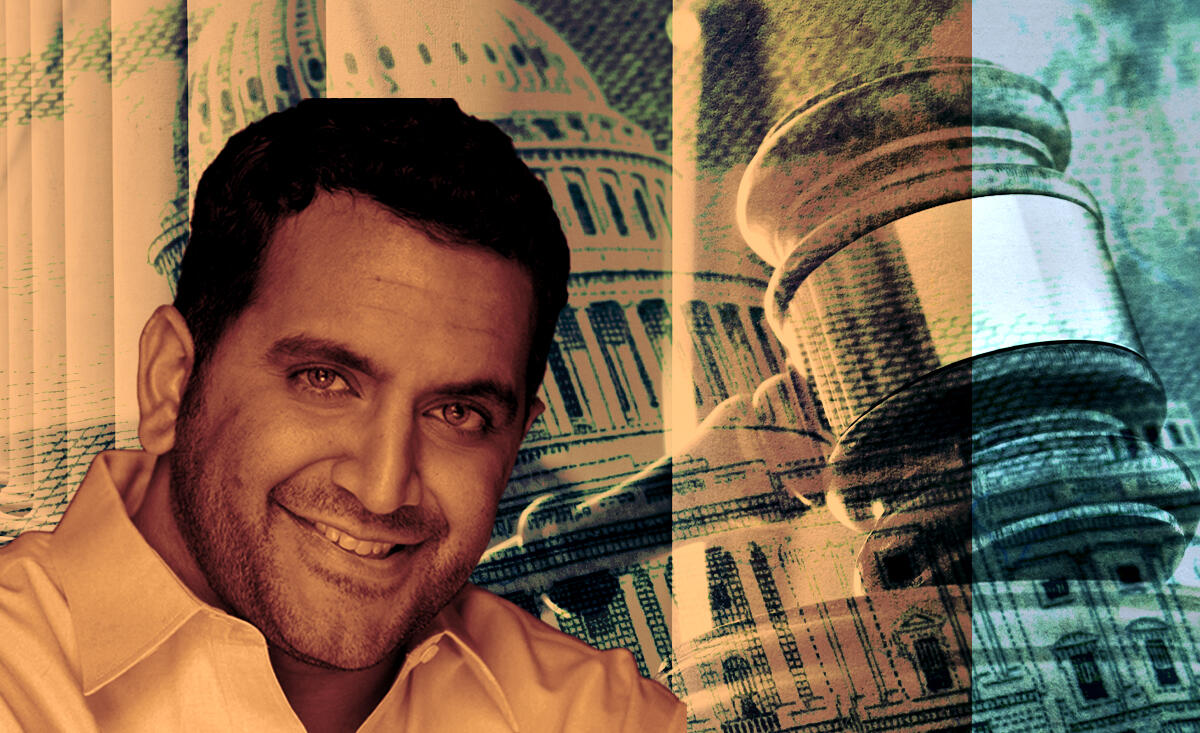

UPDATED, April 6, 2022, 3:52 p.m.: Austin developer Nate Paul, who has vowed to rebuild his empire after selling self-storage holdings out of bankruptcy, is being sued by his former attorneys, who claim he moved money to family members to avoid paying a $1 million judgment to the law firm.

Los Angeles-based law firm Gibson, Dunn & Crutcher filed a petition last week in Texas District Court in Travis County against Paul, his World Class Capital Group, his family members and other entities that he oversees. GDC, which World Class hired in 2016, alleges that Paul has transferred more than $87 million from his World Class Capital Group to conceal his assets and avoid paying his debt to the law firm.

Paul and his representatives didn’t file a response in court, or provide comment to The Real Deal.

The former wunderkind of Austin real estate told The Real Deal last month that he’s planning a comeback after selling a massive portfolio of self-storage properties out of bankruptcy. He’s faced years of foreclosures and bankruptcy battles — and even a raid by the FBI — as his multibillion-dollar real estate empire has dwindled.

GDC, representing itself, stated in court documents that Paul owes the law firm $1.06 million. In 2019, GDC initiated arbitration in New York after its fees went unpaid, and a final award was issued in 2020 of $924,584, plus interest of 9 percent per year.

Once the award was issued, GDC alleges in its lawsuit that World Class transferred dozens of LLCs and LP interests that it had out of the World Class Capital Group to other entities tied to Paul, which delayed payment to creditors like GDC.

GDC claims that Paul oversaw the transfer of more than $87 million out of a Wells Fargo account to Paul’s other entities and family members from 2018 to 2020. No records were created of these transfers, GDC alleges.

The law firm also claimed in its petition that World Class Capital Group is insolvent and hasn’t filed income tax returns since 2017. Collin Ray and Mitchell Karlan of GDC are serving as counsel.

This is not the first time Paul has been accused of improperly transferring funds between companies. Last month, U.S. Bankruptcy Judge Tony Davis ordered Paul to cede control of five companies tied to a handful of World Class properties after a U.S. trustee alleged that the 35-year-old investor was illegally moving money between entities.

Paul’s investments in Austin real estate once included marquee properties such as the 1.3 million-square-foot campus that 3M previously occupied. His quick success catapulted him to elite status as he drove a Bentley around town and was reported to be in attendance at Leonardo DiCaprio’s birthday party.

He gained national recognition in 2019 after FBI and U.S. Treasury officers raided his personal office and home. Former employees of Texas Attorney General Ken Paxton filed a whistleblower complaint that alleged Paxton abused his office to give favors to Paul. Paxton has denied the allegations, and Paul later sued the FBI, arguing that the raids violated his civil rights and harmed his businesses.

Updates to add context of sale in first paragraph on bankruptcy; in second paragraph on hiring of law firm and in 10th paragraph on ownership of 3M building.