Park Hotels & Resorts, facing a deadline to pay off a $725 million mortgage for two of San Francisco’s largest hotels, may give the keys to the lender.

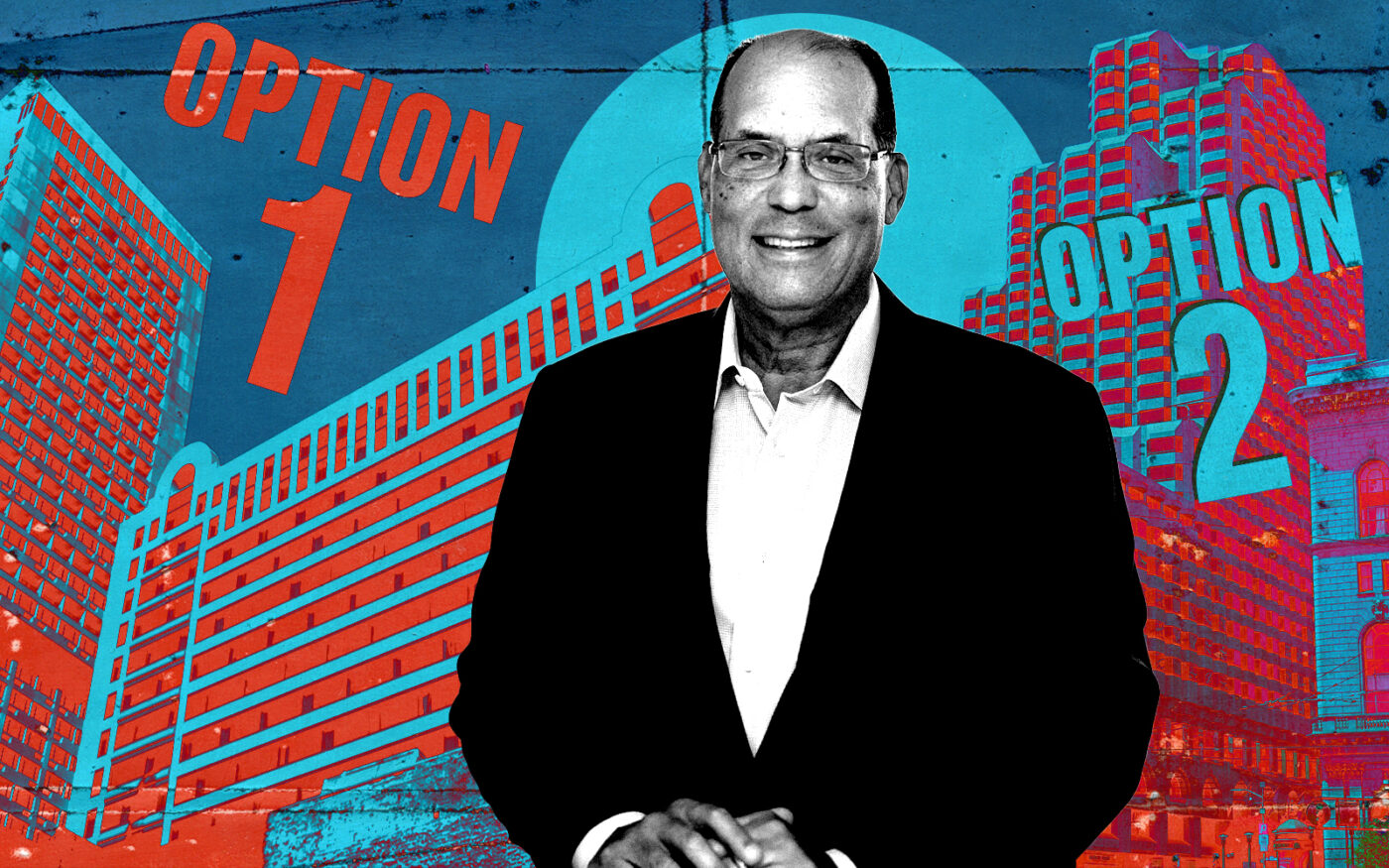

The Virginia-based real estate investment trust, looking at a maturity deadline in November for its Hilton San Francisco Union Square and Parc 55, is exploring all options – including a loan extension or forfeiture of both Hilton-branded properties, the San Francisco Chronicle reported, citing an earnings call.

The Hilton Union Square, with 1,921 rooms at 333 O’Farrell Street, is the biggest hotel in the city. It closed at the dawn of the pandemic and reopened 14 months later in May 2021.

The Parc 55, with 1,024 rooms at 55 Cyril Magnin Street in Downtown, is the city’s fourth largest hotel. It closed for two years, reopening last May.

Together, both hotels make up 9 percent of the city’s hotel rooms.

“All options are being explored, and we expect to have this resolved by the summer,” said Thomas Baltimore Jr., CEO of Park Hotels, during the call.

“If we were hypothetically to give back the keys, there’s a forgiveness of debt Income that we would have; we’re able to shield, certainly, most of that, but not all of that. It would result in a potential dividend payout of $150 million to $200 million approximately,” he said.

Last month, New York-based Moody’s Investor Service downgraded the company’s $725 million CMBS loan.

The interest-only loan was originated in 2016 by JP Morgan Chase and sold into the CMBS investor market. Wells Fargo is now the master and special servicer for the loan, which was placed on a Trepp watchlist in 2020 for mortgage-backed securities at risk of default.

Wells Fargo declined to comment to the Chronicle. Baltimore said the company has a confidentiality agreement and wouldn’t get into specifics on negotiations with the lender.

Park Hotels also owns the 344-room JW Marriott Union Square and the 316-room Hyatt Centric Fisherman’s Wharf. In the first quarter, its four hotels in the city were 48 percent occupied, up from 24.7 percent during the same period last year. At the same time, its average daily room rate was $294.80, up from $202.36.

All of the trust’s hotels in the city earned a profit for the first time since the pandemic, Baltimore said, based on earnings before interest, tax, depreciation and amortization, with hotel rates pushed up in January by the JPMorgan biotech conference.

Park Hotels, which sold the 360-room Le Meridien and the 171-room Hotel Adagio during the contagion, remains confident San Francisco’s economy will bounce back.

While tourism has partly returned to San Francisco, a rebound to 2019 levels isn’t expected until next year at the earliest.

Read more

Park Hotels said its convention bookings tripled to more than 140,000 room nights last quarter, compared to early last year.

“We are cautiously optimistic,” Baltimore told investors . “It is still a challenging environment. When you think about San Francisco, we have no doubt in our view that certainly San Francisco comes back. It’s not a matter of if, but when.”

— Dana Bartholomew