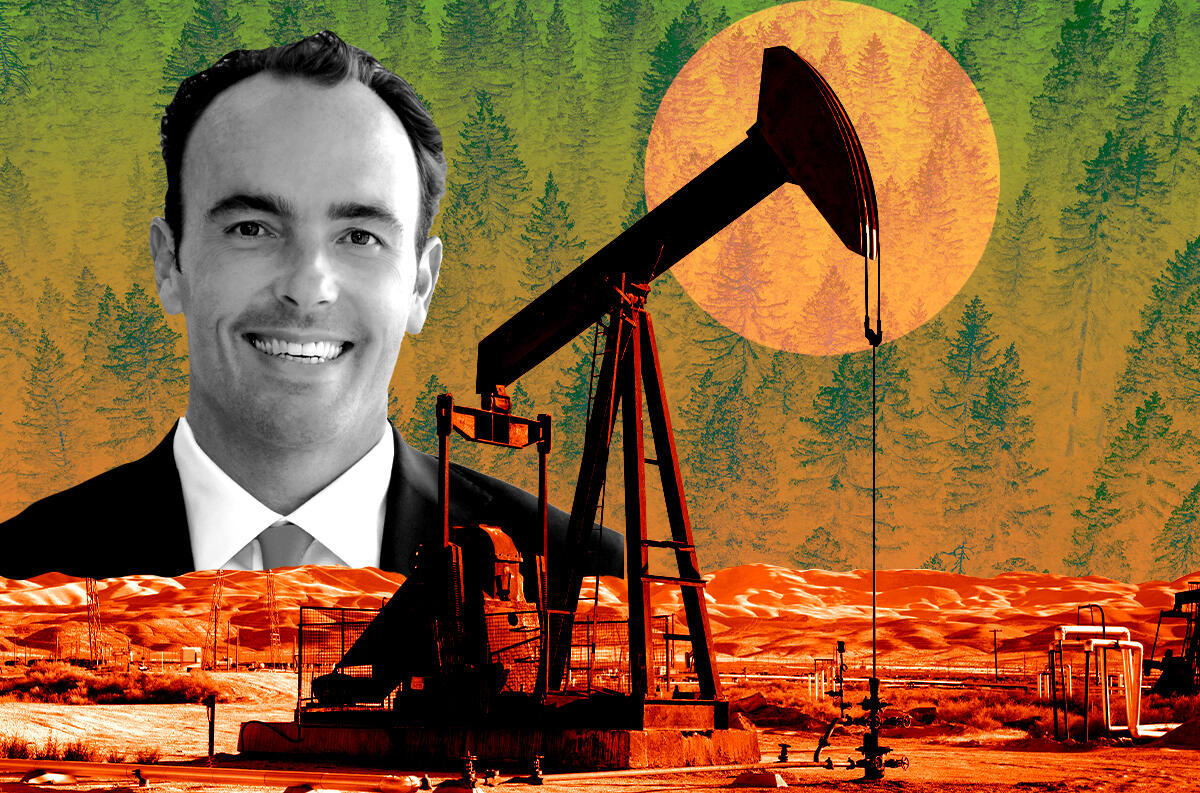

Kyle Bass has a new play: Texas land.

The market for Texas dirt “is big, and it’s real,” says Bass.

Bass is best known for shorting mortgage debt leading up to the 2008 financial crisis, but more recently he cashed in on a short bet against United Development Funding. His investment firm, Hayman Capital placed a short bet on the Dallas-based REIT in 2015, and even set up UDFexposed.com to bring light to executives’ alleged misconduct. Fast forward to January 2022— a federal jury convicted UDF Chief Executive Hollis Morrison Greenlaw and three other executives of 10 counts, including conspiracy to commit wire fraud affecting a financial institution, conspiracy to commit securities fraud, and securities fraud.

The collapse of UDF was a welcome victory for Hayman Capital, which had previously missed on big bets shorting the Chinese Yuan and the European Union’s sovereign debt. In the years that Bass was awaiting vindication over UDF’s alleged ponzi scheme, Hayman’s assets shrunk by more than 80 percent.

Fresh off the UDF win, Bass has set his sights on amassing swathes of undeveloped Texas land, the Dallas Morning News reports.

Conservation Equity Management, an investment firm founded by Bass just last year, has spent $90 million acquiring six properties totaling 37,000 acres. The pastoral portfolio includes a West Texas ranch featuring the ruins of a frontier fort, a heavily wooded timber tract in East Texas, a wildlife corridor near the Louisiana border, and a holding in the heart of a $240 million high-tech development outside Austin.

Read more

Texas is a unique place for land sales. When the Republic of Texas negotiated its entry to the United States, it was deeply in debt. The one thing it did have was land, much of which was sold off to private owners. Today, there are 142 million acres of privately owned ranches, farms and forest in the state and the median price per acre of rural land has shot up 123 percent in the past decade.

Bass’ rural land play expects more of the same.

“I’m taking all of my expertise developed over decades of analyzing global macro situations and geopolitical situations and developing a thesis on Texas land as an asset class,” Bass, who was born in Florida but raised in Texas, said in an interview with Bloomberg.

Bass plans to compound CEM’s return through carbon offsets and Texas’s boom has spawned a number of projects, including several aimed at the oil and gas industry. Bass’ also is seeking returns on these vast rural lands from anticipated increases in land values generally, as well as eco-minded strategies such as regenerative cattle grazing and forest preservation.

But offsets appear to be the center of the strategy.

All the industrial expansion is “going to require much more mitigation,” says Bass.

“Why not institutionalize this business right now?” he said. “We’re charging those that are infringing the most, and they are happy to pay it.”

— Maddy Sperling