isn’t perfect, this was the best solution for families to receive the money they’re owed and move on with their lives, an attorney representing the families, Benton Williams, said during a hearing.

Read more

For Lifespace, the agreement is already affecting its business. Fitch Ratings recently gave a negative credit report on Lifespace, asserting that $82 million of the refunds will come from bonds, and the rest will be financed through 11 other senior living facilities it owns.

Ivan Gold, a lawyer for Intercity Investments, doesn’t believe these properties are generating a reliable stream of revenue, noting that Lifespace lost about $86 million in 2022 and $32 million in 2021.

—Quinn Donoghue