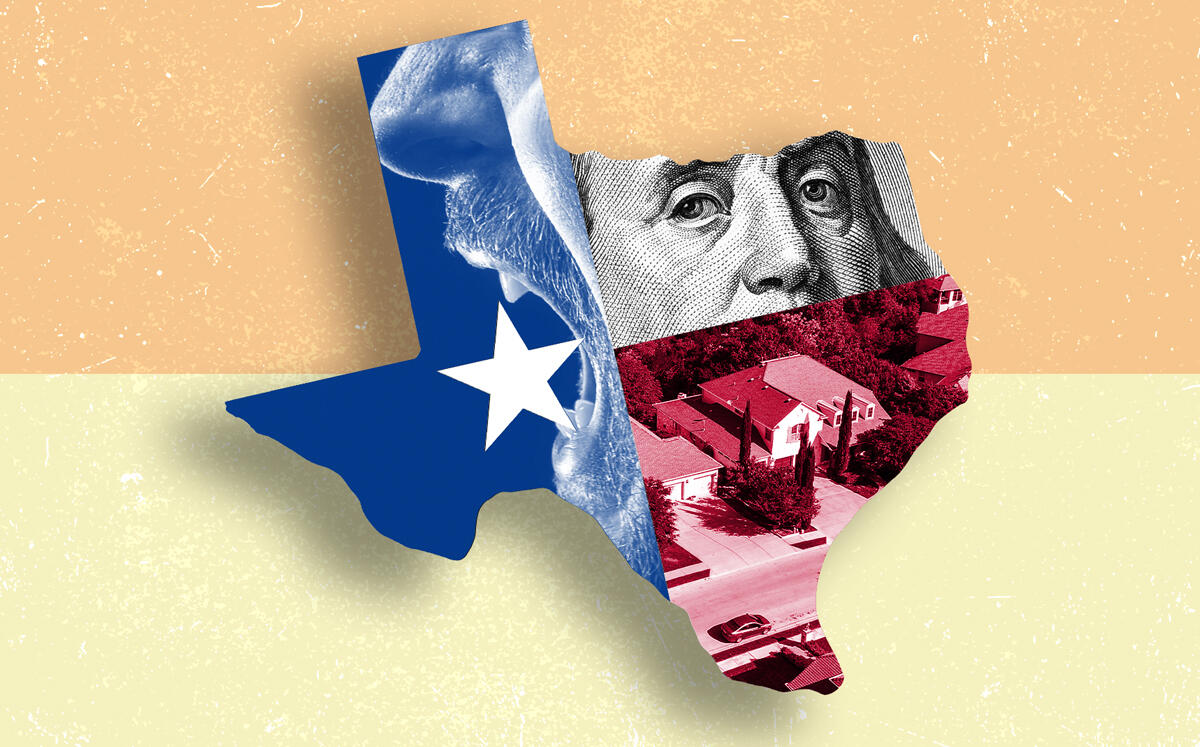

Texas homeowners are reeling from a leap in property-tax appraisals.

The Houston Chronicle described the “sticker shock” in the area Monday. One resident told the publication that her appraised home value went up by $110,000 this year. The median taxable value of appraisals in Austin went up 53.6 percent, the Austin American-Statesman reported.

While not as extreme as in Austin, it’s the same story in Dallas-Fort Worth and San Antonio.

And it’s a result of a remarkable spike in home prices statewide: taxes are determined as a percentage of a property’s value as appraised by a county tax assessor, so an increase in home values can have a dramatic impact on the amount owners pay.

In the Austin-Round Rock area, median home sales value jumped 22 percent to $521,000 in March — and set a record with a median of $624,000 within Austin city limits. The Houston metro saw its median price jump to $335,000 (15.5 percent). The Dallas-Fort Worth metroplex set its own record in March with a median home price of $335,000, up 19 percent. And in 2021, the Texas median home price was $300,000, up 15.7 percent from 2020, according to a report from the Texas Real Estate Commission.

There are mitigating factors. For starters, property owners can appeal appraisals with local districts, which can lower their taxes substantially. In addition, Texas state law dictates that if homeowners who live in or on the property being taxed file for a homestead exemption, the appraised value of their home for tax purposes can’t go up more than 10 percent a year.

And while Texas has some of the highest property tax rates in the country, the average amount paid in 2021 decreased in three large Texas metros, according to a recent Attom report.

“Major markets with the largest decreases in average property taxes,” it reads, “included Pittsburgh, PA (down 35.1 percent); New Orleans, LA (down 20.2 percent); Houston, TX (down 18.7 percent); Dallas, TX (down 12.2 percent) and Austin, TX (down 7.7 percent).”

But Texans shouldn’t expect the same this year.

“It’s hardly a surprise that property taxes increased in 2021, a year when home prices across the country rose by 16 percent,” said Attom’s Rick Sharga in the report. “In fact, the real surprise is that the tax increases weren’t higher, which suggests that tax assessments are lagging behind rising property values, and will likely continue to go up in 2022.”

Read more