Henry Cisneros has already led a major American city, a federal agency and a global television network. At 76, Cisneros is taking on yet another gargantuan challenge.

The former mayor of San Antonio and secretary of HUD wants to get involved in rebuilding America’s infrastructure — which, in his view, includes its housing stock — by bringing together public and private entities. His infrastructure investment management firm, American Triple I, headquartered in the Chrysler Building in New York, is doing that work. While the company’s projects range from the new terminal at John F. Kennedy Airport to light rail extensions in Los Angeles, Cisneros sees much of that growth, and the profits to come from it, running through Texas.

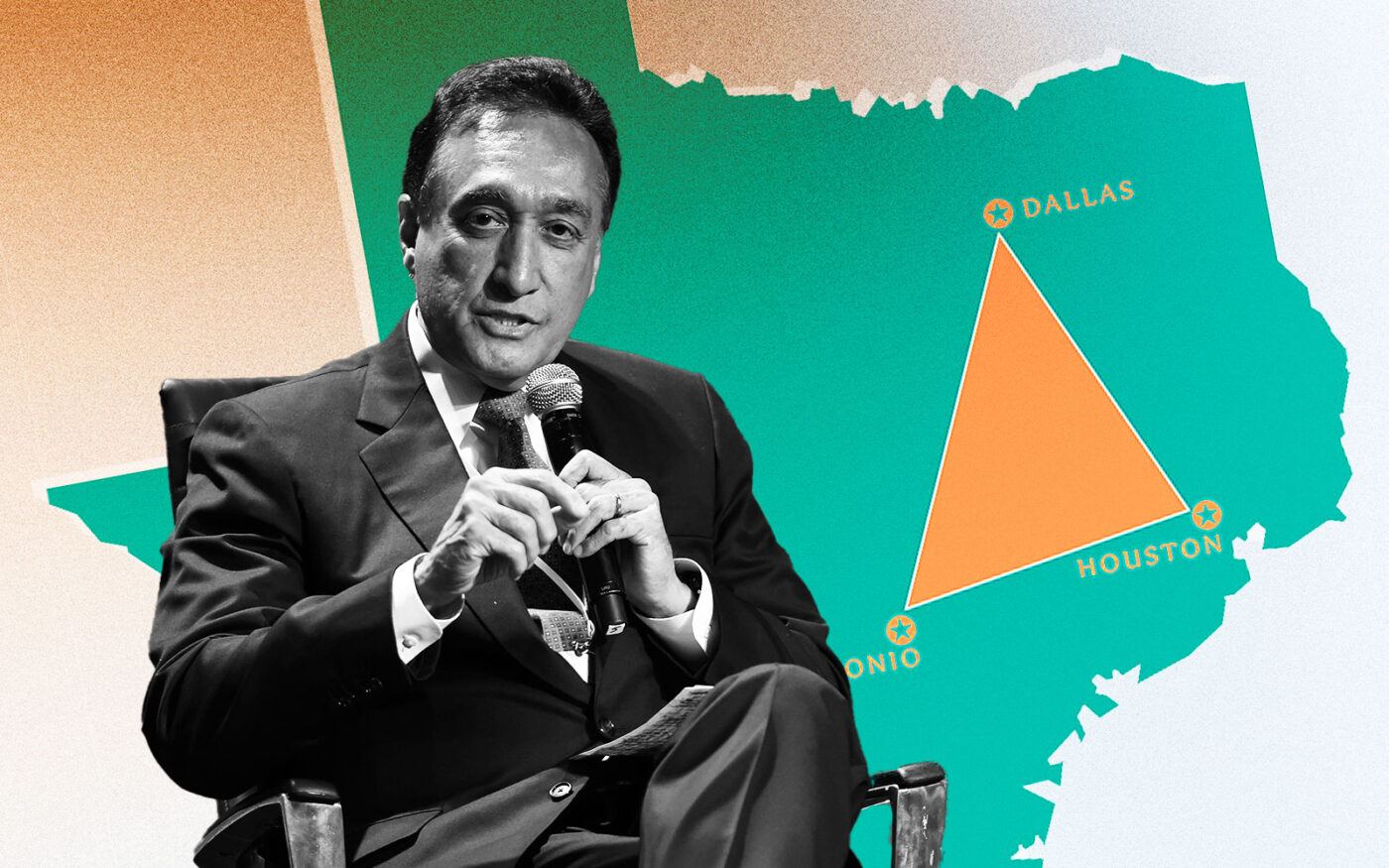

In 2021, Cisneros co-authored a book about the growing economic and political power of the Texas Triangle cites: Dallas, Fort Worth, Houston, San Antonio and Austin. Exploding population, relatively low cost of living and business-friendly climate put the megaregion on track to make it a global superpower in the next decade, the book argues.

