Presidio Bay Ventures will start a 19-month timer the moment it breaks ground on its 147,000-square-foot lab project in San Carlos next month.

Whether or not it beats the clock could say a lot about the ruddy outlook on the life science sector that’s been driving a development boom in the Bay Area for the past several years.

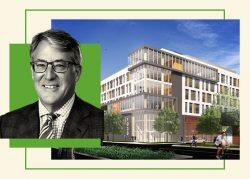

Presidio Bay not only expects to complete the four-story development at 777 Industrial Road in the fourth quarter of 2023 — it also anticipates having it at least partially leased to one or more tenants before it opens based on the life science sector’s “market dynamics,” Presidio Bay founder K. Cyrus Sanandaji told The Real Deal.

Those dynamics — demand outstripping supply, a low vacancy rate, high net absorption — are all present in San Mateo County, which includes San Carlos and 19 other cities and towns. Just 2.7 percent of the county’s life science buildings were vacant at the end of last year, according to Kidder Mathews data. Companies absorbed 217,000 more square feet of such property than they vacated in the last quarter of 2021, reinforcing the county’s status as the Bay Area’s top lab real estate subregion.

Presidio Bay is betting that demand for life science space will remain robust over the next year and a half. And if it’s looking for a test case to support its confidence, it only needs to look next door on Industrial Road to two new office and lab buildings developed by Alexandria Real Estate Equities, one of the most prominent players in the Bay Area’s life science real estate market.

When Pasadena-based Alexandria delivered that more-than-520,000-square-foot project in late 2020, about 90 percent of its space had been pre-leased to several companies. It’s now fully leased, and Alexandria is working on the second phase of the development, which is expected to total 1.6 million square feet at full build-out.

It’s not all rosy for local life science operations, which include some tenants that are one failed clinical trial away from reversals of fortune. San Francisco-based Nektar Therapeutics, for example, recently announced plans to make some of its almost 300,000 square feet of office and research facilities available for sublease following clinical trial failures and the end of its cancer-fighting program. Its leases with Alexandria and Kilroy Realty for those properties expire in 2030, according to the San Francisco Business Times.

Cautionary examples aside, the life science industry received $9 billion in venture capital funding last year, 14 percent higher than in 2020, according to CBRE data. Moreover, no new lab projects broke ground in San Mateo County in the fourth quarter of last year, and the largest such developments rising in the region are in Brisbane and South San Francisco, roughly 16 miles north of San Carlos, according to Kidder Mathews data.

Presidio Bay, meantime, got a $118 million loan from Square Mile Capital to build and lease up its San Carlos project, which it jointly owns with Kinship Capital. A Square Mile spokesperson told The Real Deal that the loan’s term is for five years but declined to disclose its interest rate. Presidio Bay declined to disclose its project’s total cost. Rather than demolish what was formerly a Honda dealership and build the development from scratch, the firm is retaining and renovating the structure’s ground floor and second level to make them suitable for lab users, modernizing its facade and constructing two additional floors.

While the Industrial Road development is the firm’s first in San Carlos, it’s already filed plans for its second, two proposed office and research buildings that combine to total 410,000 square feet. Both projects are in the so-called East Side Innovation District, which Presidio Bay and the city envision as a new research and life science hub in the Peninsula. The firm sees its Industrial Road development as the gateway to the area, while its other one, pitched for an almost five-acre lot between Old County and Quarry roads and under city review, would continue the district’s vision, according to The Daily Journal.

Read more