Rubicon Point Partners has bought a 137,600-square-foot office building in San Francisco’s South of Market for $73 million — close to half what it traded for in 2020.

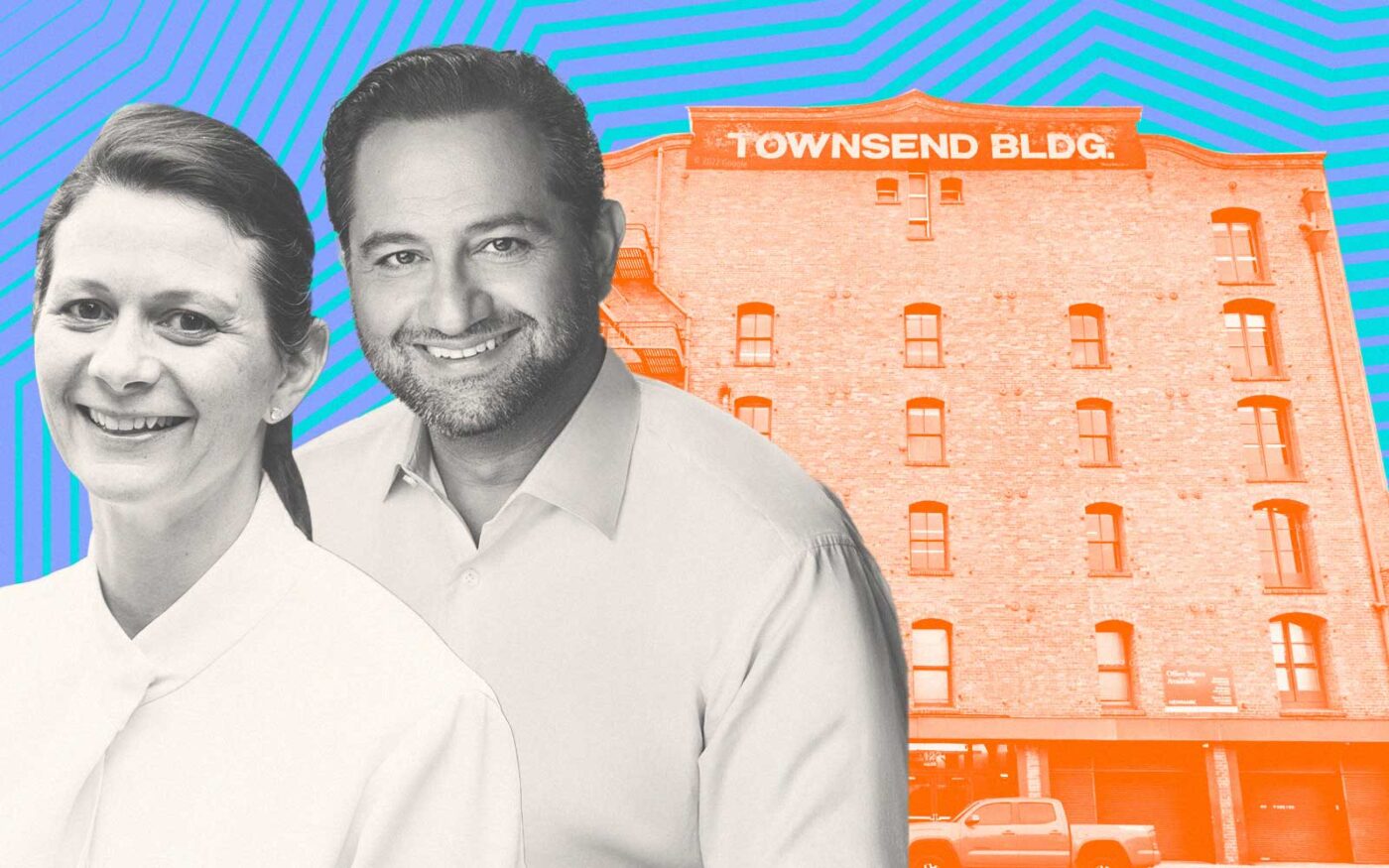

The San Francisco-based investor purchased the six-story building leased by Paypal at 123 Townsend Street, a few blocks from Oracle Park, the San Francisco Chronicle reported. The seller was a fund led by New York-based CBRE Global Investors.

The price for the 120-year-old building was $530 per square foot. The property is 73 percent leased by the San Jose-based fintech firm.

CBRE Global Investors bought the brick-and-timber building in 2020 for $140 million, or $1,017 per square foot. The building, which survived the great San Francisco earthquake of 1906, was renovated in 2000.

Despite the nearly 48 percent discount, the price paid by Rubicon was still among the highest sales in recent years for office properties in the city, according to the Chronicle.

Ani Vartanian, co-managing partner of Rubicon, said the firm bought the building because of a rise in demand this year from office tenants — 5.5 million square feet compared to 3.5 million square feet last year.

The deal, she said, was a “comment about San Francisco and the Bay Area.

“We do think that the Bay Area and San Francisco are incredibly resilient,” Vartanian told the newspaper. “Right now we are going through difficult times, but we will come out of it particularly through activation and citizen involvement, from the very local level to also the local politics.”

Since a shift to remote work during the pandemic, 34 percent of offices in San Francisco stand empty. The fire sale at 123 Townsend isn’t the first.

In September, Roger Fields and his Palo Alto-based Peninsula Land and Capital bought a vacant 13-story office building at 550 California Street for $40.5 million, or $120 per square foot. The seller, Wells Fargo Bank, bought it in 2005 for $108 million.

In August, San Francisco-based Presidio Bay Ventures bought an 11-story office building at 60 Spear Street for $41 million, or $260 per square foot. The seller, New York-based Clarion Partners, bought it in 2014 for $107 million.

Last spring, locally based SKS Real Estate Partners and The Swig Company bought a 22-story office tower at 350 California Street for $61 million, or $205 per square foot. The seller, Tokyo-based Mitsubishi UFJ Financial Group, tried to sell it in 2020 for $250 million. The building, once occupied by Union Bank, was 75 percent vacant at the time of sale.

The relatively higher price paid by Rubicon for its historic building may be baked in by its financing.

“There’s a few other variables that went into the way that we were able to justify our higher purchase price,” Vartanian told the Chronicle.

CBRE offered seller financing, which allows a buyer to pay in installments rather than getting a traditional mortgage from a bank or other lender, unidentified sources told the newspaper.

Alexander Quinn, the Northern California director of research for JLL, said that this type of financing is likely driving the higher pricing.

“Rubicon is getting below-market-rate terms for that building,” Quinn said. “Right now it’s very difficult to finance the purchase of an office building. Banks have become incredibly more conservative on their approach towards providing loans to office buildings. So a building that has seller financing is more marketable.”

— Dana Bartholomew

Read more