Vanguard Properties is fighting back against claims made by Red Oak Realty in a lawsuit last month alleging the San Francisco-based independent brokerage was poaching East Bay agents using NDA-protected information from failed merger talks. Vanguard filed a motion to dismiss the complaint in San Francisco Superior Court. Alternately, the brokerage asked that if the litigation proceeds, the court would strike portions of the complaint and deny Red Oak’s request for a preliminary injunction.

Red Oak’s original suit alleged that Vanguard, the Bay Area’s largest independent brokerage, engaged in an agent “poaching campaign” using protected information gleaned from failed merger talks.

The motion to strike refers to Red Oak as a “failing East Bay real estate brokerage that has apparently concluded it can stem the tide of departing agents by filing a meritless lawsuit against Vanguard.”

“Rather than fix the internal problems that led to these departures,” the filing goes on to say, “Red Oak’s solution to its self-inflicted wounds was to sue Vanguard in an effort to tarnish Vanguard’s reputation in the community, chill the natural and organic movement of agents away from Red Oak to Vanguard, and disrupt lawful competition amongst competitors.”

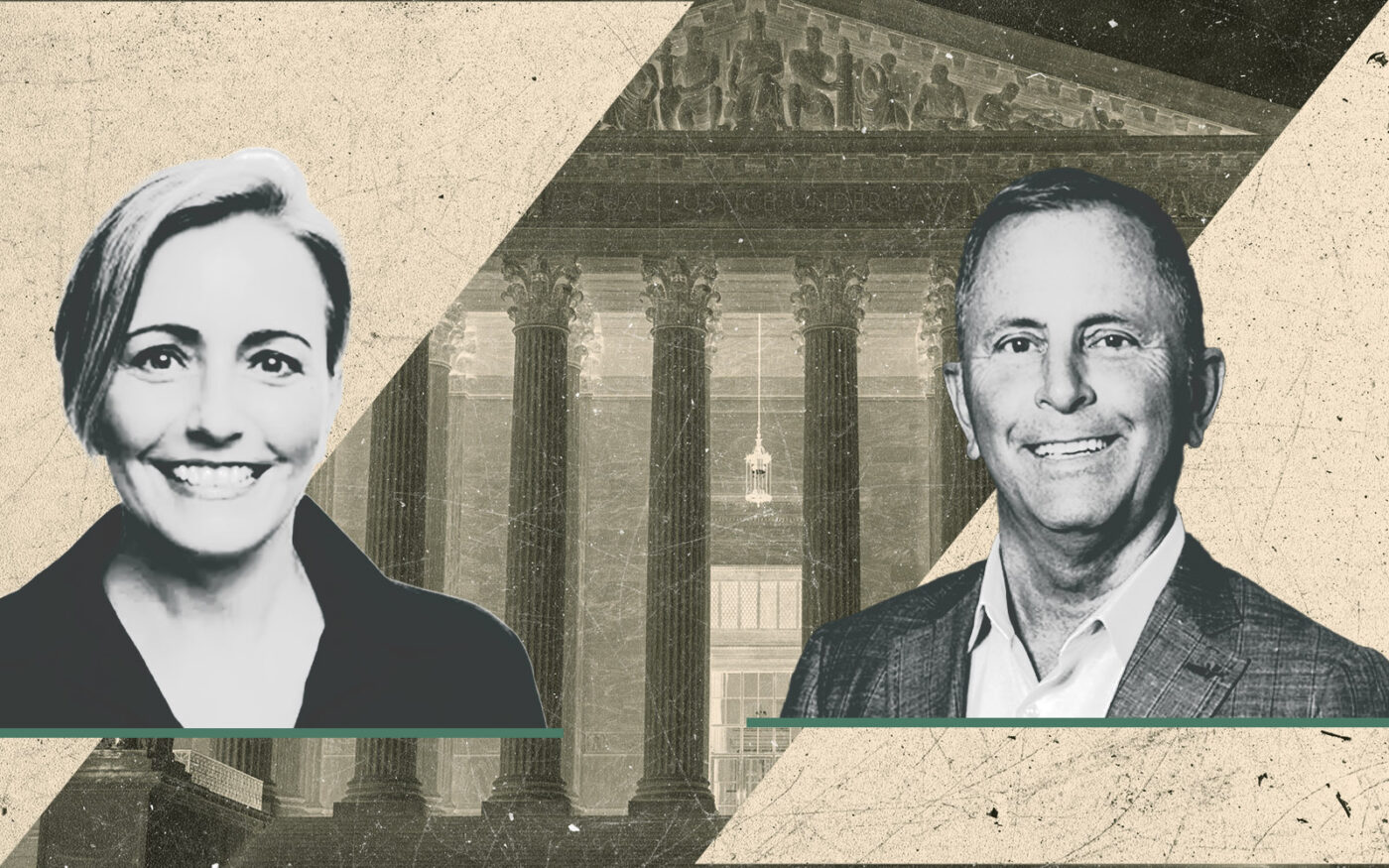

Red Oak CEO Vanessa Bergmark said that she has proof of her accusations that Vanguard used information gained during confidential merger talks in 2023 to improperly recruit Red Oak agents. She also said Red Oak had gained more agents than it lost in the last year, that it has been profitable since she began running it in 2010, and that the suit was not about the four agents who left for Vanguard, but rather putting an end to what she sees as “dirty practices” after the merger did not pan out.

“I’ve been at this for 21 years and never went out and filed a suit,” she said. “The NDA [non-disclosure agreement] goes for a certain term. Read the dates, stop doing what you’re doing and stop doing it in a way that is unethical.”

Jennifer Supman, general counsel and broker of record at Vanguard, said via email that, “as the litigation is still pending, Vanguard Properties does not have any comment beyond that contained in the opposition, numerous supporting declarations and the exhibits thereto.”

Documents and declarations

Vanguard’s motions were bolstered by extensive documentation and declarations. In one supporting declaration, Vanguard CEO James Nunemacher described the initial acquisition talks with Bergmark that began in 2020 but quickly fizzled. The talks picked up again in 2022, he said, after Mark McLaughlin, the former CEO of Pacific Union and now Chief Real Estate Strategist for Compass, approached him and Vanguard President Frank Nolan with the idea of combining several independent Bay Area real estate brokerages: Vanguard, Red Oak and two other unnamed independents.

