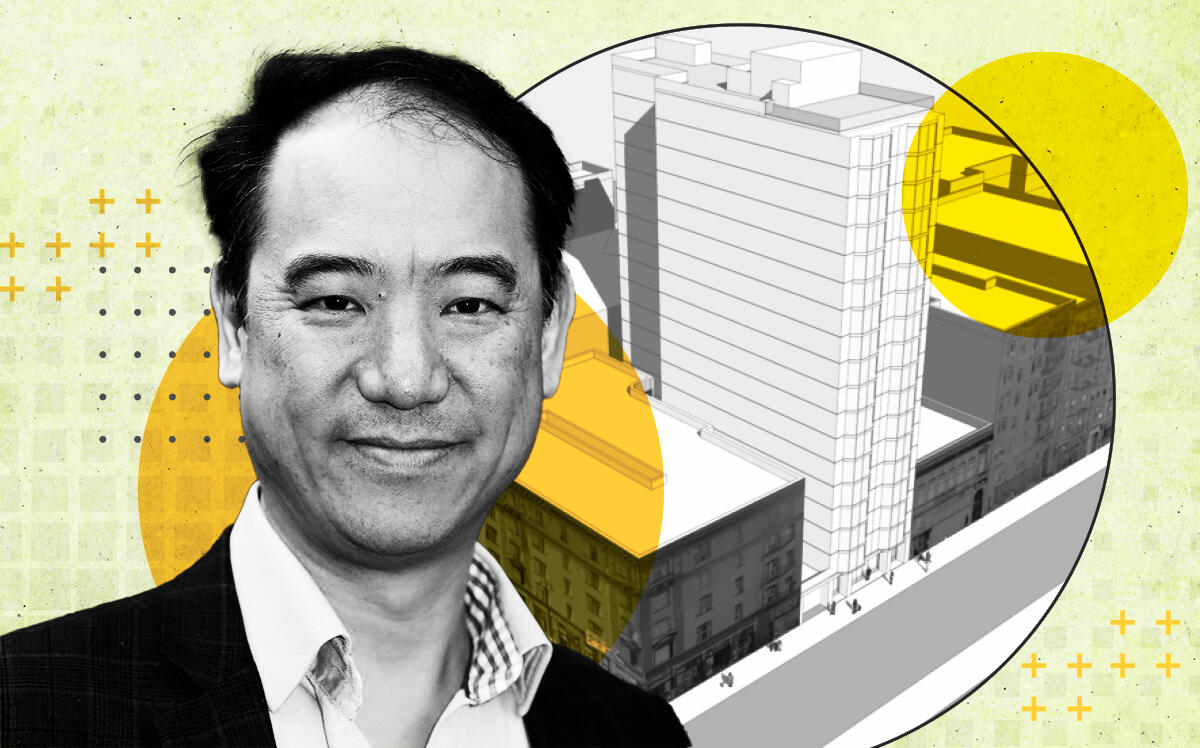

Veritas Investments aims to turn a skinny lot in San Francisco’s Tenderloin into an 18-story apartment tower.

The San Francisco-based investor, among the city’s biggest apartment landlords, has updated plans to build the 116-unit building at 105-111 Turk Street, the San Francisco Business Times reported.

The highrise would replace a parking lot and vacant single-story commercial building and rise next to an apartment building Veritas owns at 57 Taylor Street.

An affiliate of Veritas bought the property from San Francisco-based Mosser Capital Management in 2017 for $25.5 million. It also bought the five-story, 112-unit building next door from Mosser for an undisclosed price.

Together, both properties span 18,900 square feet, or less than half an acre.

Plans for the new building call for 62 studios, 12 junior one-bedroom and 12 standard one-bedroom, 18 two-bedroom and 12 three-bedroom apartments. It would include nearly 4,400 square feet of shared open space.

Veritas would use a state density bonus program to allow a building height of 177 feet in exchange for 27 affordable apartments.

The $30 million project, designed by Detroit-based SmithGroup, would be a block-like rectangle with floor-to-ceiling windows at both ends, according to a preliminary rendering. Construction would take two years, but a start date wasn’t disclosed.

Veritas says it operates more than 200 apartment buildings in San Francisco, though a recent investigation this fall by the San Francisco Chronicle identified nearly 300 buildings owned by entities affiliated with the firm.

The new construction project is a departure from its controversial business practice of buying rent-controlled buildings in need of repairs, then raising rents. Veritas also builds accessory dwelling units, or so-called “granny flats.”

City leaders and tenant advocates have taken Veritas to task for raising rents through legal increases stemming from building repairs, known as “pass-throughs.” The practice led San Francisco to ban certain pass-throughs in 2019.

Veritas has also been sued for launching prolonged construction projects designed to push low-earning renters out of buildings. The company has denied its business strategy aims to toss out rent-controlled tenants.

In October, the real estate firm bought a four-story Art Deco apartment building in the Marina District for $13.3 million. It also bought a 42-unit complex on Russian Hill for more than $33 million, marking the priciest market-rate apartment building sale in San Francisco this year.

— Dana Bartholomew

Read more