Cisneros is at work on a follow-up focused on Central Texas, specifically the emerging Austin-San Antonio metroplex.

Like just about all other metros in America, Texas cities face a pressing need for more housing. When homes become too expensive, that barrier can block a city’s path to prosperity. As Cisneros sees it, the government and the private sector both have roles to play to make sure the Texas Triangle isn’t strangled by a housing crunch.

On a chilly morning in January, Cisneros welcomed The Real Deal’s Texas Bureau Chief Joe Lovinger to his office on San Antonio’s Westside. During the pandemic, Cisneros converted his family’s old print shop into an office and personal library, where he houses a growing collection of books and memorabilia.

He discussed his infrastructure ambitions, the potential of the Texas Triangle and what he learned at the top of the public and private sectors.

This conversation has been edited for length and clarity.

Housing is a major issue in cities across the country. As a former mayor and HUD secretary, you have a unique perspective on that issue.

I’ve been to every one of the 50 states, and 200 cities within the 50 states. When I was mayor, I was president of the National League of Cities, and went to 35 states in that role. Then at HUD, I went to all of the 50 states and went to many cities 20 or 25 times. We had big issues, as you know: public housing in Chicago, housing in Atlanta, Houston, Los Angeles. After the earthquake, I spent a month on the ground in Los Angeles. So I feel I have a pretty good vantage point from which to understand the country, but particularly the cities.

You were a mayor, working where the rubber meets the road. Then you moved to HUD.

I tried to make HUD into what I call a “place-based department,” as opposed to just looking from a Washington perspective, and the billions of dollars in budgets. Some HUD secretaries will focus just on how to get more money from the Congress, and that’s their job. But we worked very hard to create a place-based focus, where what mattered was whether we were making a difference on the ground in cities. So it meant being there. We were also negotiating and resolving disputes on public housing. Good experience — I learned the country.

At HUD, were you just focused on residential development? Or commercial too?

We encouraged mixed-use, because that brings private capital into the mix. So you have really interesting projects like Fruitvale in Oakland, which is at a BART station, and is a mix of housing — some affordable — over commercial at a train station.

I think we’re going to see a good deal more of that, with this infrastructure bill that’s resulting in extension of rail lines, and modernization of rail lines. We’re going to see a good deal more of what they call TOD, or transit-oriented development. It’s a big part of the answer to the density issues, and to the affordability issue, because you want workers near rail so they can get to their work.

Texans love their cars, and Texas cities are built, in large part, for those cars. How do you encourage cities to adopt a lifestyle built around public transit and density?

We don’t have to worry about the cities — the cities are there. They’re willing to do it. It’s a question of, does the expertise exist in the transit systems and in the cities? And is the money available to do it?

But the way that Texas cities grow is through sprawl, and that makes density very difficult. How do you think about building density in cities?

I think it’s happening. I think you’re seeing high-rise buildings in Houston, high-rise residential buildings in Dallas, and it’s a phenomenon in Austin, for sure, because the tech sector in Austin, instead of being in the periphery, has chosen to be in the core. It’s a bit like San Francisco, where Salesforce and so forth have big buildings downtown. Austin, same thing.

You wouldn’t believe Austin’s skyline these days. It’s 55-story buildings. You can’t find the Capitol or the University of Texas tower anymore.

How fast is Central Texas growing?

This is a region from north of Austin to south of San Antonio, presently, of 5.2 million people. People don’t recognize that. By 2050, we will become a region of 8.4 million people. So an additional 3-million-plus.

It’s adding a Chicago.

