Zurich Insurance’s real estate subsidiary paid $53 million to acquire nearly 100 apartments in Santa Clara, one of this year’s priciest per-unit deals in the Bay Area’s multifamily market.

Zurich Alternative Asset Management, which manages the global insurer’s hedge fund and private equity investments in addition to real estate, paid about $576,000 a unit to purchase USA Properties Fund’s Santana Terrace. The complex at 190 North Winchester Boulevard totals 92 one- and two-bedroom apartments and was completed in 2020, according to title service records.

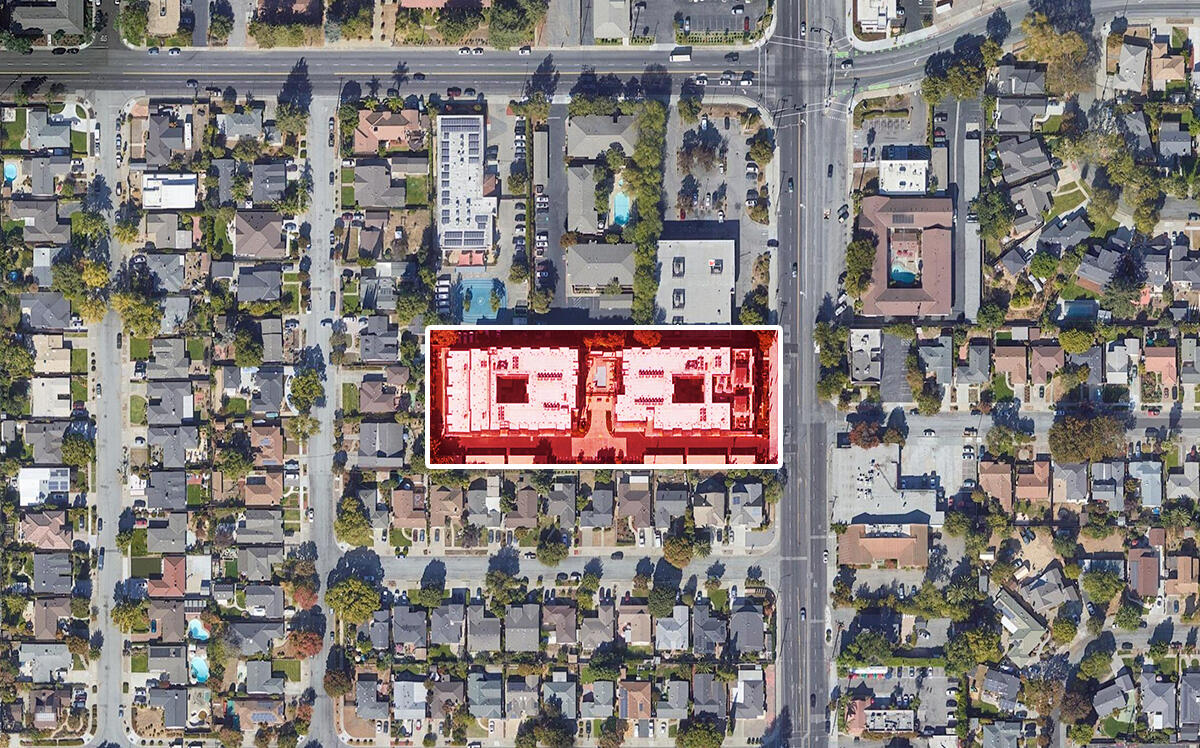

Santana Terrace at 190 North Winchester Boulevard in Santa Clara (Cushman & Wakefield)

City officials originally approved the pair of adjacent four-story buildings as apartments for seniors before rezoning the property for general occupancy last year. The change came after seller USA Properties told them it was having trouble renting out the complex.

USA Properties Fund’s Santana Terrace at 190 North Winchester Boulevard in Santa Clara (Cushman & Wakefield)

The multifamily developer started pre-leasing Santana Terrace around the start of the pandemic, in March 2020, and had rented out about a fifth of its units by July 2021, according to a Silicon Valley Voice report. It agreed to make 14 of the complex’s units affordable to households making up to the local median income — $168,500 for a family of four — for 55 years. In exchange, it got the city’s approval to market apartments to people of all ages.

It’s unclear how much of the complex was occupied at the close of sale, as neither USA Properties nor Zurich responded to requests for comment. The property’s one-bed, one-bath floor plans range from roughly 700 to 750 square feet and are priced in the low $3000s, with two-bed floor plans around 1,050 square feet available from $4,100 to $4,300, according to its marketing website and Apartments.com.

The deal ranks No. 7 in a list of year-to-date Bay Area multifamily sales over $500,000 per unit provided by CBRE. It’s not far from the next-highest sale on the brokerage’s list, MG Properties’ more-than-$579,000-an-apartment acquisition of a 333-unit Milpitas complex in July. Leading the pack is Bell Partners’ $206 million purchase of a 260-unit apartment complex in South San Francisco, CBRE data show. That works out to roughly $792,000 a unit for the three-year-old complex.

The Santana Terrace sale is only the second one of more than 50 units in Santa Clara since 2020, according to CBRE. The other, Crown Capital Financial’s purchase of the 62-unit Alhambra Gardens for $29 million, closed in January. The two properties don’t have much in common besides being in the same asset class: Santana Terrace was recently completed and is half a block from Westfield Valley Fair, Santa Clara’s largest and busiest mall. Alhambra Gardens was completed in 1963 and is surrounded by apartments and single-family homes.

As for Zurich, its Santana Terrace acquisition is the asset manager’s first real estate purchase in the Bay Area in seven years, according to CBRE. Its last multifamily deal in the region was in 2014, when it paid nearly $87 million for a 174-unit apartment complex in San Jose. It has since sold four office and industrial properties in San Francisco for nearly $221 million, the last of which traded in May 2021, according to CBRE.

Read more