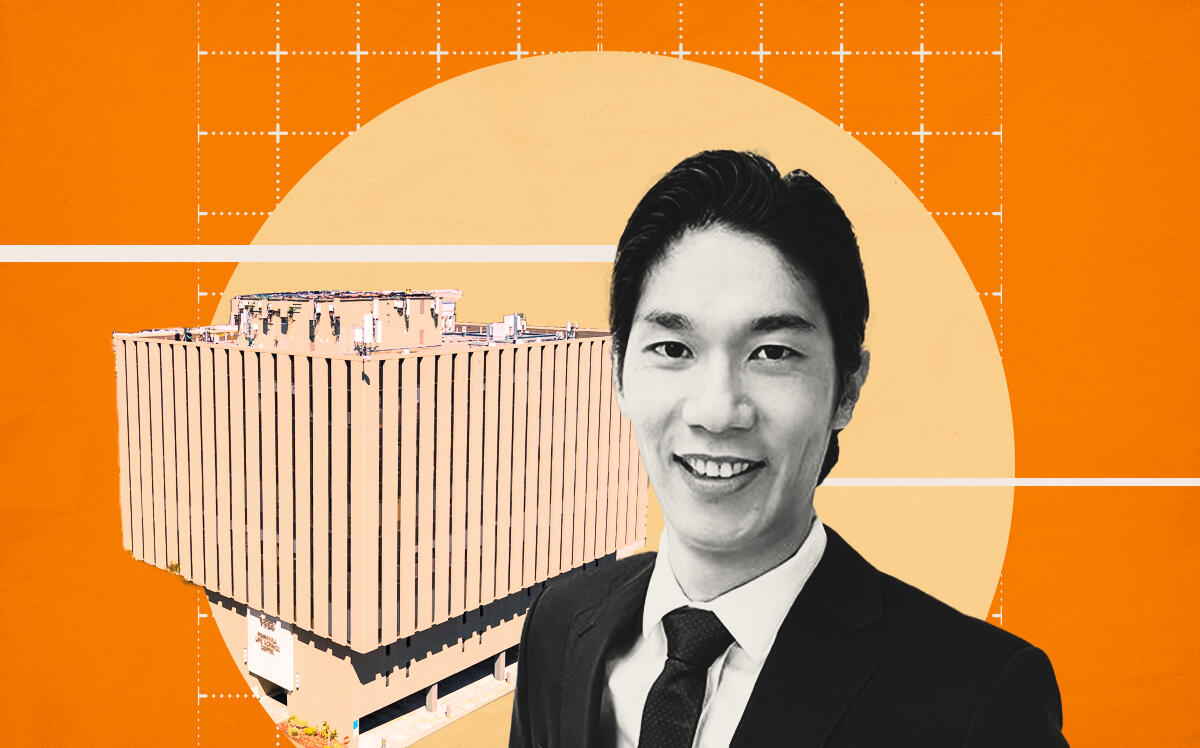

Los Angeles-based investment firm Gemini Rosemont Commercial Real Estate has acquired a life science building in Burlingame for $59.3 million, according to a release by the company. It marks Gemini’s first life science asset, a company that traditionally seeks multi-tenant office and luxury residential properties.

The eight-story, Class A building located at 1828 El Camino Real has 65,804 rentable square feet. The price works out to $901 per square foot.

Gemini Rosemont purchased the office building from Sansome Street Advisors and Gordon Brothers in an all cash transaction.

The property is 98 percent leased and anchored by three life science tenants. It was built in 1974 and renovated in 2016 and again in 2022. It is a five-minute walk from the Millbrae BART/Caltrain station, across the street from Highway 101, and a seven-minute drive to San Francisco International Airport.

“Peninsula Life Science Center is a well-located, fully stabilized property with upside potential that exceeds our investment mandate,” Tenzin Tsungmey, president of the West Coast region at Gemini Rosemont, said.“The $11 million in capital and tenant improvements in 2022, and the addition of 4 million square feet of proposed life science development within a three-mile radius, brings huge value to this investment. We’re looking for other opportunities in the greater Bay Area to continue to expand our footprint.”

The Bay Area life science marketexperienced a slight slowdown in the third quarter, but still remains strong due to the industry’s demand for employees to work on site, according to a report by CBRE. The Bay Area remains the top market in the U.S. for life science occupations.

Vacancy rose in the third quarter to 6.2 percent, compared to 5.3 percent in the previous quarter. Space under construction also rose with 6.5 million square feet in the pipeline, which will add to the 33.1 million square feet of existing inventory.

“The catalyst of growth continues to be the dense clustering of life science companies and the continuance of favorable economic conditions and interest surrounding life science development,” the report said.

Life science properties continue to attract investors. GI Partners recently acquired three buildings in South San Francisco and San Carlos for $388 million, or $1,168 per square foot. A partnership of Vigilant Real Estate Holdings and Boston-based Breed’s Hill Capital paid about $41 million to purchase a 41,000-square-foot, 1960s-era building in South San Francisco, with plans to redevelop the building into a life science asset.

Read more