Exactly. It will be larger than Houston is or the Dallas-Fort Worth region is today. You’re talking about the emergence of a major megaregion within the United States. That has international implications, because the University of Texas is international. The technology in Austin is international. The biosciences here [in San Antonio] is international. The cybersecurity here is international. So it’s a player, just like how Houston is international today, thanks to energy, space and medicine, and Dallas is international today, thanks to technology, business and transportation.

Looking at the country’s real estate and economics, I think you have to look at the Texas Triangle as a fourth megaplex in the United States. There’s the Boston-to-Washington megaplex, the Seattle-to-San Diego megaplex, there’s the Chicagoland industrial megaplex, and then there’s the Texas megaplex. That’s my assertion of how the country is developing regionally.

And there are no barriers to this. That is to say, there are no natural barriers that say this has got to stop. There are no mountain ranges [penning it in]. There are tax advantages, lower cost of living. If we do our infrastructure correctly, which is to say, roads, power, water and education correctly, there’s no stopping this.

What does the area need?

Clearly multifamily housing. When I was HUD secretary, I was asked to come out to Silicon Valley and talk to the Silicon Valley Manufacturers Association about what they needed to do to maintain the momentum in Silicon Valley. I spoke to them about housing, because prices were starting to rise. And we know what has happened to prices in Silicon Valley and San Francisco in the interim years.

They actually became an impediment to the continuation of Silicon Valley’s prosperity, because young professionals just couldn’t afford to be there. I have a niece who works for Google, and I thought she was living in paradise until I went to see the apartment she was living in. It was an apartment behind a house. As a Google executive, that’s all she could afford!

There are limitations to the trajectory of prosperity if you don’t act on the infrastructure. Multifamily is one, but we also need affordably priced single-family homes where people can make the transition from apartments to ownership.

One doesn’t often hear multifamily housing described as infrastructure.

I’ve been trying to sell that point on the national level. I’m chairman of the Bipartisan Policy Center in Washington. We now have a premier center on housing production, because we believe that at least a major part of the answer to the affordability problem is adequate supply. It’s a supply-demand problem. In places like Austin, where the supply is not keeping up with the growth, you end up with these incredible year-to-year increases in rents and prices.

It’s clear that housing is part of the “production function” to build prosperity. You can squelch your prosperity, as Silicon Valley has in some places done, by not having housing adequately priced. So any practical person looks at that and says, “We have a problem here.”

It’s also integral to the ladder of upward mobility. People go from an apartment to, for the first time, owning something. And the equity they build up in their home is, for most people, the largest contribution to their net worth. So it’s more than just four walls and shelter. It’s an investment that introduces people to ownership, net worth and wealth.

What can the government do to encourage that?

It should be deeply involved, because it has a lot of levers — permits, expedited processing, extra fees that are imposed. Austin’s getting it. Austin’s trying to clear a lot of those things up in order to get housing production accelerated.

The national government has a place in this as well: encouraging manufactured housing, encouraging materials that can be used in creating sustainable housing, energy efficiency, and so forth. And then funding affordable housing through, for example, the Low Income Housing Tax Credits program, which is one of the best instruments for producing affordable housing.

Your company, American Triple I, has been involved in some of the biggest infrastructure projects of the last decade. You also co-founded CityView, a major residential developer. What’s your involvement in those companies?

American Triple I is a company that raises capital for institutional infrastructure. So right now, for example, we raised $400 million for Terminal Six at JFK [airport]. We were one of the members of the consortium that raised the capital. We were involved in raising capital for a rail project in Los Angeles that would link the UCLA area along the 405 into the San Fernando Valley.

I’m not personally involved in residential. My son-in-law runs that company, called CityView. It’s based in LA. I’m more focused on infrastructure.

CityView is doing interesting work.

Yeah, it’s workforce — not upscale, not government subsidized — workforce. Middle-range housing in Los Angeles. Raised a couple of billion dollars worth of capital, and translated that into about $5 billion worth of housing.

When we founded the company, the intent was to do single-family detached homes. But the pandemic hit us pretty hard, and our investors said, “We’ll stick with you, but we don’t want to do single-family. If you’ll do multifamily, you can use the money for that.” And we started doing that.

My son-in-law [Sean Burton] runs that company. He married my daughter — they were classmates at NYU, and they met in a moot court.

On opposing sides?

Yes, and he says, “I won, but it’s the last argument I ever won.”

Read more