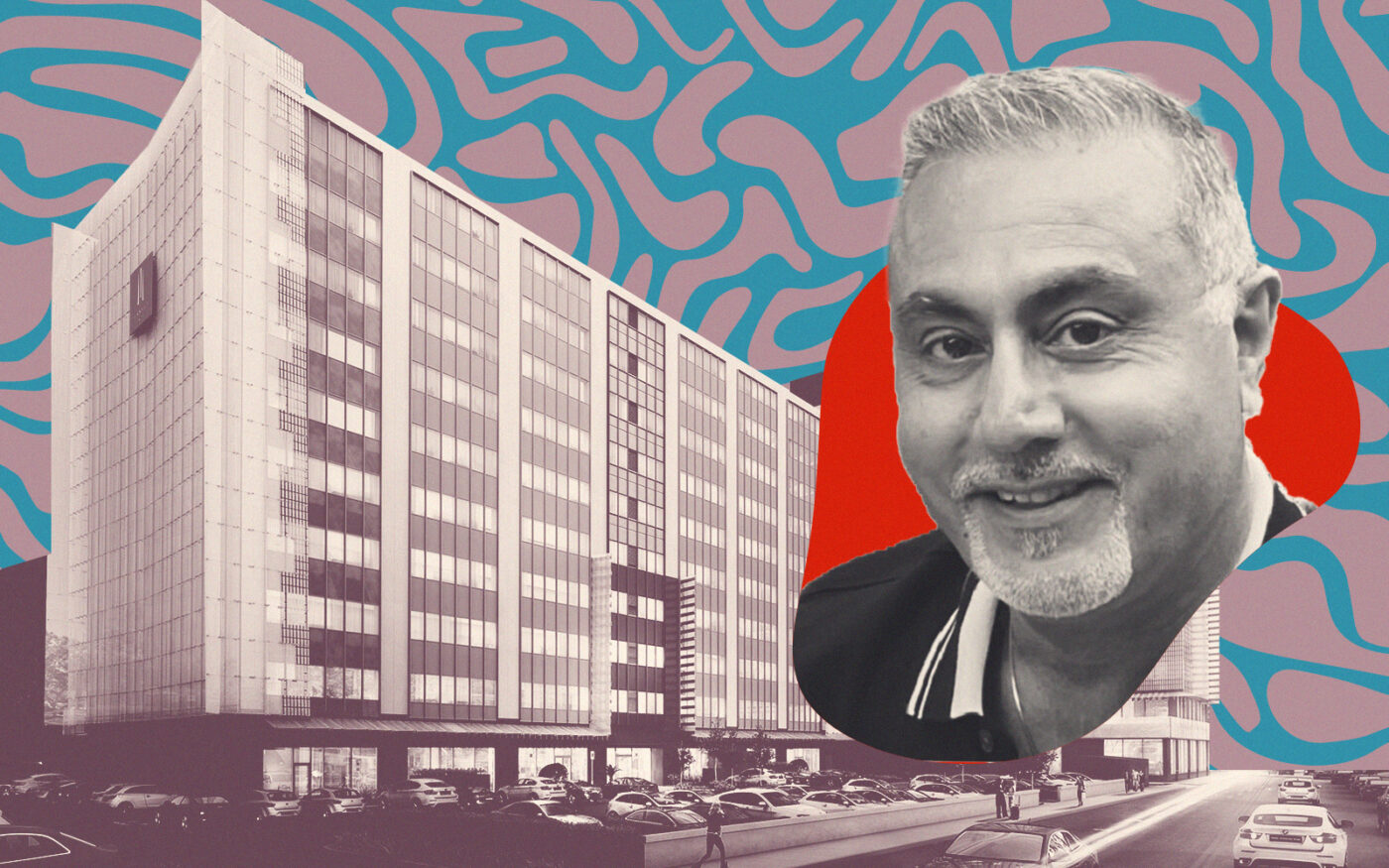

Shoe Palace CEO George Mersho is high-stepping through discount office deals in Downtown San Jose.

An unidentified group of investors led by Mersho bought the 325,200-square-foot Market Square office complex at 111 North Market Street for $34.2 million — about 77 percent less than what it traded for five years ago, the San Jose Mercury News reported.

The seller was Rubicon Point Partners, based in San Francisco.

The deal comes less than two months after a similar group led by Mersho picked up an 11-story, 157,500-square-foot office tower at 303 Almaden Boulevard for nearly $23.8 million, or $151 a square foot — 70 percent less than the $509 per square foot it traded for in 2017.

The buildings’ sales point to a major reset for office property prices in Downtown, part of a reassessment of the office market in the Bay Area and beyond after tech companies led a broad shift to remote work.

Office vacancy in Downtown San Jose hit 31.5 percent in the third quarter, according to CBRE.

Rubicon Point bought the two-building, 10- and 12-story complex at North Market and West St. John streets in 2019 for $141.4 million, or $435 per square foot.

Its recent sale to the Mersho group works out to $105 per square foot. In 2016, the property fetched a price of $199 a square foot.

The Market Square towers, built in 1967 and renovated four years ago, are considered a top-notch Class A property, according to CBRE’s marketing brochure.

Rubicon Point Partners undertook major upgrades to the lobbies and individual offices and also revamped a connecting courtyard at the property, which has ground-floor restaurant and merchant spaces.

The CBRE brokers also touted the location of the office center next to San Pedro Square.

“Market Square enables tenants to seamlessly transition from office hours to happy hour without missing a beat,” the CBRE brochure stated. “Enveloped by bountiful urban living options, chef-driven restaurants, craft coffee cafes, happy hour hot spots and diverse cultural destinations, tenants can experience a hub of activity just steps from the office.”

Mersho also heads Bridge Group Investments, based in Morgan Hill. The firm has teamed up with Los Angeles-based Steerpoint Capital on numerous commercial real estate deals.

In July 2022, Bridge Group and Steerpoint bought the 735,000-square-foot Shops at Montebello mall in Los Angeles County for $87 million.

The previous month, an affiliate of Mersho sold a lot in South San Jose for $19.9 million to Houston-based Hines, which bought the parcel of unknown size at 644 Piercy Road.

— Dana Bartholomew

Read more