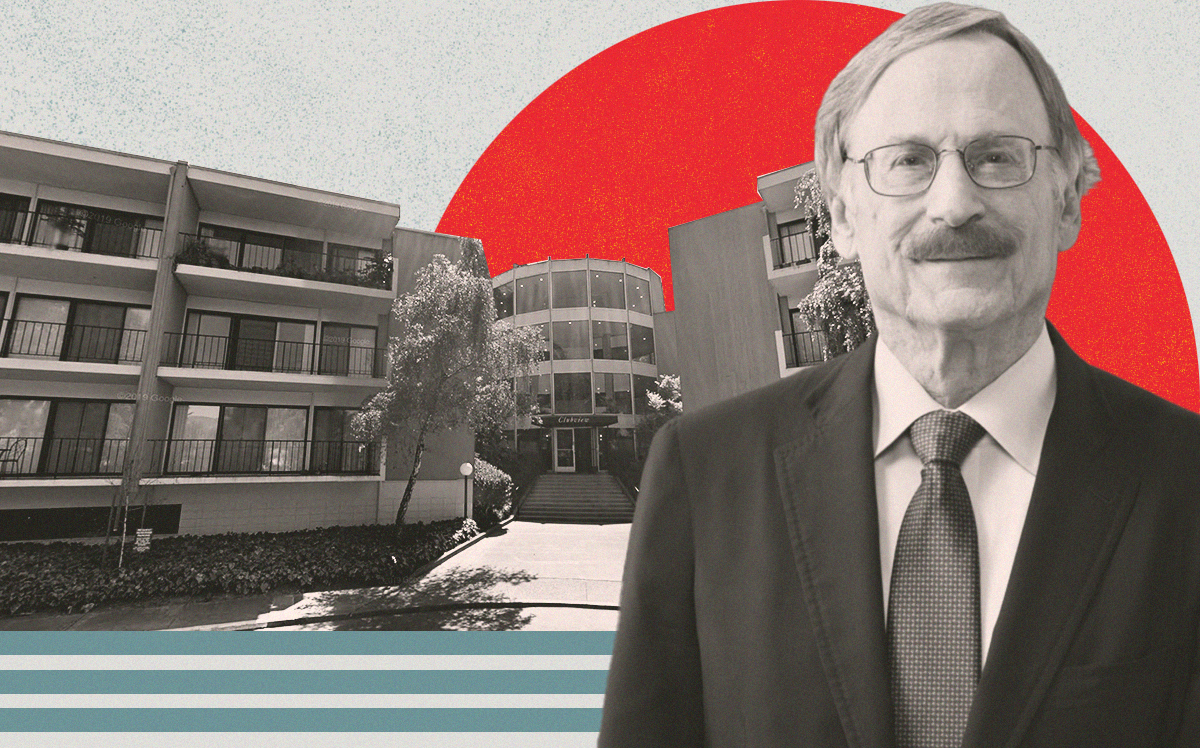

Richard “Tod” Spieker and Catherine Spieker have acquired a San Jose multifamily property from San Jose-based Gagliardi Brothers for $15 million, according to property records.

The deal runs counter to the trend of the married couple’s Palo Alto based-Spieker Companies offloading South Bay properties in recent months.

The multifamily is located at 1175 Ranchero Way in San Jose and has 45 one-bedroom and 16 two-bedroom units, as well as 93 parking spaces. Ranchero Way. built in 1969, has gone through renovations in recent years that include a new entry way, new railings and stairways, plus electrical upgrades.

This acquisition comes after Spieker Companies has sold off assets since the start of the year. A 70-unit apartment complex approved for redevelopment in Mountain View was sold for $57.4 million to Arizona-based Taylor Morrison. The company also sold a 102-unit multifamily building in South San Francisco to SF-based Koret Organization for $48 million.

San Jose has bucked national trends in which average rents declined over the past year. Instead, the South Bay city had the second-largest average rent increase from the first quarter last year to this year at 6.1 percent, according to data collected by CBRE. The average rent in San Jose is $2,641, according to Zumper.

On the investment side, demand for multifamily properties could be on the rise because mortgage payments nationally have skyrocketed past multifamily rents, according to a report by CBRE. U.S. homebuyers today face average monthly mortgage payments that are 37 percent higher than the average monthly apartment rent.

The Bay Area had $6.14 billion in multifamily investments in the most recent four quarters, according to CBRE. That ranked 12th in the nation and less than half on the top spot, Dallas which had $15.72 billion.

With higher interest rates, the average monthly mortgage payment for a newly purchased home, including taxes, has increased 70 percent since the end of 2019. Meanwhile, rent payments on a national scale have remained stable or fallen.

“Home prices have fallen by 9.7 percent since second quarter 2022 but not enough to significantly offset the impact of higher mortgage rates,” the report said. “For monthly mortgage payments on newly purchased homes to come back into line with CBRE’s forecast rental rates at the end of 2023, home prices would have to decrease an additional 24 percent this year assuming no further rise in interest rates.”

Read more