A San Francisco investment company acquired a Class B office building in downtown Palo Alto, paying hundreds of dollars more per square foot than a half-dozen investors did in recent years for properties of a similar caliber in the city.

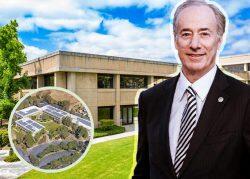

Walnut Hill Group paid $54 million, or $1,556 a square foot, to buy the vacant 35,000-square-foot building at 379 Lytton Avenue, according to the Mercury News. The deal was recorded with the Santa Clara County Clerk-Recorder’s Office on Feb. 18, the newspaper said. The seller was Lytton-Campbell Associates LLC, which bought the three-story property about half a mile north of a Caltrain station for an undisclosed sum in 1998, according to county property records.

The deal marks the highest price per square foot paid for a value-add property in Palo Alto history, said CBRE’s Jefrey Henderson, who co-represented the seller with colleagues Michael Frost and Jon Teel. Value-add buildings are ones that investors buy with the intent of increasing their value through capital improvements.

Six such office properties have traded in Palo Alto since the end of 2017 for about $1,100 apiece, four of which after the start of the pandemic, according to a list of Palo Alto commercial real estate sales created by Real Capital Analytics that Henderson shared with The Real Deal. The Lytton Avenue building, meantime, sold for about $400 a square foot more than them.

To be sure, there’s no universally agreed-upon definition of a value-add property, and the Lytton Avenue building was renovated in 2010, according to a copy of its offering memorandum. Those improvements, combined with its proximity to public transit and downtown location, help to explain the higher price-per-square-foot amount Walnut Hill paid relative to the six other prices per square foot for the value-add deals on Henderson’s list. The company didn’t respond to a phone call seeking comment.

Walnut Hill plans to spend more than $200 a square foot on renovations to reposition the 37-year-old building to Class A offices, Henderson said. Those upgrades are necessary for it to be able to charge monthly asking rents in the $11 a square foot range, he said.

Palo Alto office building vacancies jumped to 12 percent at the end of 2021 from 4.6 percent two years earlier, according to CBRE data. Pre-pandemic, office properties in the city’s downtown, traditionally its most in-demand submarket, were changing hands for more than $2,000 a square foot.

While Walnut Hill paid 23 percent less per square foot than the least expensive downtown Palo Alto office deal in 2018, Henderson said the priciest per-square-foot sales that year were for offices that their previous owners had renovated before flipping for a profit.

Despite the spike in vacancies, average asking rates in Palo Alto have remained essentially unchanged, according to CBRE. At $9.33 a square foot a month, it’s still Silicon Valley’s most expensive office market, CBRE data show.

The Lytton Avenue building hit the market for sale in September. Offices of that size in downtown Palo Alto come to market once a year or every other year, Newmark’s Ben Stern, who wasn’t involved in the building’s marketing effort, told The Real Deal in August. Sole tenant Sheppard Mullin, which had fully occupied it since 2011, is relocating to new digs in neighboring Menlo Park, giving Walnut Hill the opportunity to start renovating the property’s offices in the near term.

Read more