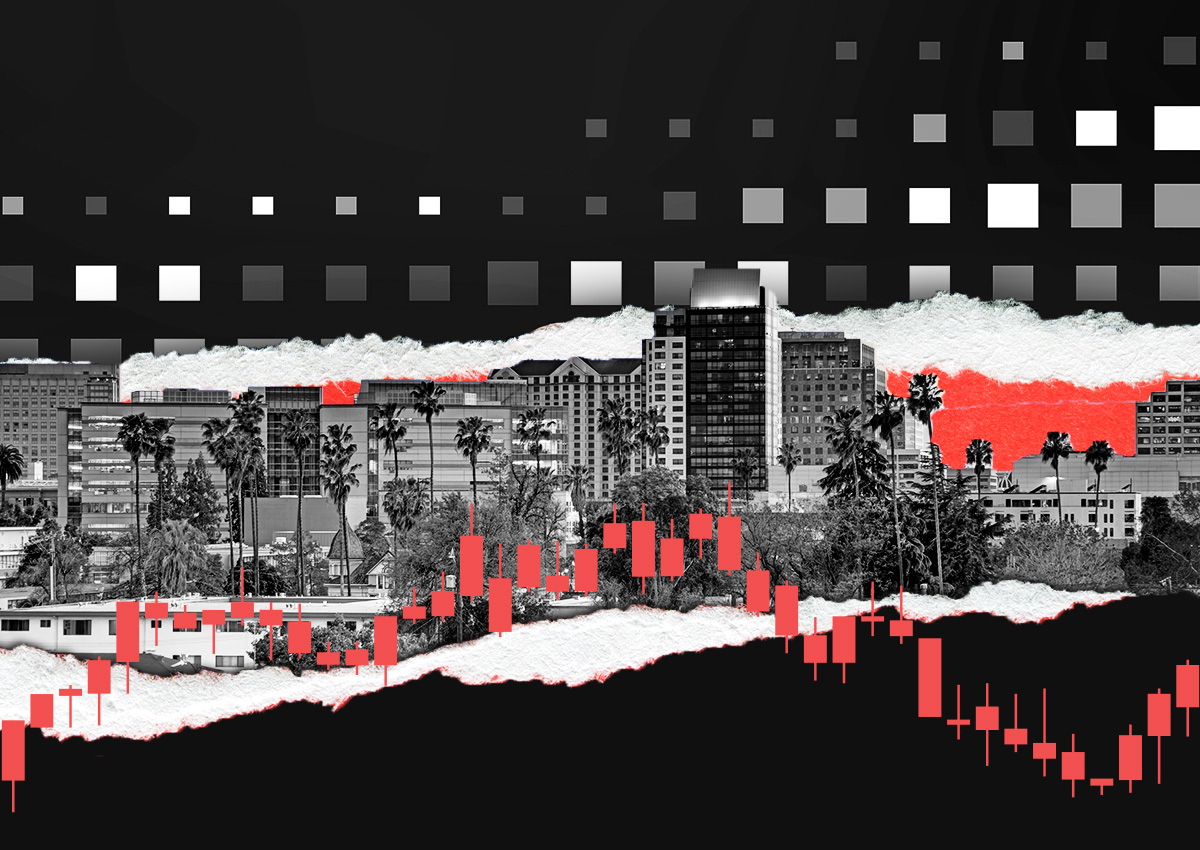

Companies across Silicon Valley are bolting their offices.

Office vacancy rates in the tech hub were up to 17 percent in June from 11 percent in 2019, the Wall Street Journal reported, citing figures from CoStar.

In some towns, such as Menlo Park and Mountain View, the rate this spring climbed past 20 percent.

While the level of surplus offices is below San Francisco’s — estimated as high as 33 percent — analysts and investors expect Silicon Valley will narrow the gap as tech companies lay off workers and empty out unwanted floors.

“There’s not a lot of technology demand in the market today,” Douglas Linde, president of Boston Properties, said in April during a company earnings call.

Leasing activity at the office tower his company is developing in San Jose has been practically nonexistent. “There are no conversations going on there,” he said on the call.

Offices in Silicon Valley cities from San Jose to Sunnyvale are dominated by big tech firms such as Google, Meta and Apple, which almost never shed offices, even in a tight market.

But Google drew alarm this year in San Jose when it held up its Downtown West, a transit retail village planned for 80 acres to house up to 25,000 employees.

While big tech companies such as Amazon.com and Google have called workers back to the office, at least part time, return-to-office policies haven’t stopped companies from slashing office footprints.

A record 7.6 million square feet of offices are available for sublease in Silicon Valley, up from 2.7 million in 2019, according to CoStar.

In May, Google listed for sublease 1.4 million square feet of surplus offices in Mountain View and Sunnyvale.

Meta, parent of Facebook, recently listed another 700,000 square feet related to shutting offices in Sunnyvale, according to brokers.

Read more

Silicon Valley now has one of the lowest return-to-office rates, according to Kastle Systems, which tracks security swipes. In the first week in June, the return rate in San Jose was 39 percent of what it was before the pandemic, the lowest of the 10 cities tracked by Kastle. The average was 50 percent.

Vacancy along Sand Hill Road, among the world’s toniest addresses for venture-capital firms, has more than tripled since 2019 to 14 percent, according to CBRE. Andreessen Horowitz, one of the largest, said it was operating “primarily virtually.”

— Dana Bartholomew