San Francisco’s century-old Huntington Hotel atop Nob Hill closed its doors “until further notice” in September after defaulting on its mortgage, and now $52 million of its debt is on the market.

Woodbridge Capital owns the hospitality property, while Deutsche Bank is the lender on the debt.

“The loan provides a unique blank-slate opportunity for an investor to acquire a NPL secured by an upscale hotel in one of San Francisco’s most exclusive neighborhoods,” according to the listing from JLL agent Tom Hall, who is based out of New York and specializes in loan and REO sales.

The agency said it could not comment on the offering, but the listing noted that it has “been retained on an exclusive basis by the lender to arrange the sale of a $52.2 million non-performing senior loan” on the borrower’s fee simple interest in the storied Nob Hill hotel. JLL also listed the hotel’s $13.5 million mezzanine loan debt to Walton Street Capital in February 2021, according to The Registry.

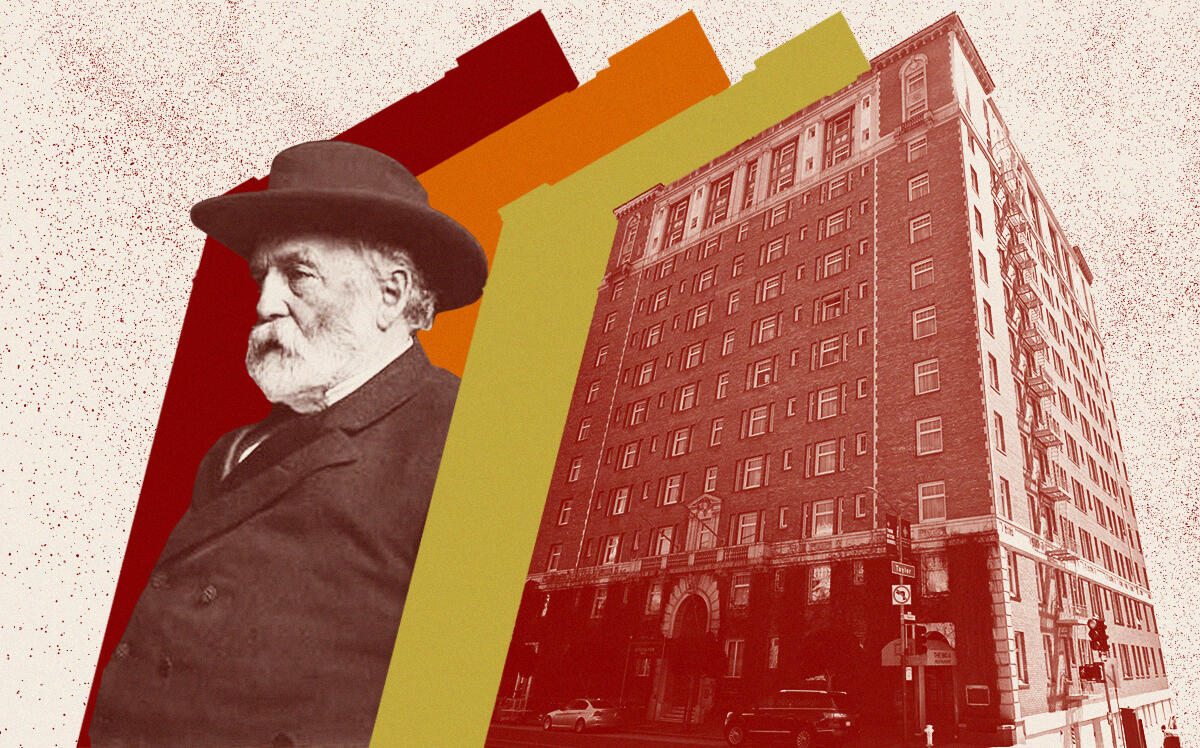

The Huntington Hotel was built as an apartment building in 1924 and is famous for its Big 4 Restaurant, named after the “Big Four” business tycoons of the era: Collis Huntington, who also gave the hotel its name; Leland Stanford; Charles Crocker; and Mark Hopkins, who has a prominent hotel named for him down the street. The Huntington is also home to the 11,000-square-foot Nob Hill Spa, which offers one of the city’s few indoor pools. The hotel, restaurant and spa have all been closed since April 2020.

A Woodbridge Capital affiliate has owned the 12-story, 134-key hotel since September 2018, when it bought the property from Grace International of Singapore for $51.9 million, according to the San Jose Mercury News. Including penalties, late fees and unpaid interest, Deutsche Bank claims it is owed a total of $61.1 million.

The loan originated in September 2018 with an initial balance of $47 million or $351,000 per key, according to the listing. It has been in default since November 2020, and reached maturity default in October 2021. Foreclosure proceedings began in August 2022, “providing investors with a quick path to recovery.”

No price was given for the debt offering and getting further information from JLL requires signing an electronic non-disclosure agreement.

Hotel sales in the Bay Area dropped by $2 billion in the first half of the year, according to a recent report by Atlas Hospitality Group. The consulting firm attributed the decline to the lingering effects of the pandemic and higher interest rates.

The total dollar volume for hotels bought in the nine-county Bay Area was nearly $661 million, down two-thirds from the nearly $2 billion in hotel purchases during the first six months of 2021, according to Atlas.

Read more