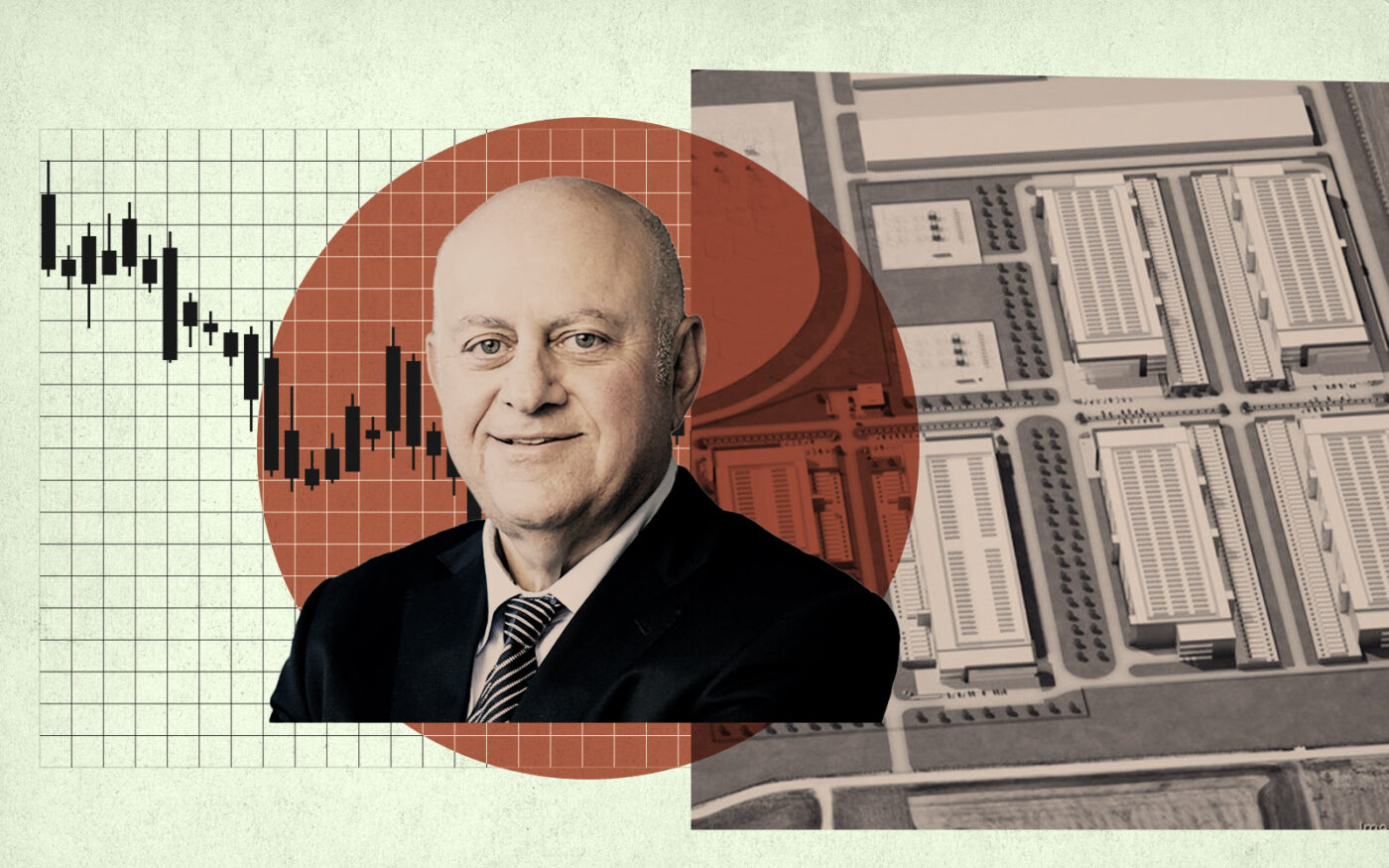

Prologis, facing plunging revenue because of a growing number of empty warehouses coast to coast, has set its sights on artificial intelligence for a market turnaround.

The San Francisco-based industrial real estate investment trust reported an 18 percent drop in revenue last quarter to $2.01 billion, down from $2.45 billion in the same period a year ago, the San Francisco Business Times reported, citing an earnings call.

The industrial giant blamed the decline on rising warehouse vacancies because of excess supply and a waning demand after the pandemic e-commerce boom.

Nonetheless, Prologis is raising its annual earnings outlook, saying growing demand for data centers — which store, process and distribute digital data and applications and the energy facilities needed to power artificial intelligence — could boost profitability.

Demand for artificial intelligence infrastructure like data centers and energy facilities provides “tremendous confidence in future growth,” Hamid Moghadam, CEO of Prologis, told investors on the call.

Nationwide, developers such as Prologis are planning a growing number of data centers to meet demand.

This spring, the Goldman Sachs Group estimated that data-center power demand will grow 160 percent by 2030, in part because of artificial intelligence. At the same time, the once hot industrial market has cooled substantially, according to the Business Times.

Rapid construction of warehouses created an excess supply, pushing vacancy to 6.1 percent from April through June, up from 4 percent in the same period last year, according to Cushman & Wakefield.

The pipeline of warehouses under development is dwindling, Tim Arndt, chief financial officer of Prologis, said that will aid in absorption and help pull vacancy rates down.

In the East Bay, vacancy in the 127-million-square-foot industrial market rose 4.9 percent in the first quarter, up from 2.1 percent a year earlier. Net absorption, which measures space leased minus space vacated, hit a negative 1.3 million square feet, down from 419,000 square feet.

In the past two decades, Prologis said many production, distribution and repair businesses have moved from San Francisco because of a shortage of up-to-date facilities and available space.

In April, Prologis, the nation’s largest industrial landlord, warned of darker days ahead. The REIT made more than analysts expected in the first quarter, but predicted a slowing warehouse market as tenants tamp down logistics costs.

— Dana Bartholomew

Read more