In January 2023, the parties signed a non-disclosure agreement, which Nunemacher said in his declaration included profit and loss statements and financial valuations, but not agent agreements, commission structures or a list of Red Oak’s most valuable agents.

The merger talks “did not progress very far, and Vanguard ultimately withdrew from those discussions upon realizing that a consensus on Vanguard’s key terms was unlikely.” Nunemacher denied ever using the information covered by the NDA for any reason except to evaluate the potential merger, and said he was not involved in the company’s recruitment efforts in the East Bay, which are led by its COO David Chol.

The supporting documents also include declarations from Chol, other Vanguard higher ups and four former Red Oak agents that state the agents initiated contact with Vanguard, not the other way around, because they were unhappy at Red Oak, because they wanted to work with particular Vanguard agents, or both. The dissatisfaction stemmed from “poor management, an absentee CEO, bad culture, a lack of camaraderie/collaboration among agents, unprofessional workplace conduct, fines on agents who failed to attend weekly sales meetings, outdated marketing strategies, inexperienced marketing personnel, a new ‘roll back’ commission structure, a general environment that did not prioritize the agents’ needs, etc.”

They deny that Vanguard used information on commission splits, agency fees, compensation or marketing gained from the merger talks to recruit agents and argue that previous California court rulings support employees’ ability to move freely between companies.

“It is black letter law in California that soliciting another company’s agents (or employees) is not unlawful,” according to the filing.

In her declaration, agent Corey Weinstein, who was the first Red Oak agent to decamp for Vanguard last fall, said that she changed agencies because she had an opportunity to partner with Maria Cavallo-Merrion, an agent she had long admired who had moved to Vanguard from Compass in early 2024.

“I did not move to Vanguard because of commission splits, agency fees, compensation or marketing,” she said. “I joined Vanguard to structure the next phase of my career by joining a team with Maria and building a successful partnership.”

In his declaration, agent Leif Jenssen said that he left Red Oak, where his grandmother had also been an agent, after 30 years. He had been “happy at the company for a long time” but felt that it had begun to change as it grew, becoming “more bureaucratic and less pragmatic.” He cited changes to its commission structure, an unwanted overhaul of his marketing materials and the closing of his long-time office, after which he and his business partner Tamir Mansour were given “a glorified broom closet” in a new office.

