Michael Barker of Barker Pacific Group can cite one big reason his Citigroup Center highrise is losing its namesake anchor tenant at the end of year. The outlook from the financial service firm’s six floors in the middle of the 42-story tower now known as One Sansome can’t compete with the “killer view” the company will get at its new digs half a mile closer to the Embarcadero at One Market Street.

“It’s not bad, it’s on the 25th floor, but it’s not the dramatic view of Alcatraz and the Golden Gate Bridge,” Barker said of the Citigroup space.

Agents said they have noticed this trend throughout San Francisco’s still-struggling downtown: Even as rents languish and vacancy rates remain high in much of the office market, the creme de la creme office properties are able to command top-tier rents with limited availability.

“Many tenants are upgrading their workplace environment to create a welcoming and enjoyable experience for their employees to come back to,” Conor Famulener of CBRE said via email. “Even with the amount of overall availability on the market, premium and trophy assets are still highly sought after with very little available space to choose from.”

Class B and C buildings have been hit the hardest by the “flight to quality,” with data from Avison Young showing 80 percent of leasing activity in the first quarter was in premium properties.

But even within Class A buildings, there are dramatic differences in what A-plus properties can command. Rents in “non-prime” Class A properties dropped nearly 14 percent between 2019 and 2022, according to CBRE data, while “prime” properties are up slightly from pre-pandemic rates. Vacancies have gone up in both types of Class A properties, but non-prime spaces were nearly a quarter empty in the first half of 2022, compared with only about 13 percent for prime space.

Non-prime offices may need to offer greater financial incentives or more flexible lease terms in order to compete, Colin Yasukochi, head of CBRE’s tech research, said via email. But even these incentives are more likely to be effective if the non-prime property is located in a prime area “near major mass transit stations and existing retail and restaurant establishments.”

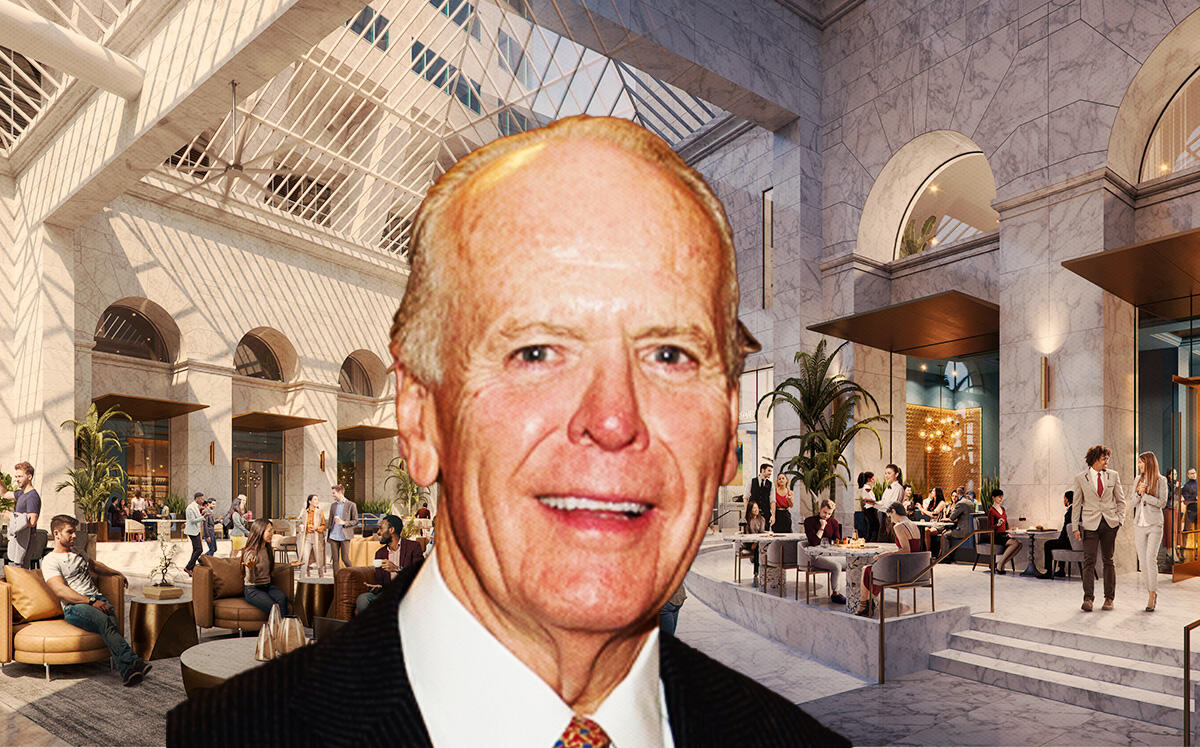

With many of those ground-floor spaces still vacant, BPG is investing $20 million to create destination dining in One Sansome’s century-old conservatory. The landlord is working with Phil Spiegel of the real estate consultancy Please Management, who worked on the Julia Morgan Ballroom and Merchant Exchange Club, to create a restaurant and event venue for up to 2,000 people.

Barker is also in the process of turning the building’s “cavernous” entry into conference rooms that will be available to tenants free of charge, as well as a lush hotel-lobby-like lounge. The revamped ground floor should be a place workers would like to sit and grab a cocktail with colleagues, he said, not just pass through on their way to and from work.

“We’re trying to create more of a collaborative experience for tenants and their employees as they work together instead of sitting in their home closet trying to do their thing on the computer,” Barker explained.

Worker enticements

While all Class A properties have quality maintenance and infrastructure in place, the trophy properties often have intangibles such as views or a vibe.

Other than financial incentives, instilling a building-wide sense of community is one of the main ways owners of non-prime space have tried to attract tenants over the last year, according to Mark Anderson of Avison Young. He said owners have been creating “much more of a hospitality nature” to their buildings, including free gyms, nicer bike parking with lockers and showers, a lounge with a pool table or pinball machine, and building-wide events like a trivia night. The goal is to convince workers that coming to the office is more compelling than “your four walls at home.”

“What you’re trying to do is entice people to want to go back to collaborate, but you’ve got to have something that’s worthwhile on the other end,” he said. “I think some buildings will struggle with that if they don’t adapt.”

Barker has sunk more than $100 million into adapting One Sansome’s 40-year-old tower into a modern space that today’s tenants will want to leave home for, including a new private bar with 35-foot-high ceilings on the 42nd floor. The space had never been rented in part because there was no elevator to access it. BPG added elevators between the 41st and 42nd floors and then rented both to brokerage Newmark, which is representing the building and just moved its headquarters into the “wow” space with “dramatic” views, Barker said.

Though Newmark is actively marketing the soon-to-be vacant Citibank floors, and has “proposals out to a couple of prospects for portions of the space,” Barker said, the penthouse bar is so newly finished that agents haven’t yet been able to use it to entertain clients.

“The wine and beer is not flowing quite yet,” Barker said. “But it will be.”

Read more