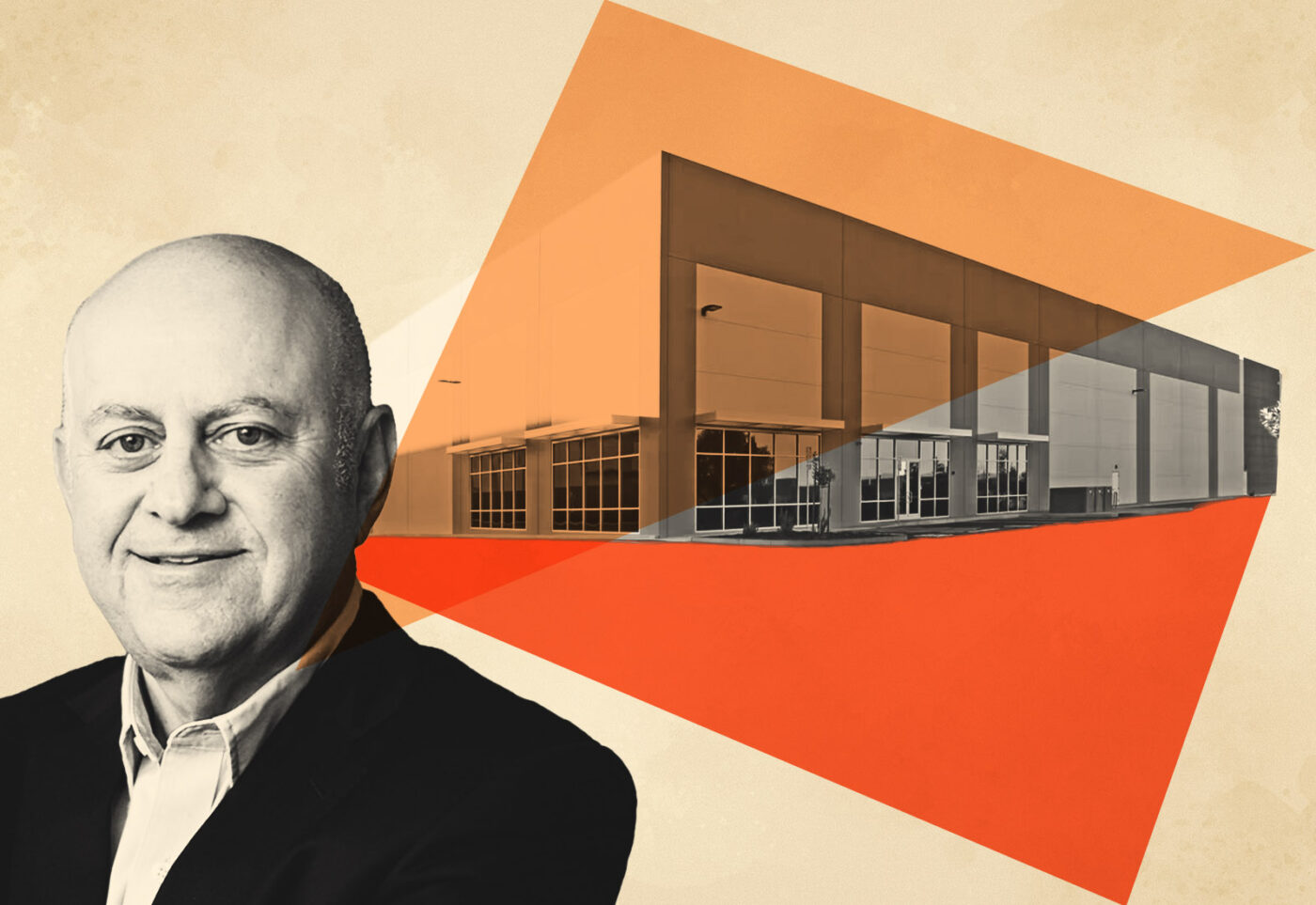

San Francisco-based industrial titan Prologis has acquired a San Jose building for $38 million, according to public records. The deal comes as San Jose’s industrial market has continued to show strength.

The seller’s information is not publicly available.

The building, known as San Jose industrial Center, is located at 6212 Hellyer Avenue, and totals 111,000 square feet. Prologis paid above market rate for the building which is valued at $27 million. The sole tenant is medical device maker Varian Medical Systems. The property is a Class A facility and was built in 2016.

The vacancy rate for Silicon Valley’s industrial market has continued to show resilience at 3 percent in the second quarter, which was the same as the previous quarter, according to a report by Cushman & Wakefield. The average asking rent for industrial space in Silicon Valley dropped slightly, finishing the quarter at $1.44 per square foot, down from $1.46 per square foot in the first quarter.

“Despite remaining economic uncertainty, industrial vacancy is expected to remain low thanks in large part to persistent demand from e-commerce, last mile delivery and a growing need from the life science sector for advanced manufacturing and distribution,” the report said.

Prologis is the world’s largest industrial real estate investment trust, and owns or has stakes in properties and development projects with approximately 1.2 billion square feet in 19 countries.

The company beat expectations in the second quarter and posted record returns in its quarterly filing. The REIT reported second-quarter revenue of $2.45 billion, or nearly double the $1.25 billion from the same quarter a year ago. Net earnings came to almost $1.22 billion ($1.31 per share), compared to $610 million (82 cents) in the second quarter of 2022.

The giant doesn’t seem to be slowing down. Last month it struck a multi-billion dollar deal with the Blackstone Group to buy a portfolio of nearly 14 million square feet of industrial space from Stephen Schwarzman’s firm for $3.1 billion. The portfolio consists of about 70 properties in major markets, including Dallas, South Florida and the New York City metro area.

Read more