Landlords across the state can forget squeezing renters with hefty security deposits.

A new law by Assemblyman Matt Haney enacted this week limits security deposits to no more than one month’s rent for all but the smallest landlords, the Los Angeles Times reported.

Before Assembly Bill 12 was passed, landlords frequently asked for security deposits worth two to three months worth of rent.

“Massive security deposits can create insurmountable barriers to housing affordability and accessibility for millions of Californians,” said Haney, D-San Francisco, who chairs the California Legislature’s Renters Caucus, in a statement.

Previously, landlords could charge two months of rent for unfurnished rentals and three months for furnished properties.

The bill was written in December 2022, passed by the Assembly and Senate last fall and signed by Gov. Gavin Newsom in October.

An exception in the bill was made for landlords who own two or fewer properties that collectively have no more than four rental units.

The law was backed by the powerful Los Angeles County Board of Supervisors.

Supervisor Lindsey Horvath said in May last year she was unable to move into a rental a couple of years earlier because she was asked to pay “nearly a half a year’s rent upfront.”

“As someone with a well-paying job, making more than the median income of the county, it was difficult for me to rent a new apartment because of the substantial deposits that were required,” she said.

The legislation also raised concerns within the real estate industry.

Sharon Oh-Kubisch, a partner at Irvine-based Kahana Feld, which practices real estate law, noted two potential drawbacks to the legislation. While she supports the bill’s goal of cutting the high cost of renting, the financial burden is flipped to landlords, she told the Times.

Security deposits are intended to cover damages when a tenant moves out, she said. Lower deposits mean landlords are more likely to have to sue clients who cause serious damage.

“A landlord can demand damages at the back end, but then they’re more than likely going to have to sue and hire counsel to get that money,” Oh-Kubisch told the Times.

Reducing security deposits may also work against tenants who have less than perfect credit or lack a strong history of renting, she said.

Higher security deposits allowed landlords to be more flexible, Oh-Kubisch said. With those “safeguards” gone, she expects landlords to be “more precise and heighten scrutiny for tenants.”

She didn’t address how landlords have been accused of illegally pocketing security deposits.

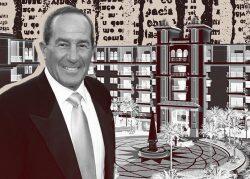

In 2022, Los Angeles billionaire Geoffrey Palmer agreed to pay $12.5 million to settle a class-action lawsuit accusing his company of withholding security deposits from more than 19,000 tenants when they moved out of his apartment complexes.

The same year, Brooklyn landlord Yeshaya Wasserman of SGW Properties agreed to return nearly $300,000 of security deposits to tenants.

— Dana Bartholomew

Read more