UPDATED: MAY 12 at 11 a.m.:

Reports of Google’s decision to halt the Downtown West project in downtown San Jose sent shockwaves throughout the city and the rest of Silicon Valley. However, it’s one high-profile illustration of distress in the market that has been prevalent throughout 2023.

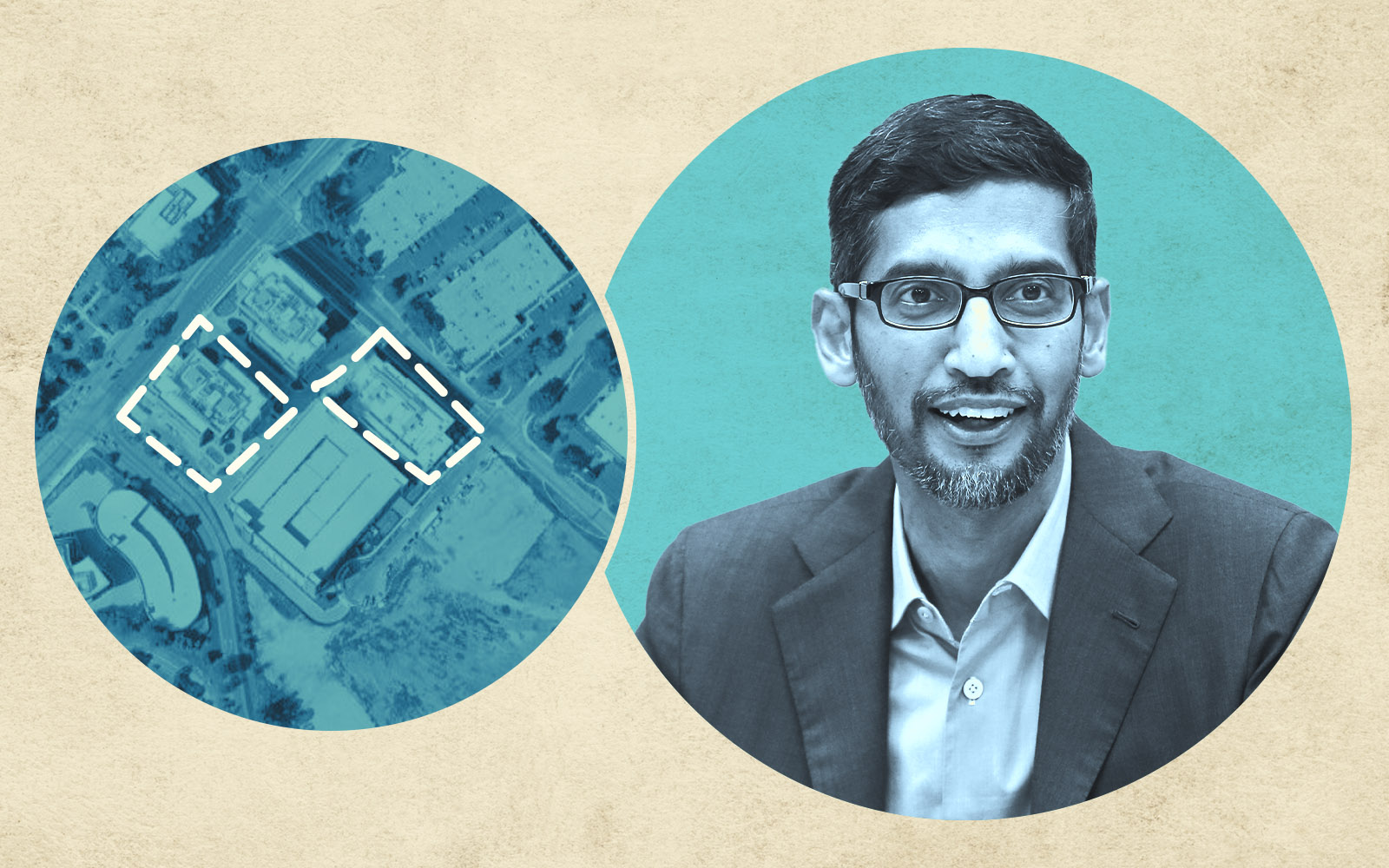

The Downtown West development near Diridon Station was to include 4,000 homes, 7.3 million square feet of offices, 500,000 square feet of shops and restaurants, a community center and 15 acres of parks. Its economic impact was estimated at $19 billion.

