Last fall, Ladder Capital Finance seized a century-old movie theater converted into offices in Uptown Oakland after the owner spent millions on renovations and then failed to pay its loan.

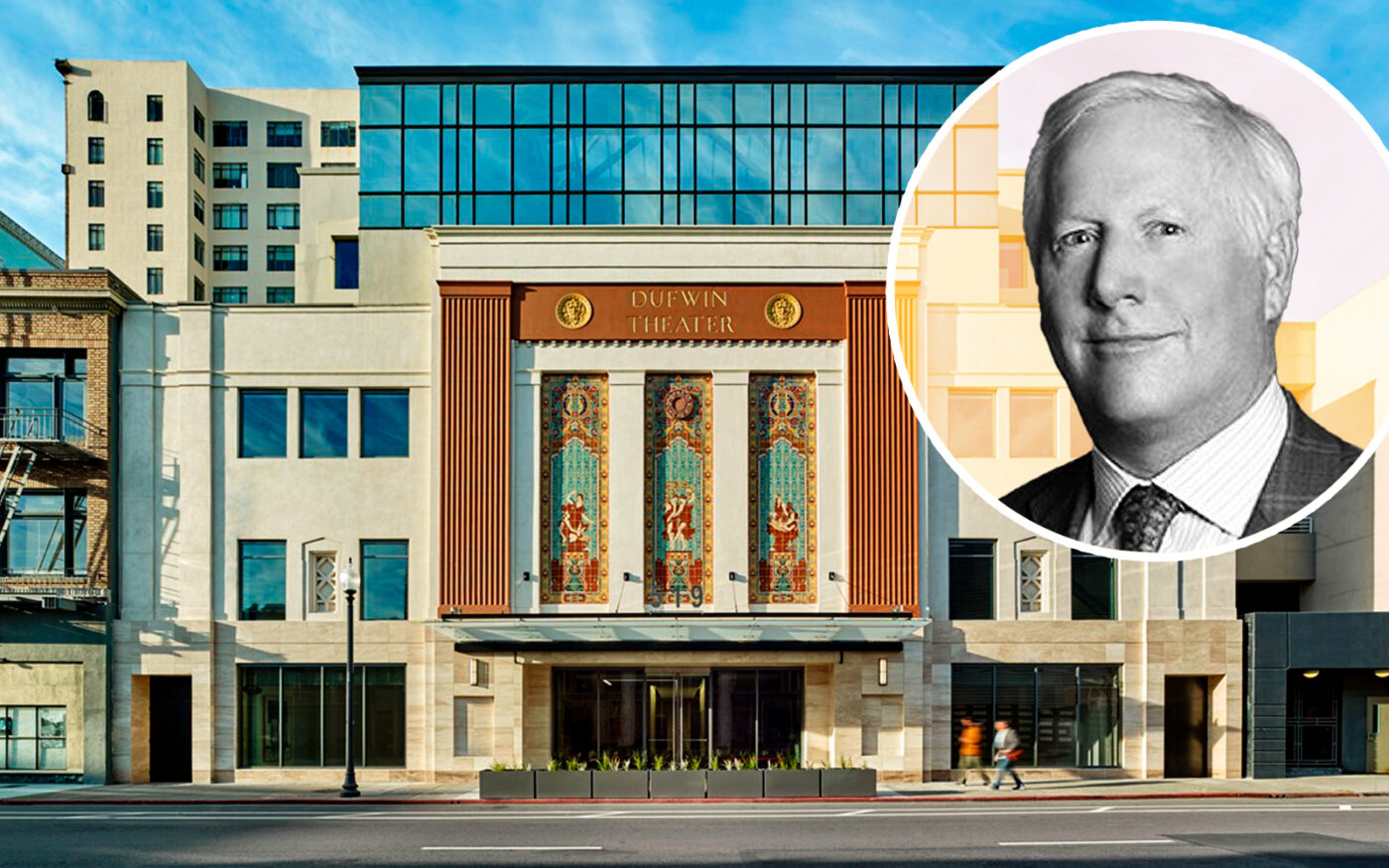

The New York-based lender has now put the 63,200-square-foot Dufwin Theater at 519 17th Street up for sale for an undisclosed price, the San Francisco Business Times reported. CBRE holds the listing.

For Embarcadero Capital Partners, it marks a failed attempt to create better “creative offices.”

The Redwood City-based investor bought the seven-story Dufwin out of receivership in 2016 for $8.4 million, or $133 per square foot. The theater, initially built for live performances in 1928, reopened as the Roxie in the 1930s and was converted into offices in 1980.

Embarcadero then poured $10 million into renovations. The revamped offices, dubbed 519 Uptown, had new windows in the lower floors, plus a new roof deck, showers, bike storage and a conference center. Its original tile murals were restored.

John Hamilton, principal with Embarcadero Capital, said in 2019 it planned to lease the building to an office tenant seeking “creative space” in the heart of Uptown, near BART, the Fox Theater and Uptown Station.

Last summer, the Alameda County Tax Assessor estimated the value of the building at $11.47 million.

Embarcadero may have built a better moviehouse-turned-offices — but it never saw a return on investment. The company specializes in “value-add” properties, hoping to boost the value of the buildings through renovations, bringing in new tenants.

In September, Ladder Capital took the property from Embarcadero through a deed in lieu of foreclosure. At the time, the property had $13.3 million in debt with interest, according to public records viewed by the Business Times.

The building had been previously owned by Oakland investor Tom Henderson, who purchased it in 2012 for $3.3 million, or $53 per square foot. In 2023, Henderson was sentenced to 16 months in prison for a $110 million investor fraud scheme involving EB-5 visas.

In late 2023, Embarcadero Capital Partners defaulted on a $63.5 million loan tied to a 181,200-square-foot office campus in Sunnyvale.

Read more