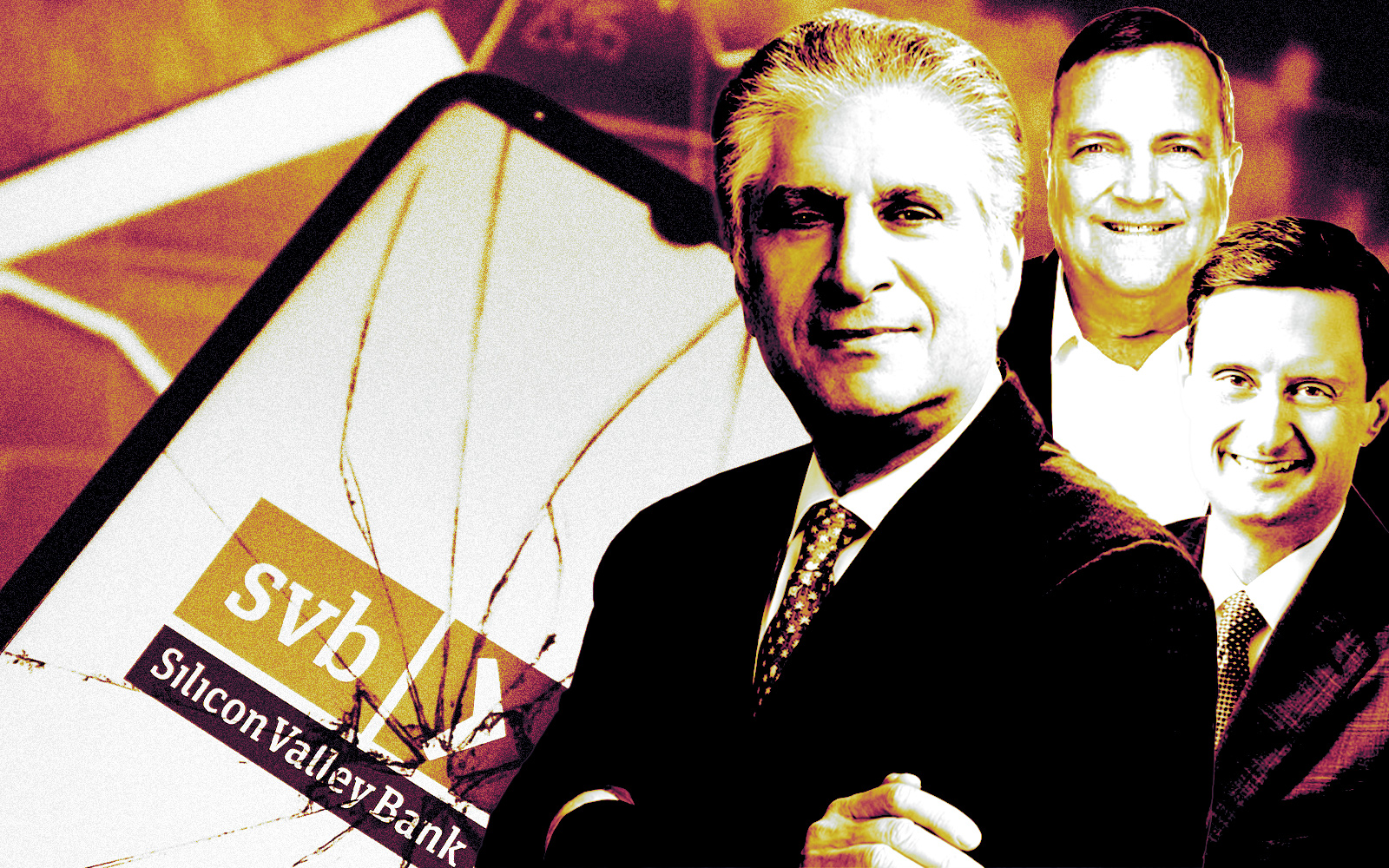

As the failure of Silicon Valley Bank spooks investors and depositors at regional banks across the country, Texas financiers are not immune.

Share prices of Dallas-based Comerica Bank fell to $42.61 on Monday, a decline of more than 25 percent on the day. Shares were trading for $58.81 at market close on Friday, but earlier that day, regulators shut down Silicon Valley Bank, marking the largest bank failure since the Great Recession.

Comerica had $16.4 billion of commercial real estate loans on its books at the end of 2022, accounting for 31 percent of the bank’s total loans. The bank’s loans specifically for real estate developers increased $1.5 billion last year. On top of its commercial real estate financing, Comerica had $258 million in residential mortgage loans, according to SEC filings.

Late last week, Citigroup analysts called Comerica one of the “best regional bank plays.” JPMorgan Chase gave the stock similarly strong marks, though analysts for Piper Sandler downgraded it to “neutral” in February.

The bank is diversified enough to remain liquid, and that other banks’ troubles are a result of being over-concentrated in certain asset types and areas, said Carmen Branch, a spokesperson for Comerica.

“We do not feel the recent events are reflective of the overall health of the banking industry,” Branch said. “Most regional banks — including Comerica — have a more diverse, stable and ‘sticky’ deposit base and remain well capitalized and highly liquid.”

“Comerica remains open for business as usual,” she said.

Elsewhere in Texas, publicly traded banks fared poorly. Shares of Independent Bank, based in McKinney, fell 9.3 percent on the day. Independent’s book is heavily dependent on real estate lending, with $7.8 billion in commercial real estate loans at year end. Cullen/Frost shares fell 12.6 percent on Monday, while Texas Capital Bank shares declined 15.9 percent.

It is still too soon to assess the extent of any potential contagion from Silicon Valley Bank’s failure. On Sunday, New York regulators shut down Signature Bank, a top multifamily lender in the state with about $36 billion in real estate loans. The government has assured depositors that Signature and Silicon Valley Bank customers will get their deposits back.

Still, it wasn’t all doom for Texas lenders, as shares of Prosperity Bank, the Houston-based lender with $5 billion in commercial real estate loans, dipped just under 3 percent Monday.

Read more