“Like all major cities, downtown San Jose continues to struggle to get employees back in the office,” Craig Petersen, an office and R&D specialist at brokerage Kidder Mathews, said. “Remote work has persisted longer than most of us thought possible.”

The persistence of remote work has put a halt to the development pipeline — this started before Google’s pause, but the search giant’s decision “doesn’t help,” Petersen explained. The completion of the BART extension in San Jose was also pushed out to 2034, and Google really wanted BART to service its project, he added.

“All new development was put on hold when the pandemic arrived and they are not starting up due to extremely high office vacancy — not just Google’s project,” Petersen said. “It would be crazy to start a project with the high office vacancy.”

Developer Boston Properties has halted two Santa Clara office projects and signaled that the projects may not move forward until it had already signed tenants. The two projects together would bring nearly 2 million square feet of office space to Santa Clara.

“We are evaluating market conditions each month, and when we ascertain where demand (and) supply (are), and rents have better clarity, then we will make the decision as to whether to proceed or wait for pre-leasing,” Aaron Fenton from Boston Properties said in a 2021 article in the Silicon Valley Business Journal.

New York-based Related Companies, the entity owned by Miami Dolphins owner Stephen Ross, was supposed to break ground on its massive Related Santa Clara project in 2020, but it has yet to begin. Related has stated it expects to break ground this year, however no announcement on a specific date has been announced.

Related Santa Clara is a 9-million-square-foot project that features nearly 6 million square feet of office space across the street from Levi Stadium, home of the 49ers.

In San Jose, Google plans to continue with the 10- to 30-year Downtown West project. However, the company has not determined when development will restart.

“We’re working to ensure our real estate investments match the future needs of our hybrid workforce, our business and our communities. While we’re assessing how to best move forward with Downtown West, we’re still committed to San José for the long term and believe in the importance of the development,” a Google spokesperson told The Real Deal.

Google’s reassessment of its office needs reflects a larger shift in the market, as indicated by recent statistics. The Silicon Valley office availability rate — which includes both empty offices and those available for sublease — rose to 19.5 percent in the first quarter, compared to 16 percent at the end of last year and 17.7 percent in the first quarter of 2022, according to data collected by Kidder Mathews.

“Many tenants have decreased their office requirements, making renewal activity the primary driver of market activity,” the report said.

Asking rates declined to $4.60 in the most recent quarter, compared to $4.94 in the final quarter of 2022, a drop of 6.9 percent. Landlords are starting to lower rates to combat rising vacancy and availability rates, according to Kidder.

A stark example illustrating distress in the Silicon Valley office market is the decline in sales volume. Sales in terms of square footage fell by more than 50 percent year-over-year, from 460,000 square feet to 228,000 square feet. The decline was even steeper in quarter-over-quarter with nearly 700,000 square feet of office space sold in the fourth quarter of 2022.

Another stress point in the market stems from the collapse of local banks, starting with Silicon Valley Bank at the beginning of March. SVB held $2.6 billion in commercial loans of which 21 percent were for office properties. SVB was acquired by North Carolina-based First Citizens Bank two weeks after it went into receivership.

In its annual report, SVB said its commercial-backed loans “may involve a higher risk of default compared to our other types of loans,” given uncertainty around the economy and residual effects of the pandemic on retail, hotels and offices.

Read more

Google is expected to hold onto the Downtown West project and proceed as the market changes. But the consequences of distress could linger for a while, and investors should exercise patience.

“It might take a couple of years for the economy to heal, but those who are patient with the office market could be rewarded greatly for it,” the Kidder report said.

Attribution: Previous story didn’t state that Aaron Fenton’s quote came from Silicon Valley Business Journal in 2021.