After a long-fought legal battle, the original developer of a plagued Wade Park project had his claims of fraud dismissed by a federal judge, according to the Dallas Business Journal.

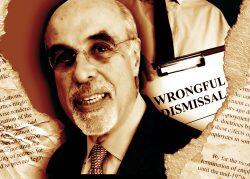

Commercial real estate developer Stan Thomas and his Wade Park entities’ claim against New York-based lender Gamma Real Estate Capital included allegations including fraud, breach of contract, money laundering, theft of trade secrets, racketeering and tortious interference with business relations. A New York federal court on Friday dismissed fraud and other claims against the lenders with prejudice, meaning the same claim cannot be refiled.

The project formerly called Wade Park or “Project X” was a $2 billion, 112-acre development at the corner of the Dallas North Tollway and Lebanon Road, across the street from the landmark Dallas Cowboys’ $1.5 billion Star. Thomas had laid out plans in early 2017 for one of the largest mixed-use projects in the Dallas-Fort Worth area, complete with a high-rise office, an entertainment venue, 1 million square feet of high-end retail space, roughly 2,400 luxury residential housing units, and five hotels.

Read more

Around this time, Gamma made a four-month $82.75 million bridge loan to the Wade Park developer. However, construction was completely halted by the summer of 2017, leaving just a giant pit and two partially constructed buildings in its place. It was repeatedly posted and removed from foreclosure listings throughout 2018, and thus never made it to auction.

In August 2020, Thomas filed charges against the lender, its president, Jonathan Kalikow, and others alleging a “loan-to-own” scheme to take over his multi-billion-dollar development. The complaint further accused Kalikow and the Gamma entities of a “loan-to-own” scheme. Thomas’ 2020 complaint against the lender was filed at the same time as the bankruptcies of two of his business entities, Wade Park Land LLC and Wade Park Land Holdings LLC.

Gamma contended that the Wade Park plaintiffs did not repay the bridge loan, or the other $48 million loan acquired in July 2018. After three extensions, the lender entered into six forbearance agreements and a deed-in-lieu agreement giving Thomas and his entities more time to repay.

When the Wade Park development entities defaulted again in February 2019, an affiliate of the lender took title to the Wade Park property.

In a 90-page opinion issued late Friday, U.S. District Judge Lewis Liman found that these forbearances undermined Thomas’ claims of a “loan-to-own” scheme.

“Our clients are gratified by the court’s comprehensive and compelling rejection of plaintiffs’ baseless claims,” said Michael J. Dell, a partner with law firm Kramer Levin and part of the team representing Gamma Real Estate, in a statement.

Today, the city of Frisco is working exclusively with Gamme Real Estate on new development plans for the land.

[Dallas Business Journal] – Maddy Sperling