The value of San Francisco’s two largest hotels has plunged by $1 billion, with the city’s hospitality industry trailing the nation.

The 1,024-room Parc 55 and the 1,921-room Hilton San Francisco Union Square are worth a combined $553.8 million, 65 percent less than their appraised value in 2016 of $1.56 billion, the San Francisco Business Times reported, citing Kroll Bond Rating Agency via a note from Trepp.

Last summer, Virginia-based Park Hotels & Resorts defaulted on a $725 million loan tied to its Parc 55 at 55 Cyril Magnin Street and its Hilton San Francisco Union Square at 333 O’Farrell Street.

In October, a receiver took control of both hotels, with plans to sell them in less than a year. The receiver has until Sept. 1 to find a buyer for both hotels or they’ll go into nonjudicial foreclosure.

Despite their estimated plunge in value, the pool of would-be buyers is likely small, according to the Business Times.

The hotel portfolio has not made money since 2020, though it managed a net cash flow of nearly $1 million last year before mortgage payments, according to bondholder reports.

For the 12-month period ending in March, both hotels had an occupancy of 52 percent. Their cash flow deficit was $15.7 million.

Industry analysts don’t see San Francisco’s hospitality market recovering before 2030, so a prospective buyer would need to suspend profit expectations for several years on top of paying for pricey upgrades to thousands of rooms.

One hotel expert estimated it could cost between $50,000 to $100,000 per room, putting a total revamp in the realm of between about $150 million and $300 million.

The Hilton Union Square is the biggest hotel in the city. It closed at the dawn of the pandemic and reopened 14 months later in May 2021.

The Parc 55 is the city’s fourth largest hotel. It closed for two years, reopening in May 2022.

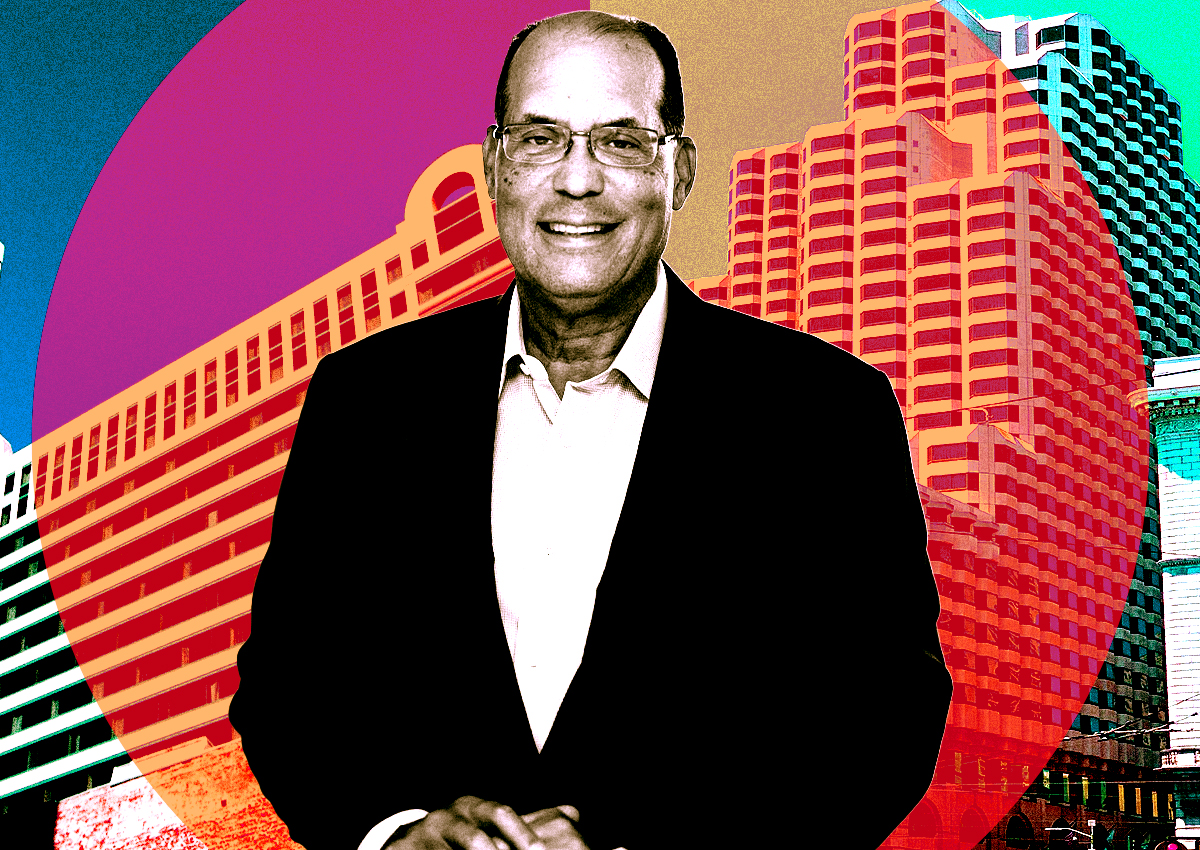

Michelle Russo, CEO of Hotel Asset Value Enhancement, serves as their court-appointed receiver.

— Dana Bartholomew

Read more