If the two federal buildings in San Francisco that may be sold off by the government end up hitting the market this year, potential buyers could get a significant discount compared to overall downtown prices, which have been trending higher. And those buyers would likely be betting on a long-term San Francisco renaissance.

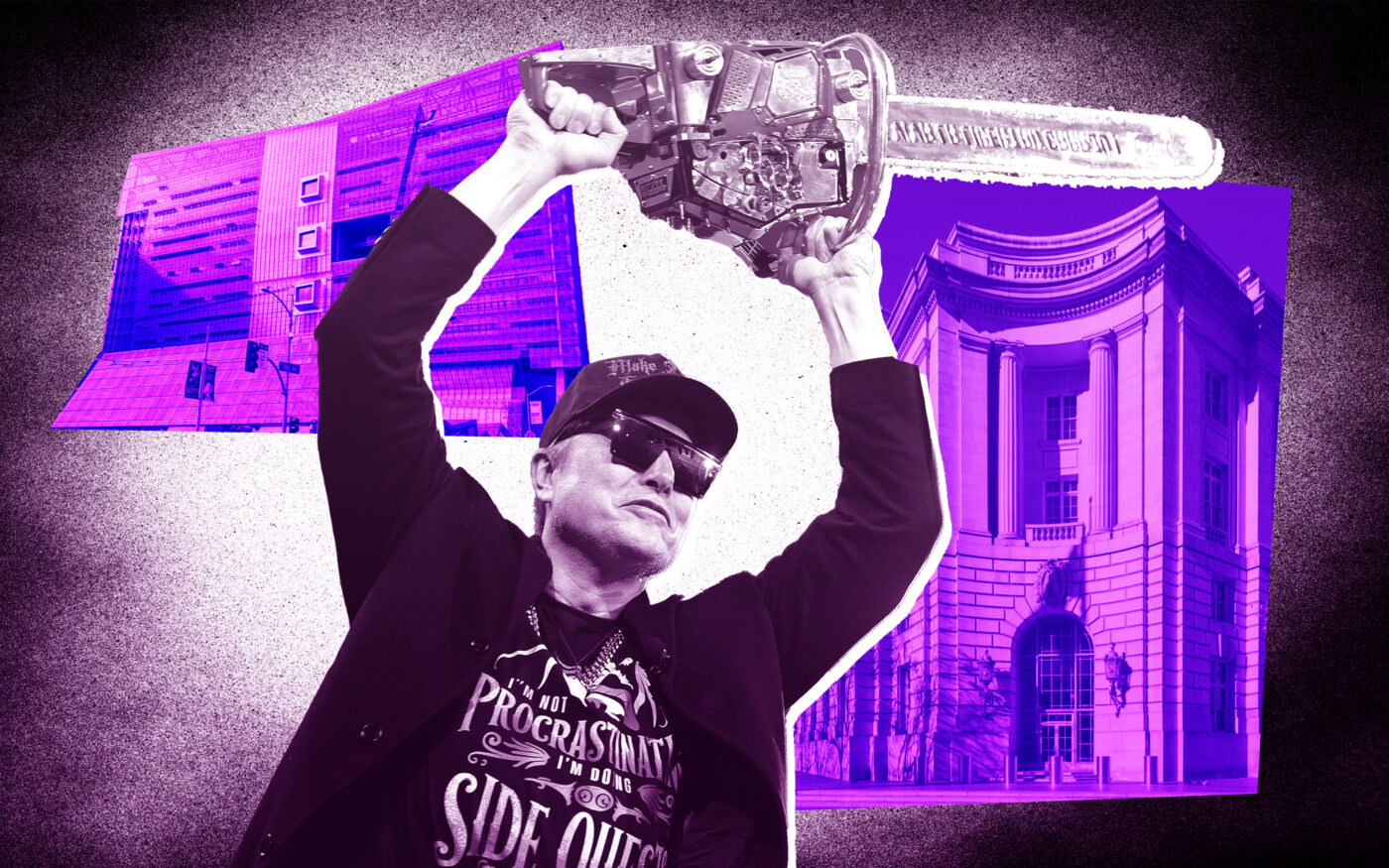

The Speaker Nancy Pelosi Federal Building in South of Market and 50 United Nations Center Plaza in Civic Center were on Elon Musk’s Department of Government Efficiency’s short list for sale, according to U.S. General Services Administration internal documents widely reported last month. The list was publicly posted on the GSA website this week, only to be removed a day later with a note that the identities of “non-core” properties “for disposal” would be “coming soon.”

“Selling ensures that taxpayer dollars are no longer spent on vacant or underutilized federal spaces,” the GSA page about the list read on Wednesday morning. “Disposing of these assets helps eliminate costly maintenance and allows us to reinvest in high-quality work environments that support agency missions.”

The GSA did not immediately reply to a request for comment on why it initially chose these two buildings to be designated as “non-core assets.”

