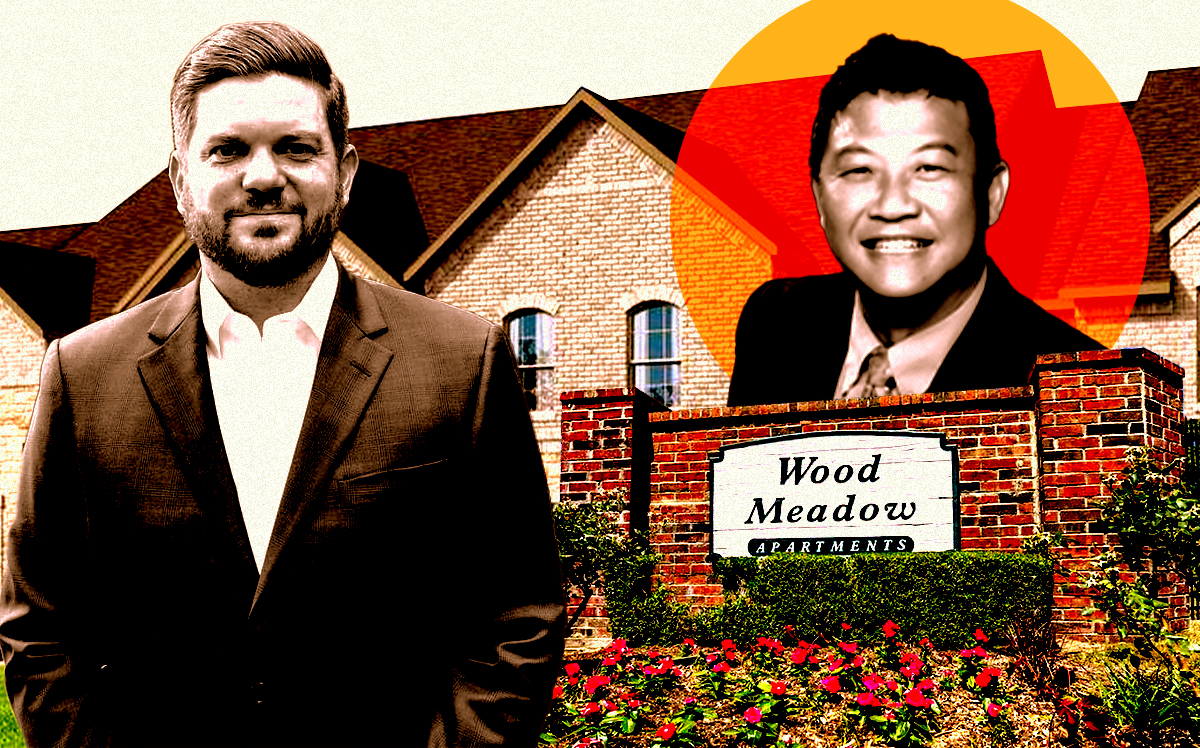

Dallas-based SPI Advisory continues to wheel-and-deal in the metroplex, this time selling off the Wood Meadow Apartments after making a number of capital improvements.

The investment firm first bought the 222-unit, Class B apartments located at 6897 Meadow Crest Drive in North Richlands Hills, a suburb just outside of Fort Worth. The company acquired the complex in 2017 before embarking on a number of renovations the following year.

Twinkle Star Asset, a local multifamily investment firm, bought the apartments for an undisclosed price, SPI announced. While financial records were not disclosed, the complex’s taxable value last year was $24.5 million or $110,000 per unit, according to Tarrant County Appraisal District records. In 2018, the value was listed at just under $17 million.

Apartment amenities include a pool, a fitness center, a dog park and on-site security. SPI improvements to the property included unit upgrades, dog park renovations, office remodeling and additional amenities.

Class-B apartment flips have been a popular trend in the multifamily investment game across Texas recently. Texas’ booming population has made underperforming Class-B assets ripe for acquisition, and those investments have been providing substantial profits for firms that can invest in renovations.

Tthe Wood Meadow Apartments were a beneficial asset in a strong market and were “bittersweet” to sell, SPI Advisory executive Michael Becker said. SPI is a private investment fund that focuses on multifamily acquisitions and sales across Texas. The company has acquired and sold dozens of firms comprising thousands of units since the company’s formation in 2014.

The firm’s 2023 strategy is to target and purchase high quality assets with low-to-modest capital risk as the number of multifamily developers needing to sell outpaces the current buyer demand, according to the firm’s 2022 Q4 newsletter. The report stated the firm plans to be aggressive seeking investments early in 2023 and will likely slow down heading into 2024 to weather prolonged high interest rates that will result in additional profits in the event that rates fall by the end of the year.

Read more

North Dallas-Fort Worth continues to be a hotspot for multifamily investment as the growing metroplex population flocks to the suburbs. The Dallas-Fort Worth metroplex ranked second in the nation for new multifamily and commercial construction last year, bringing in over $10 billion worth of investment. Many DFW cities have led the nation in apartment building in recent years.