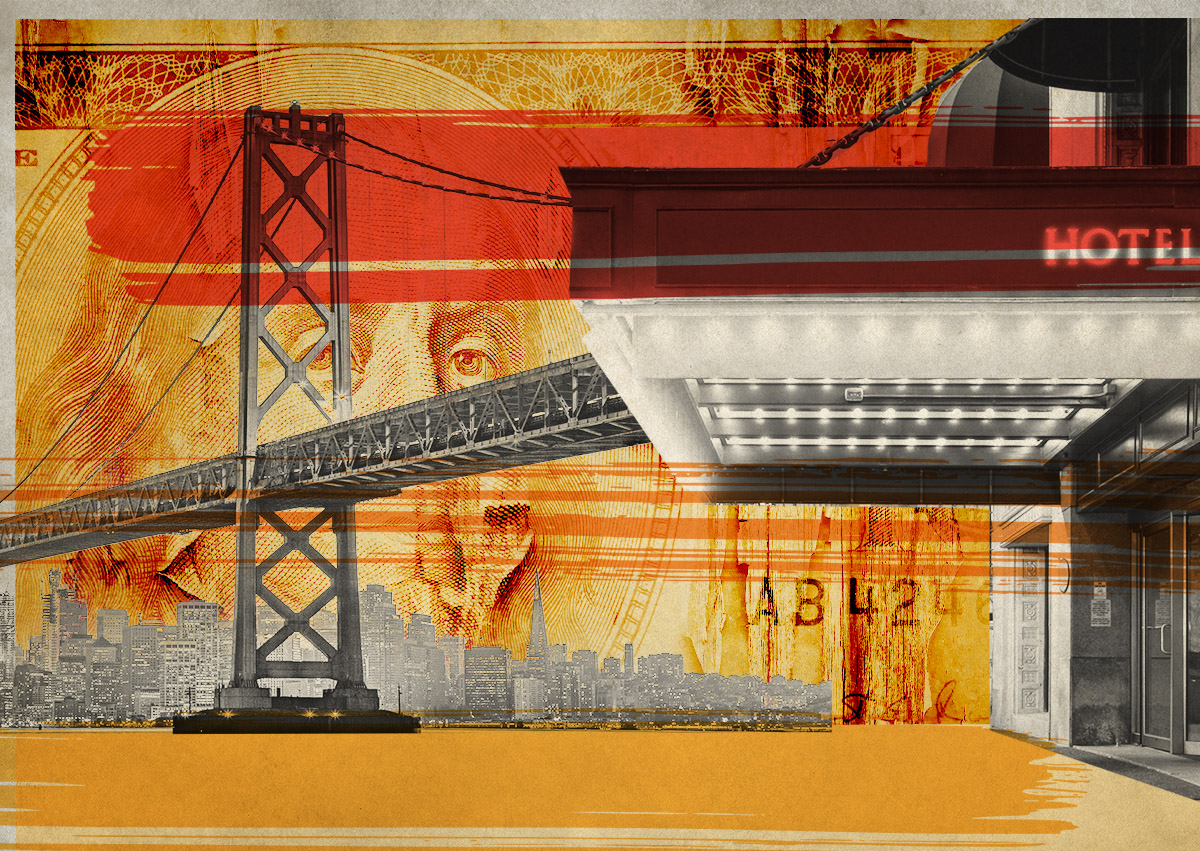

Hotel foreclosures and fewer conventions in San Francisco could cause more hotels to change hands.

The pending ownership change of two of its largest hotels after an expected $725 million loan default could spur further hotel sales, the San Francisco Business Times reported.

The plan by Virginia-based Park Hotels & Resorts to stop making payments on its $725 million loan for its two large properties — the 1,921-room Hilton San Francisco Union Square and the 1,024-room Parc 55 San Francisco — has rocked the local hotel industry.

The move “could also influence other public hotel owners in San Francisco to consider divesting some of their assets,” analyst Gregory Miller said in a note from Truist Securities.

The “northwestern Union Square and Market Street west of 4th Street” have become less desirable hotel locations given the Moscone Center’s struggle to draw conventions, Miller said.

They’re also near the Tenderloin, like Hilton San Francisco Union Square and Parc 55.

Hotel owners on the sales watch list, he said, are Pebblebrook Hotel Trust and RLJ Lodging Trust, both based in Maryland.

Pebblebrook, owner of eight San Francisco hotels, has sold four Downtown properties in the last three years, including the former Sir Francis Drake, now the Beacon Grand; the Villa Florence; The Marker; and Hotel Spero.

In April, the real estate investment trust filed two requests for zoning verification, often signs of a prospective sale, according to the Business Times. They include the 196-room Hotel Zeppelin at 545 Post Street in Union Square and the 221-room Hotel Zoe Fisherman’s Wharf at 425 North Point Street.

RLJ Lodging Trust, which owns 10 hotels across the Bay Area, has the 401-room San Francisco Marriott Union Square at 480 Sutter Street and the 166-room Courtyard San Francisco Union Square at 761 Post Street. It bought the former in 2013, the latter in 2017.

Hotels in Union Square that depend on convention business include the Hotel Zeppelin, the San Francisco Marriott Union Square, the JW Marriott San Francisco Union Square and the Grand Hyatt San Francisco.

“New York City has eventually recovered decently well despite the REIT divestments,” Miller said. “It is possible San Francisco may follow the same course — divestment of assets to private owners followed by a healthier-than-expected recovery of the market.

“However, San Francisco is more of a convention-weighted city than New York and Moscone citywides look challenged for several years into the future.”

— Dana Bartholomew

Read more