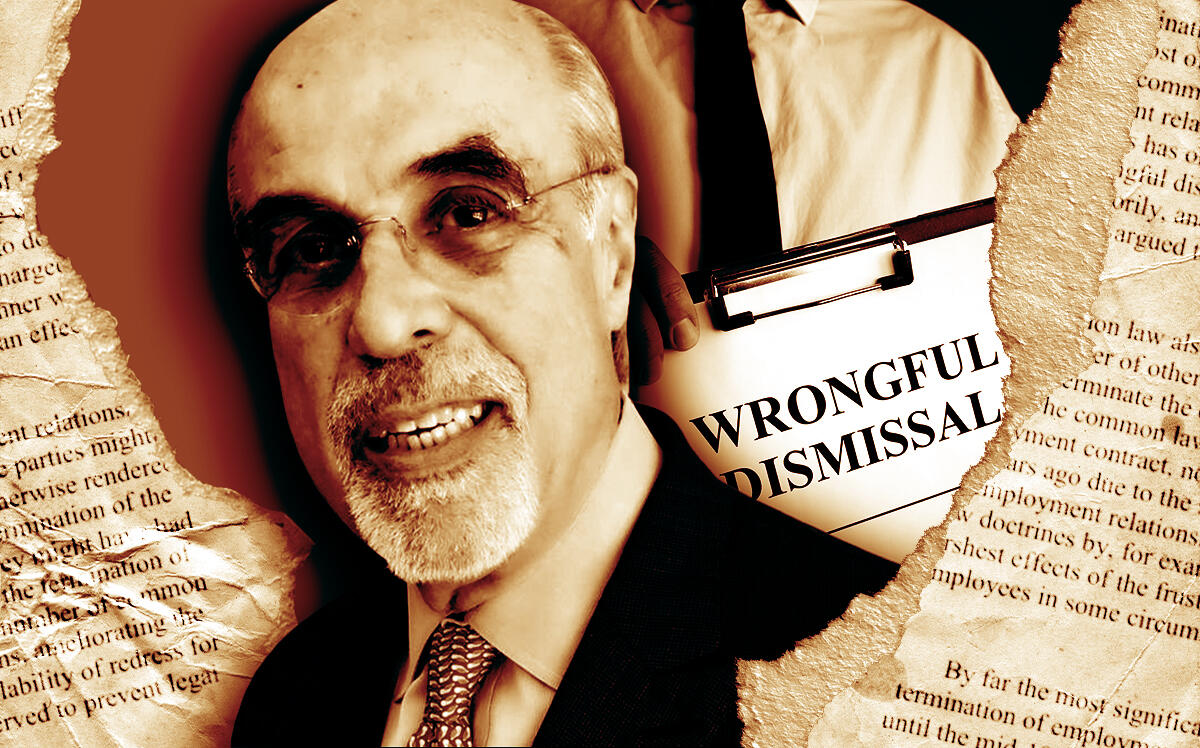

Whitestone REIT is facing a $25 million wrongful termination suit from its former CEO alleging top executives engaged in a “ruthless power grab” when ousting him in January.

In a lawsuit filed last week, James Mastandrea claims executives at the Houston-based company fabricated claims against him in order to take over the company, according to Houston Business Journal.

The complaint includes claims of breach of contract, breach of fiduciary duty, tortious interference with a contract, civil conspiracy and aiding and abetting a breach of fiduciary duty. Mastandrea is seeking payment of $25 million under his revised 2014 employment agreement, as well as additional damages, court costs and attorneys’ fees.

Whitstone, a real estate investment trust that focuses on retail shopping centers across the Sunbelt, has a market capitalization of $508 million. The firm has denied the allegations made by Mastandrea.

Mastandrea names as defendants then-CFO and Mastandrea’s successor David Holeman, general counsel Peter Tropoli, several trustees and the company itself in his complaint.

Then-executive vice president and soon-to-be ex-wife of James Mastandrea, Christine Mastandrea has also been named as a co-defendant by the complaint. Upon her husband’s departure, the company promoted Christine Mastandrea to COO.

“What may have started as a professional disagreement over the strategic goals of the business most certainly turned into a personal and vindictive campaign by the individual defendants to wrongfully oust Mastandrea from the company,” the former executive’s complaint said. “These individual defendants, acting in furtherance of their own personal goals and ambitions, made false misleading and disparaging statements to various committees and trustees of Whitestone, leading to Mastandrea’s termination.”

Read more

“Following the completion of a comprehensive independent internal investigation, the board voted to terminate James Mastandrea’s employment for cause,” the company said in a statement. “Mr. Mastandrea’s termination was consistent with the highest standards of corporate governance.”

The complaint alleges the primary reason Whitestone’s board of trustees decided to fire him was related to his alleged role in negotiations for a potential sale of the company to an unnamed third party. As CEO and chairman, Mastandrea considered selling Whitestone to establish a succession plan for when he eventually stepped down as CEO, according to Thomas Ajamie, Mastandrea’s attorney.

According to the former CEO’s complaint, Whitestone was defaulting on its credit obligations when he joined in October 2006. Through Mastandrea’s strategy of targeting properties in high-growth markets in Arizona and Texas and going after service-oriented tenants, Whitestone’s property assets grew from $170 million to nearly $1.1 billion over 15 years.

As of September 30, Whitestone’s quarterly net income stood at $2.9 million and it owned 59 commercial properties in and around Austin, Chicago, Dallas-Fort Worth, Houston, Phoenix and San Antonio, according to U.S. Securities and Exchange Commission filings.

Mastandrea’s termination was not related to the company’s operating performance, financial condition or reporting, Whitestone said at the time.

[Houston Business Journal] – Maddy Sperling