Bondholders behind a CMBS loan on a 580,000-square-foot office building in San Francisco’s Financial District have signaled that they’re open to renegotiating terms, indicating the current landlord has some leverage in a workout even though it would come to the table in default.

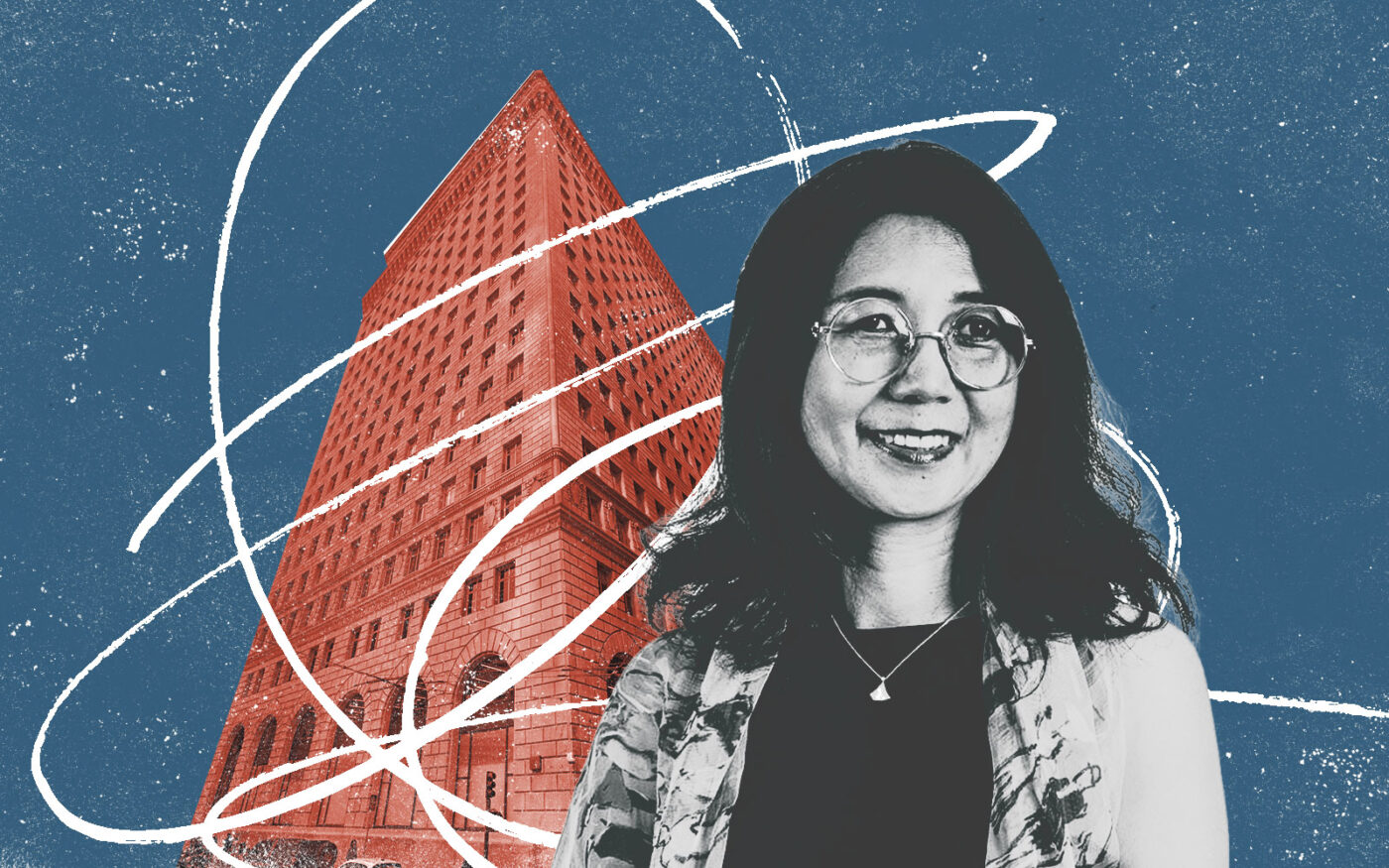

Burlingame-based investor Kylli last month defaulted on a $350 million loan against 225 Bush Street, and its lenders are considering discounting the balance, the San Francisco Business Times reported.

Notes sent to commercial mortgage-backed securities bondholders mention other possibilities for workout scenarios, the publication reported, including a sale of the loan and other “enforcement actions.” Representatives of Kylli, a unit of China-based Genzon Investment Group, declined to comment.

A move by Kylli to pay off the debt at a discount would put it amid a trend in San Francisco’s office market where such deals allow landlords to trim overhead, which provides room to meet expenses with lower revenue or rents. Such moves have been prompted by a record vacancy rate of 37 percent, according to CBRE, with scads of empty space sapping both current revenue and pricing power going forward for many landlords.

225 Bush Street is a prime example of Downtown San Francisco’s struggles. The 22-story building was nearly full prior to the pandemic but has dropped to less than 50 percent as recently as September, according to the Business Times.

Kylli paid $350 million for a majority of 225 Bush in 2014, and got the rest of the property in a deal with minority partner Flynn Properties in 2019. Kylli borrowed $350 at the time of the deal, and the building notched an appraised value of $589 million.

The current tenant roster at 225 Bush Street includes LiveRamp, which is signed for 78,000 square feet through the next two years, and Stryder, which is committed to 53,000 square feet until 2029.