Rent-to-own retailer Conn’s Inc.’s recent bankruptcy filing could result in millions of square feet of retail and industrial space opening up across Texas.

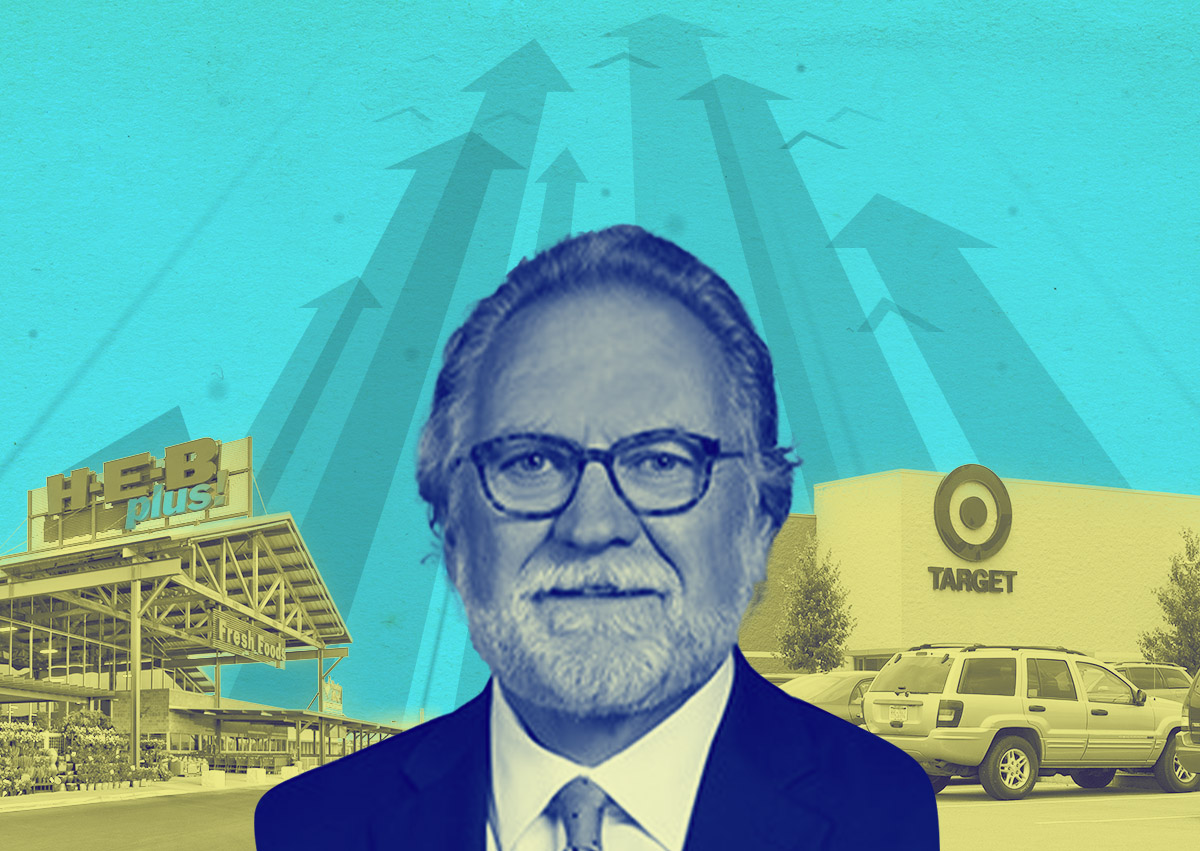

The Woodlands-based retailer, led by CEO Norman Miller, will close all 174 of its Conn’s HomePlus stores and about 380 Badcock Home Furniture stores, Bisnow reported.

Other retail bankruptcies have spared Texas due to its strong demographics and population growth, but Conn’s significant footprint throughout the state will make the closures hit harder, said Steve Triolet, senior vice president of research and market forecasting at Partners Real Estate. Conn’s occupies 4 million square feet of space and has 83 stores in Texas.

Prominent properties owned by Conn’s include a 443,000-square-foot distribution center in Grand Prairie and a 657,000-square-foot building at 1401 Rankin Road in Houston, which serves as a retail clearance center, distribution center and corporate office.

While reusing an old Conn’s store would present challenges due to the chain’s large retail floor plates, there could be opportunities for landlords to find new tenants and raise rents, as tenants compete for space. However, the sudden departure of such a major retailer could trigger a domino effect, leading smaller tenants to vacate retail developments left without an anchor.

“I wouldn’t call it a red flag for the retail market,” Triolet said. “Maybe it’s a little bit of a yellow flag, since we’re seeing so many of these announcements across the country. But overall, the market fundamentals are strong, especially for all the Texas markets, but really, in all of the Sun Belt.”

Read more

Retail vacancy rates are extremely low, at 4.1 percent nationwide, according to JLL, and most new retail construction consists of pre-lease agreements. The state’s industrial demand has been robust, with a 3.5 percent absorption rate through 2022, far exceeding the national average of 0.1 percent.

Conn’s has laid off 267 people at Texas locations, including The Woodlands, San Antonio, Beaumont and Grand Prairie. The company, which also operates the in-house credit provider American First Finance, sells furniture, electronics and appliances.

— Andrew Terrell