JPMorgan Asset Management sold a landmark Dallas office tower to a California investment firm after five years for what local brokers speculate may have been among the highest prices for a commercial property in the city.

The Ross Avenue tower was acquired by Regent Properties, a California-based real estate investor that recently opened a second headquarters in Dallas, according to the Dallas Morning News. The 37-year-old high rise was sold by JPMorgan Asset Management.

While details of the purchase were not disclosed, local brokers contacted by the newspaper estimated the 50-story Trammell Crow Center–plus the retail and garage building across the street– went for more than $600 million. At that price, only last year’s sale of Crescent complex in Uptown for almost $700 million would surpass it.

The Commercial Observer reported in December that Regent Properties was seeking about $424 million in financing for its purchase of the building.

The New York-based company spent upwards of $180 million on upgrades and additions to the property, the paper reported. In partnership with Stream Realty Partners, the management firm oversaw a complete makeover including a renovated lobby, outdoor areas, and an attached parking garage with ground floor retail and restaurant space.

Read more

The cosmetic upgrades to the building apparently helped the 1.2 million-square-foot office attract and maintain tenants over the course of the pandemic, according to Eric Fleiss, CEO of Regent Properties.

“We spent the last year-and-a-half aggressively looking for high-quality assets that institutional owners don’t want to own because of the pandemic,” said Fleiss. “Our strategy has been to buy as many high-quality, well-located Class A urban high-rise buildings as we could.”

The 1.2 million-square-foot office is a “long-standing fixture of the Dallas skyline,” said Fleiss. While the tower needed money for revitalization, he added “there is more work to be done.”

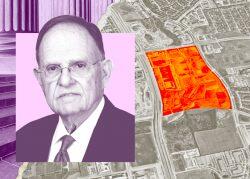

Regent Properties is leaving a considerable footprint in the North Texas real estate market. In 2016, it bought an 84-acre industrial campus between Highway 75 and Legacy Drive that houses tenants like Samsung and Peloton.

The Dallas-Fort Worth area finished right behind New York City in terms of investment property purchases in 2021 with almost $47 billion in properties sold.

[Dallas Morning News] – Maddy Sperling