In the wake of the recent failures of Silicon Valley and Signature banks, First Republic Bank seems to be in the clear, with share prices rising sharply on Tuesday.

The San Francisco-based bank known for loans to the commercial real estate sector and the likes of Facebook’s Mark Zuckerberg to buy his Palo Alto home has not had a run on its deposits, the San Francisco Business Times reported, citing its executive chairman.

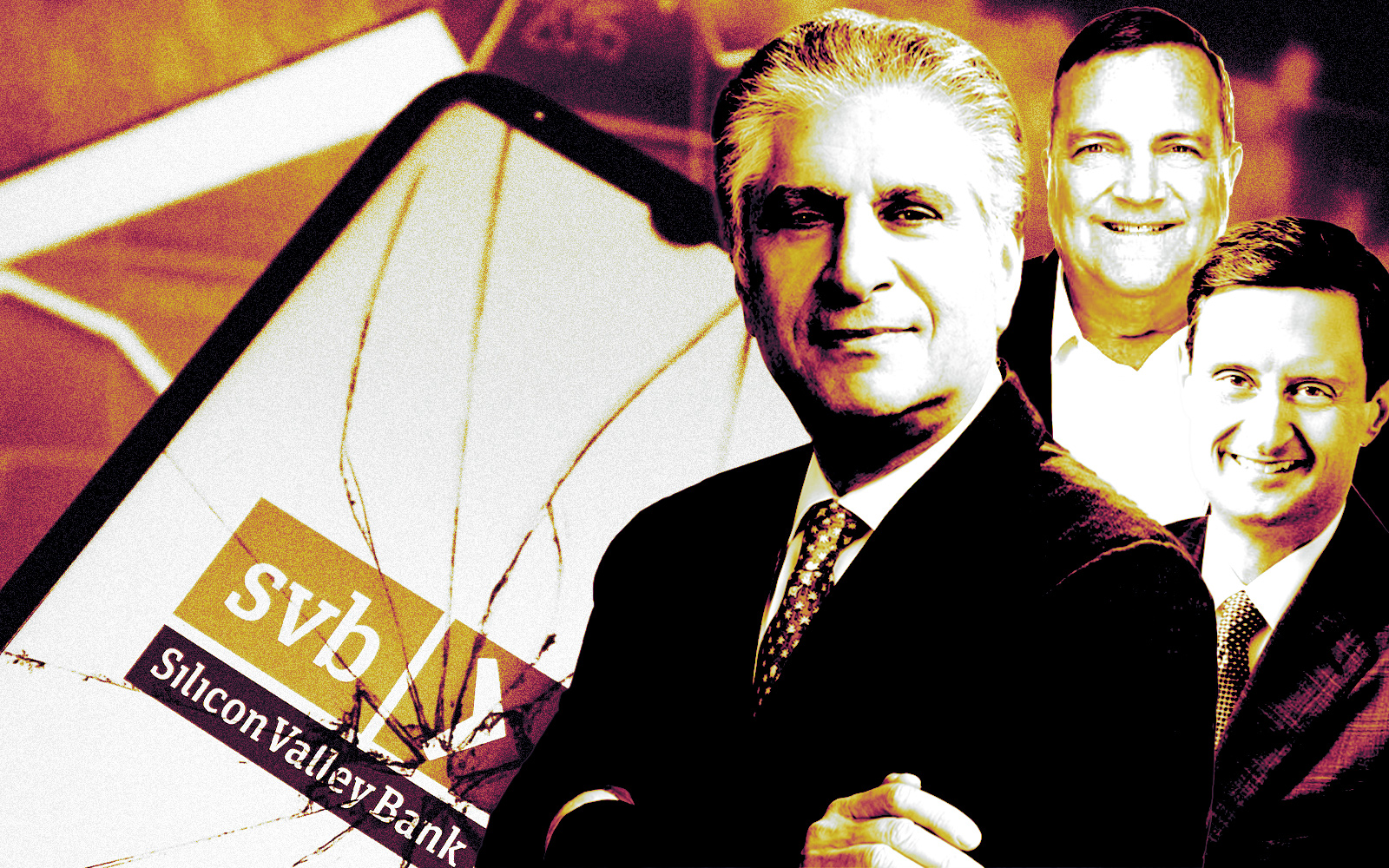

Though First Republic Bank shares initially tanked during a wave of fear that gripped the nation’s banking system, founder and Executive Chairman Jim Herbert told CNBC’s Jim Cramer that the bank was not seeing any dangerous outflow of deposits.

First Republic saw its shares fall almost 62 percent in regular trading Monday, closing at $31.21, down $50.55 after trading as low as $17.53 earlier in the day. Shares were rising sharply Tuesday morning, trading upwards of $49, a 52-percent jump after the a.m. bell.

First Republic was far from alone. Western Alliance Bancorp., parent of San Jose-based Bridge Bank, saw its shares plummet 47 percent to $26.12, down $23.22, also in extremely heavy trading. Its share price also jumped Tuesday, to $39, a morning increase of 50 percent.

The initial share-price declines occurred despite First Republic announcing late Sunday that it had arranged access to as much as $70 billion in additional capital from the Fed and JPMorgan Chase.

“First Republic’s capital and liquidity positions are very strong, and its capital remains well above the regulatory threshold for well-capitalized banks,” Herbert and the bank’s CEO Mike Roffler said in a news release Sunday.

At First Republic’s headquarters at 111 Pine Street in San Francisco’s Financial District Monday, employees were milling around and a TV camera crew was filming B-roll.

But there were no signs of customers desperately seeking to take their money out of the bank, as was seen last week at Silicon Valley Bank.

The speed with which Santa Clara-based Silicon Valley Bank and Signature Bank, of New York, failed since Friday is spurring concern about the health of other banks. Silicon Valley Bank’s dramatic downfall suggested their problems were tied to tech startups.

But the bigger issue has been the Federal Reserve’s interest rate shock by raising rates at the fastest pace in history to fight inflation, according to the Business Times. The rate hikes have created losses in some banks’ bond portfolios, triggering concerns among depositors about the safety of their money in their banks.

Federal regulators took action Sunday to give Silicon Valley Bank and Signature Bank customers full access to their deposits on Monday, even deposits exceeding the FDIC insurance limit of $250,000.

First Republic has built the nation’s 15th-largest bank, as of last fall, by providing a high level of service to Zuckerberg and other high-end clients. First Republic has long focused its advertising on testimonials from luminaries in business and beyond touting why First Republic is their bank.

“First Republic has an extremely loyal customer base,” one venture capitalist told me Monday.

— Dana Bartholomew

Read more