San Antonio-based finance firm SWBC is starting a private equity fund to invest $200 million in multifamily residential real estate in Texas, a category in high demand as population growth and rising home prices drive rental demand.

SWBC opened the first in a series of funds — SWBC Real Estate Fund LP — to invest in newly developed multifamily assets in Texas as well as some renovation projects, according to the Dallas Business Journal.

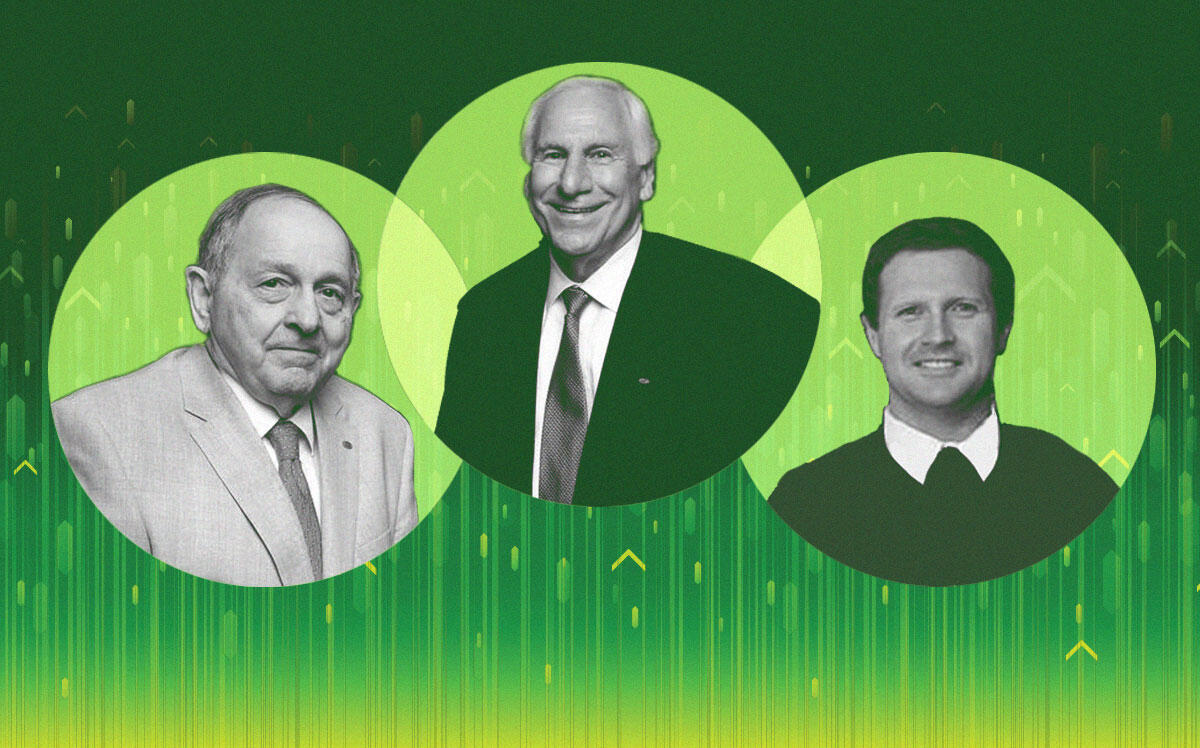

“We continue to find opportunities to develop Class A multifamily properties throughout the state of Texas, and we believe that this fund will allow our team to provide value for our qualified investors, as well as our business partners,” said Charlie Amato, SWBC chairman and co-founder, in the press release featured in Dallas Business Journal.

“Texas is one of the states that continues to experience record growth,” said Gary Dudley, president and co-founder of SWBC. “We are excited about offering a fund to certain qualified investors to help us capitalize on the opportunities that exist due to that growth.”

Read more

The project is a partnership with SWBC Real Estate, which has a portfolio worth $900 million in multifamily properties throughout Texas, including Mission Hills and Twin Creeks at Alamo Ranch apartments in San Antonio; Chalk Rock Canyon in Austin; and the Overlook Ranch and River Walk Village apartments in the Dallas-Fort Worth area.

Stuart Smith, COO of SWBC Real Estate, said in the release that the firm will oversee development and asset operations while allowing the investment team to focus on the investors.

“This structure is different from many other real estate funds as we will have our own in-house real estate group and the fund manager under the same corporate umbrella,” Smith said. “We view this as an advantage for investors in many regards, as we will have our own private pool of capital for all suitable future developments and potential acquisitions.”

[Dallas Business Journal] – Maddy Sperling