It was Mansour who approached him about moving their business to Vanguard because he was friendly with Cavallo-Merrion. After many months of contemplation, he met with Chol and Oakland Office Manager Pamela Hoffman at Mansour’s home, where the Red Oak agents negotiated a set commission split and a dedicated office at Vanguard. He did not tell anyone at Red Oak he was leaving until he could first tell Bergmark after she returned from a vacation. She was “not pleased” and told him he could not send a departing email to his colleagues, he said in the declaration.

“I was sad to leave some of my best friends at Red Oak, but ultimately, I needed to do what was best for me,” he said.

Bergmark said that she could not go into specifics but that her general reaction to reading the declarations was that, “it’s surprising that those were written under penalty of perjury.”

In her recollection, it was Vanguard, not Red Oak, that pushed for the immediate departures of her former agents.

“People can grow and move on in business and do it thoughtfully and carefully and we would absolutely do that with them,” she said. “They don’t have to stay, but they don’t have to go in T-minus 11 minutes or this bomb’s going to go off. That’s what happened in each one of these departures, and that’s what’s unfortunate.”

In the declarations, both the former Red Oak agents and Vanguard executive staff said no proprietary information gleaned from the merger talks were used to recruit agents.

“Plaintiff has not identified a single actual trade secret and has offered zero evidence that a trade secret was used to recruit Red Oak agents, that Vanguard breached the NDA or that Vanguard even solicited any Red Oak agent,” the Vanguard filings read.

In his declaration, Chol said he was not privy to the information from the merger discussions and did not even know merger talks had occurred until the suit was filed.

“All I knew about Red Oak was what Red Oak agents shared with me, and information I heard from other Bay Area agents,” he said.

Hundreds of emails

The filings also argue that the supposedly confidential information Vanguard is alleged to have used to win over Red Oak agents was in fact publicly available via MLS records and other sources that track agent performance, as well as Red Oak’s own marketing and recruitment emails. The Vanguard filings include hundreds of pages of emails that show Red Oak higher ups reaching out to Vanguard agents extolling the benefits of coming to their firm after Vanguard opened its Oakland location last spring, one of several agencies that recently expanded their inner East Bay footprints.

Bergmark said the emails from herself and President Nicole Aissa go out to almost anyone with active listings on the MLS in Red Oak’s coverage areas and were not targeting specific agents. She made a distinction between what she said were Red Oak’s generalized recruitment efforts and Vanguard’s more pointed talks.

“Were we going out there and meeting with all these Vanguard agents and saying we had a merger in place, and we know X, Y and Z? No, not at all,” she said.

Red Oak does not have a reputation for aggressive recruiting and is well respected among other independents, according to the owner of another independent East Bay-based brokerage, which is not involved in the suit. While Vanguard was originally welcomed when they first began opening offices in the East Bay because of “ABC — anything but Compass,” the independent owner said, there has since been “an ick factor that is just not appropriate” to Vanguard’s expansion efforts, even if they are eventually determined to be legal by the courts.

“I don’t know if it’s a legal issue or more of a moral code, but it’s not right,” the owner said.

Next round

In its filings, Vanguard contests the assertion made in the Red Oak suit that Oakland Office Manager Pamela Hoffman encouraged Red Oak agents to cancel their listings and relist them once they came aboard at Vanguard. This is the behavior that Bergmark said pushed her to file the suit.

In her declaration, Hoffman called that allegation “categorically false” and said that in each instance Red Oak was paid its full share of the departing agent’s commission if there was a signed listing agreement in place and provided documentation to that effect.

In one case where a listing was canceled and relisted with Vanguard a few months later, it was due to market conditions and not because of the agent’s move, Hoffman attested. Further, she declared, the agent had decided on his own to hold off on signing new listings until the transition from Red Oak to Vanguard was complete, and was advised by a Vanguard staffer that that would not occur until his license was moved, but “I never told any Red Oak agent to cease listing negotiations with Red Oak clients and I am not aware that any Red Oak agent ceased listing negotiations with Red Oak clients.”

A hearing on the motions to dismiss the case or strike portions of the complaint has been set for Feb. 3 and Bergmark said there would be more documents filed on her end.

“There will, without a doubt, be a round three,” she said.

Read more