Alpine Residential is wasting no time refinancing a pair of multifamily buildings in Jersey City that the developer only recently completed.

Alpine secured an $82 million loan from JLL Real Estate Capital to refinance the properties at 270 Johnston Avenue and 66 Monitor Street in Downtown Jersey City, the Commercial Observer reported. The loan, which retires existing construction debt, is a five-year, interest-only, fixed-rate Freddie Mac loan.

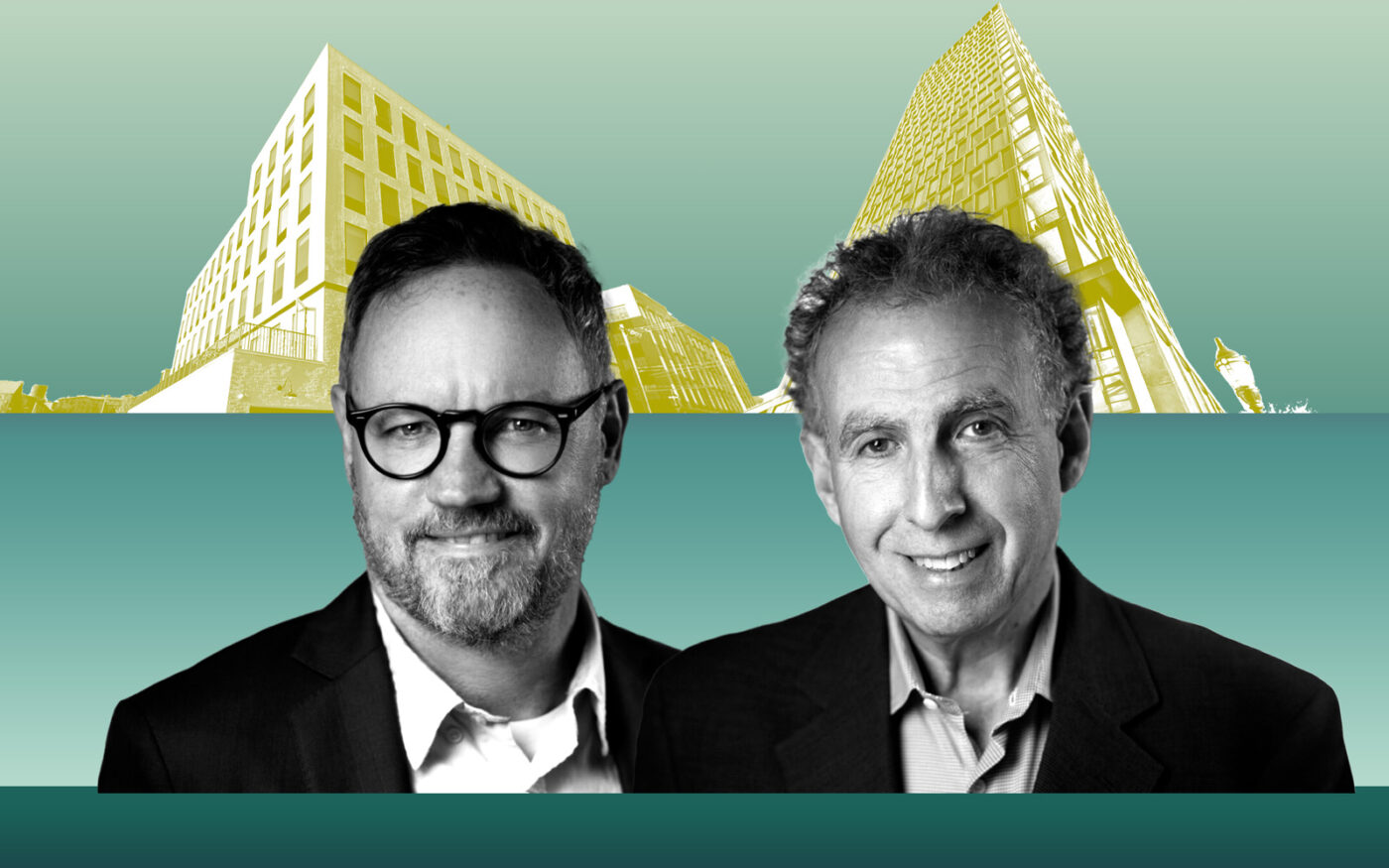

A JLL Capital Markets team including Thomas Didio and Michael Mataras arranged the financing.

The Atlas and Starling developments sit near the Liberty State Park and its light rail station and along the Hudson River. One of the brokers in the deal said the proximity to light rail and mass transit helped to attract “significant lender interest.”

Atlas on Johnston Avenue contains 169 units, including 11 affordable housing units. Starling on Monitor Street is significantly smaller, featuring only 39 units, three of which are affordable. Both were completed this year.

Alpine did not respond to the Observer’s request for comment.

Jersey City is one of the country’s most expensive rental markets and money is flowing freely into developments in the city.

Late last year, Nasser Freres scored a $245 million construction loan for The Greyson, a project at 25 Cottage Street in the city’s Journal Square neighborhood. TYKO Capital provided the financing for the 28-story, 622-unit development, which is expected to be delivered in the first quarter of 2026.

Also recently, Kushner Real Estate Group landed $175 million for Artwalk Towers in the neighborhood, after completing Journal Squared, a $900 million project comprising 1,800 units across three buildings.

There were more than 8,000 multifamily units in Jersey City’s pipeline as of December, according to Yardi Matrix. Construction began on roughly 4,000 units over the course of last year, beating the previous year’s starts by a small sum.

Read more