The Nancy Pelosi Building is a Class A, 18-story high-rise at 7th between Market and Mission Streets, built in 2007, according to CBRE. It currently houses the Department of Labor, Health and Human Services, the Social Security Administration and other federal agencies. Across Market Street, on over 2 acres near City Hall, the Asian Art Museum and the Main Branch of the San Francisco Public Library, sits 50 United Nations Plaza, a Class B, low-rise built in the 1930s. It houses the GSA and the Department of Education.

San Francisco’s 30 federally owned buildings are mostly in and around downtown, but also include the Environmental Protection Agency’s offices near South Park, and a second Social Security office on Valencia Street in the Mission, according to research by The Real Deal.

The GSA does not often sell off its San Francisco properties, but before the pandemic it agreed to give the city a “surplus” lot at 1064 Mission for free to create a 256-apartment supportive housing development for those coming out of homelessness, completed in 2022 and located next to the James R. Browning United States Courthouse. It also recently announced a new auction for a portfolio of 17 Menlo Park buildings it first began trying to offload in 2022 with a minimum asking price of $120 million. It received no bids at the time and the portfolio recently returned with a minimum asking price of $85 million.

Civic Center and SOMA were historically “some of the most desirable locations for investment” in the city given their pre-pandemic single-digit vacancy rates and high rental rates, according to Darren Kuiper of Colliers. But since the pandemic, office tenants have been gravitating to the core of the Financial District, especially Class A buildings with onsite parking, security, amenities, views and immediate access to transit.

That means the two federal buildings could be of interest to long-term-focused bargain hunters.

“If you can purchase a good-quality office building in SOMA or Mid-Market at a roughly 30 percent to 60 percent discount to a similar property in the downtown core, why wouldn’t you if you are a believer in the office market recovery in San Francisco?” Kuiper said.

He added that a significantly lower basis would allow new owners to offer major discounts on rents to help fill buildings in the neighborhoods, which are often older but have more character than a new tower.

“Investors who are buying in these locations may have a stronger conviction in the long-term recovery in the market and a potential shift, from a tenant perspective, back to preferring Class B buildings with cool or creative space,” he said.

Office sales citywide, especially Class B buildings, have been improving but are still well off from pre-pandemic highs, CBRE data shows.

Seven Class A San Francisco buildings sold last year for an average of $329 per square foot, up from the three that went for an average of $250 per square foot in 2023. Sales of Class B buildings tripled between 2023 and 2024. Fifteen Class B properties sold for an average of $296 per square foot in 2024, compared to $245 per square foot for five sales in that category in 2023. While those are signs of improved buyer interest, in 2019 there were 19 Class A sales and 14 Class B sales citywide, according to CBRE, at $903 per square foot and $877 per square foot, respectively.

Then there’s further discounts for SOMA and Civic Center, in particular. In the South of Market West submarket, which runs from Sixth Street to Van Ness, prices in 2024 have ranged from about $100 to $300 per square foot for buildings larger than 100,000 square feet, with no real distinction between Class A and Class B, CBRE data indicates. There have been no recent Civic Center deals for buildings of that size.

The brokerage declined to speculate on the value of the two federal buildings, but based on these average figures, the 640,000-square-foot Nancy Pelosi Federal Building could fetch between $64 million on the low end of the SOMA figures and about $200 million if it gets closer to the citywide average. The 305,000-square-foot 50 United Nations Plaza, which houses the GSA, could be between $30 million and $90 million.

CBRE data also shows that the city has been turning the corner on the types of large leases needed to fill buildings of this size. The Bay Area had 11 of the largest office leases nationwide in 2024, and four of those — adding up to over 1 million square feet of leased space — were in San Francisco. Of the 3.4 million square feet in office leases signed throughout the Bay Area, 1.7 million were expansions, said Colin Yasukochi, executive director of research for CBRE.

Large leases are typically the “catalyst that moves market supply and demand dynamics,” he said, adding that small- and medium-sized leases signed by artificial intelligence and other tech companies today could grow into bigger lease requirements in the years ahead.

“That is when we will see substantial vacancy reductions,” he said.

Using AI tools and real-time data, VTS predicted that leasing activity in the city would rise 28 percent this year, amounting to an anticipated 9 million square feet of office space.

Max Saia, vice president of investor research for VTS, said he wasn’t surprised to see such a positive outlook for the city, despite the negative headlines about its office market, where one in three offices are empty.

“San Francisco had such a sharp increase in office demand over the past year,” he said, pointing to VTS data showing that the city closed out 2024 with a 32.4 percent increase in year-over-year demand.

San Francisco’s new mayor Daniel Lurie has also been helping the slowly improving office market by committing to cleaner streets and a revitalized downtown, Kuiper said.

“With meaningful changes already occurring, there seems to be a quiet but strengthening belief from investors that the city’s near-term and mid-term outlook is finally looking brighter,” he said.

Of course, any further moves by the federal government to sell buildings or greatly reduce its workforce could impact that recovery.

The regional GSA portfolio includes over 7 million square feet of leased and owned office space, with over 3 million in San Francisco, making it “a city in itself,” according to David Klein of Lee & Associates in San Francisco.

“A substantial downsizing of the federal government will have a major impact on vacancy and asking rental rates in the region,” he said, especially in San Francisco and Oakland, two markets “already reeling from high vacancy.”

Read more